Oil prices headed higher on Friday for the fifth day in a row as fears related to U.S.-China trade talks subsided and production cuts continued to make headlines.

Friday, February 15th, 2019

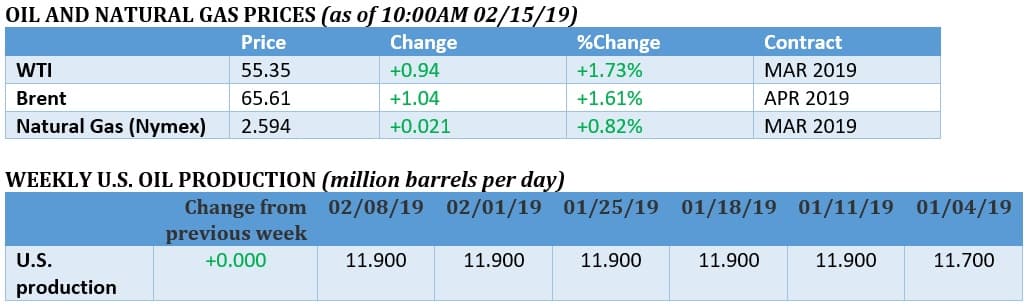

(Click to enlarge)

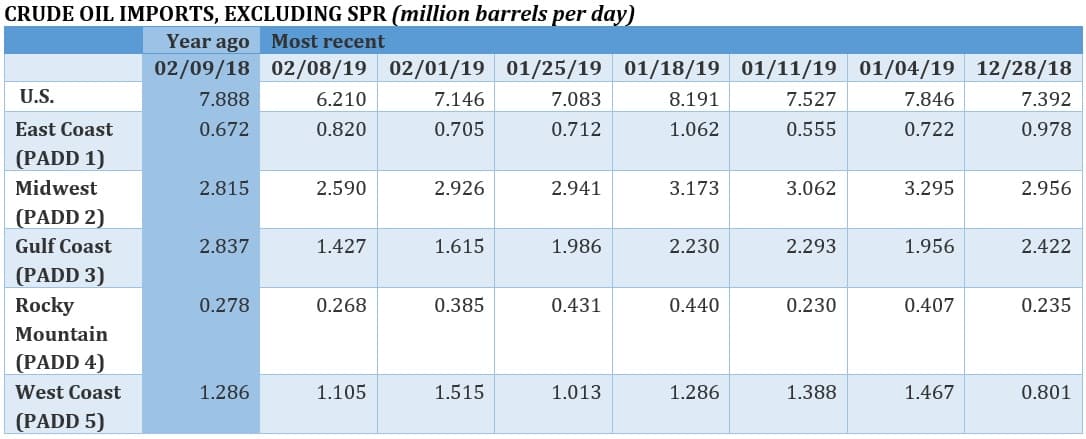

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Oil posted sizable gains this week, with ongoing outages in Venezuela tightening the market. Also, one of the largest bearish factors for oil – the U.S.-China trade war – showed some signs of easing.

OPEC cut output…and demand forecast. OPEC cut production by 800,000 bpd in January, going a long way to erasing the supply surplus. However, the group also cut the demand estimate for its crude by 240,000 bpd from the last forecast due to a slowing economy. The group is still producing a bit more than what they think is needed. Saudi Arabia already indicated that it would shoulder an additional 0.5 mb/d reduction by March.

IEA warns on quality differences. The IEA said in its latest Oil Market Report that the dwindling supplies of medium and heavy barrels, at a time when light sweet oil is surging from U.S. shale, has disrupted both the crude and product markets. Medium and heavy losses from Iran, Venezuela, Mexico and limited midstream capacity restraining growth in Canada has all combined to put a premium on those barrels. As a result, refiners could face some challenges this year as they search for the right type of crude for their facilities.

EIA: U.S. to surpass 13 mb/d in 2020. The EIA revised up its forecast for U.S. oil production in its latest Short Term Energy Outlook. The agency expects the U.S. to average 12.4 mb/d this year, a huge 300,000-bpd jump from last month’s estimate. Even better, the U.S. could average 13.2 mb/d in 2020, revised up from 12.9 mb/d from the previous report.

Saudi Arabia partially shuts oil field after accident. Saudi Aramco partially shut its Safaniyah offshore oil field after a power cable was cut by a ship’s anchor, according to Reuters. The shutdown occurred about two weeks ago. The Safaniyah field is the largest offshore oil field in the world, with a capacity exceeding 1 mb/d. Energy Intelligence says about 300,000 bpd was impacted. Related: Brent Crude Hits 2019 High At $65

U.S.-China trade talks make progress. A week of trade talks in Beijing between the U.S. and China ended with both sides indicating that significant progress was made. The talks will continue next week in Washington. It seems unlikely that a comprehensive agreement will be secured before the March 1 deadline, but the WSJ reports that they could agree to a memorandum of understanding outlining a framework trade deal, allowing talks to continue beyond the deadline. President Trump also indicated he would be willing to punt on tariffs if the two sides were making progress.

