A new report by McKinsey forecasts a rapid switch from gas guzzlers to electric vehicles on the world's roads will be boosted by the plummeting costs of owning a battery powered vehicle.

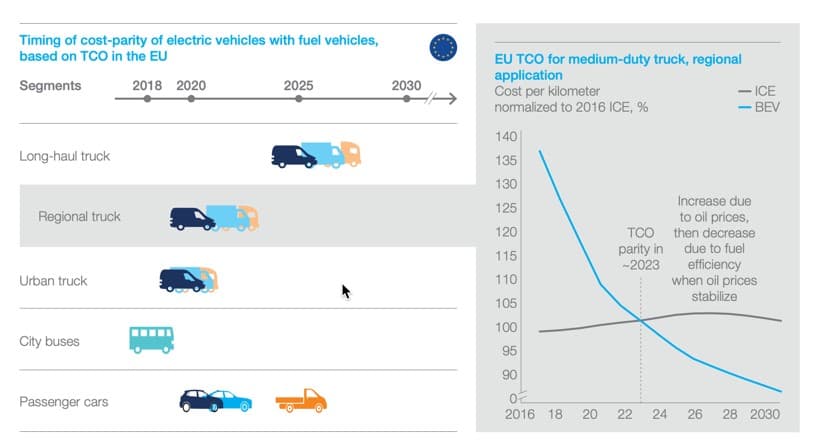

The consulting firm's 2019 Global Energy Perspective report foresees a two-thirds drop in the cost of EV battery packs by 2030. The tipping point at which EVs will be cheaper to own than internal combustion engine-powered vehicles is forecast to be reached in the early 2020s:

The timing of total cost of ownership (TCO) parity in the U.S. and China is comparable to Europe, with China slightly earlier and the U.S. slightly later, reflecting differences in fuel taxation and subsidies for electric vehicles.

After this tipping point, "economic considerations alone" would be sufficient to accelerate the growth of EV sales, says McKinsey. Car sharing and autonomous driving will add further incentives to go electric. Improving battery technologies will mean that even long-haul trucks could be economically electrified during the second half of the next decade.

(Click to enlarge)

Source: McKinsey Global Energy Perspective 2019

McKinsey's view of the electrification of the transport sector makes for some dramatic reading:

- EV sales jump to 100m units by 2035

- Battery-powered passenger car sales grow by a factor of 60 through 2050

- By 2035 there will be 400m EVs on the road in China and developed countries

- To meet demand, 2.4m charging stations must be deployed per year through 2035

- By 2050 road transport will constitute 27 percent of electricity demand, up from less than 1 percent today

- Demand for oil could peak as soon as the early 2030s

McKinsey's rosy view of transport electrification stands in contrast to a recent U.S. government study which forecasts electric car sales will be stuck in the slow lane for the foreseeable future.

By Mining.com

More Top Reads From Oilprice.com:

- How Blockchain Is Changing The Face Of Oil Trading

- Oil Market Tightens On OPEC Cuts

- The Renewable Revolution Has A Lithium Problem

Total EVs on the roads around the world are currently estimated at 4 million out of a global fleet of 1.5 bn ICEs or 0.27%. ICEs are projected to reach 2.0 bn by 2025 rising to 2.79 bn by 2040 according to US Research.

The Achilles heel of EVs is customer appeal. Despite huge government promotional subsidies, the United Sates has only 1 million EVs on its roads. Moreover, only 360,000 EVs were sold in the US in 2018 out of total sales of some 17.2 million ICEs, merely 2%.This compares with 2.61 million EVs on the roads in China. Therefore, projections by McKinsey that EV sales will jump by 100 million by 2035 and that there will be some 400 million EVs on the roads in China and developed countries by then are a bridge too far.

A major hurdle is the trillions of dollars of investment needed to expand the global electricity generation capacity in order to accommodate the extra electricity needed to recharge the millions of EVs projected to be on the roads by 2035. Moreover, according to McKinsey, to meet such demand, 2.4m charging stations must be deployed per year through 2035.

Another major hurdle is the global EV manufacturing capacity. Current worldwide capacity doesn’t exceed 500,000 EVs annually. So it will take many decades to manufacture 400 million EVs by 2035 as has been suggested by McKinsey.

The penetration of EVs into the global oil market will continue to be slow hampered by customer appeal, cost and infrastructure. Even if 400 million EVs were to be on the roads by 2035 which is an impossibility, they will only be able to reduce global oil demand by 9% or 10 million barrels a day (mbd).

Big Oil’s investments in EVs and renewables will be guided by three pivotal principles. The first is that there will be no post-oil era throughout the 21st century and probably far beyond. Oil will continue to reign supreme all through.

The second principle is that there will be no peak oil demand either. Global oil demand will continue to grow well into the 22nd century. While a wider penetration of EVs into global transport market coupled with government legislation could decelerate the demand for oil, EVs could never replace oil in global transport throughout the 21st century and far beyond.

The third principle is business opportunities. While Big Oil is investing huge amounts in renewables and EVs, such investment pales in size when compared with that in oil and gas exploration and production, refining and petrochemicals. The reason is that although renewables could offer steady returns over time, they are nothing compared to the huge revenues that oil and gas could generate. While renewables accounted in 2018 for 3.7% of global primary energy demand, oil and natural gas accounted for 58%. For Big Oil, its core business is and will continue to be oil, gas and petrochemicals for the foreseeable future.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Two points:

1) The need for 2.4 million charging stations (I assume they mean quick chargers) per year is way off base. Most people will charge at home or work. Charging stations are only needed for travel and apartment dwellers. I have been driving electric for almost 5 years, and only need public charging when I travel.

2) McKinsey's study is indeed "rosey" compared to the US government's, but then the USG's predictions have been wrong on everything from EV adoption to renewables growth. They still underestimate how fast the transition is occurring.