U.S. bans MTBE shipments to Venezuela. The U.S. has banned MTBE from entering Venezuela, a fuel additive in gasoline. The sanctions could make the gasoline shortage much worse.

Gauidó names a new Citgo board. Venezuela’s opposition named a new temporary board of directors to Citgo this week, a move intended to seize control of the U.S.-based subsidiary of PDVSA.

China negotiates with Venezuela’s opposition. China has loaned more than $50 billion to Venezuela over the last decade, and has begun talks with Venezuela’s opposition, fearing that it could see its position cut off with a change of government. Venezuela still owes China more than $20 billion, to be paid back with crude oil shipments. “China recognizes the increasing risk of a regime change and does not want to be on the bad side of a new regime,” R. Evan Ellis, a China expert at the U.S. Army War College, told the WSJ. “While they prefer stability, they realize they have to put eggs in the other basket.”

U.S. leverage over Iran wanes due to Venezuela. The U.S. is likely to allow some degree of oil purchases from Iran beyond the May deadline, a growing number of experts believe. The catastrophic losses of oil supply in Venezuela, and the failure to secure rapid regime change, will make it difficult for the U.S. to take Iran’s oil exports down to zero without causing an oil price spike. Venezuela sanctions and tighter heavy crude oil market would lead to another round of…U.S. waivers on Iran oil export sanctions,” Sara Vakhshouri, president of Washington-based SVB Energy International, told the WSJ.

Amazon and GM in talks on electric truck. Amazon (NASDAQ: AMZN) and GM (NYSE: GM) are reportedly in talks on investing in Rivian Automotive LLC for a deal that would value the electric truck maker at $1 to $2 billion. The deal would give Amazon and GM minority stakes in Rivian, Reuters reports. Rivian is trying to mass market an electric pickup truck.

U.S. and German tensions ease. Germany agreed to help finance an LNG import terminal that would receive gas shipments from the United States, and in return, the Trump administration will pull back from its effort to try to kill the Nord Stream 2 pipeline. The handshake agreement eased tensions between the two countries. U.S.-German relations have taken a turn for the worse under the Trump presidency, with high-profile fights over the Iran nuclear deal, the Paris Climate agreement, steel tariffs, NATO and the Nord Stream 2 pipeline, among other issues.

Related: Green New Deal Critics See Red

EU convenes summit on alternative to dollar. The European Union held a summit to promote the euro in an effort to break dollar dominance, according to Reuters. The meeting included top European oil and gas companies, utilities, and other industrial giants. The EU has long paid lip service to its preference for alternatives to the dollar, but the souring ties between the EU and the Trump administration has accelerated those efforts. “Washington doesn’t like cartels like OPEC,” one participant told Reuters. “But then how can you have one market dominated by one currency - the dollar.”

China’s imports and exports rebound in January. China’s imports and exports rose faster than expected in January, reducing fears of a dramatic slowdown. Both metrics were in negative territory in December.

Energy companies perform better without growth metrics. Oil and gas companies have long tied production growth or reserve replacement growth to CEO pay. A new report finds that companies that separate executive pay from growth metrics perform better. This comes at a time when shareholders are increasingly pressuring the oil and gas industry to focus more on profits rather than growth. Moreover, the prospect of peak demand calls into question aggressive spending on long-lived assets.

Chevron bets on shale. In an interview with Bloomberg, Chevron’s (NYSE: CVX) CEO Mike Wirth laid out a vision of belt-tightening and lower spending, with an overwhelming focus on shale, particularly in the Permian. Gone are the days when Chevron threw down billions of dollars on a single project. Chevron’s spending is about half of what it was in 2014.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Aramco Makes Existential Bet On Oil

- ‘’Lower Your Costs, Or Die’’ Big Oil’s New Mantra

- US Drillers See Modest Rise In Oil Rigs As Prices Hold

Long-term, oil prices will surge beyond $100 because of four pivotal factors. The first is that there will be no post-oil era throughout the 21st century and probably far beyond. Oil will continue to reign supreme all through.

The second factor is that there will be no peak oil demand either. Global oil demand will continue to grow well into the 22nd century. While the penetration of increasing numbers of electric vehicles (EVs) into global oil market coupled with government environmental legislations could decelerate the demand for oil, EVs could never replace oil in global transport throughout the 21st century and far beyond

The third factor is that the core business of Big Oil will continue to be oil, gas and petrochemicals for the foreseeable future.

A fourth factor is that US shale oil industry could become a diminished presence in the global oil market if not a thing of the past within 5-10 years. The bulk of US shale oil production has recently been coming from the Permian particularly after the steep decline of both the Bakken and the Eagle Ford shale plays in 2016. The Permian is projected to flatten by 2020 with growth slowing down from 860,000 barrels a day (b/d) in 2018 to a mere 230,000 b/d barrels by 2020 according to OPEC (2018 World Oil Outlook). Such developments definitely argue against any pronounced rise in US oil production in 2019 and beyond. An eventual plateau in Permian oil supply will have profound implications for long term oil prices.

And despite the almost daily reports from very reliable sources about a slowdown in the Permian, the US Energy Information Administration (EIA) is expecting that US oil production will average 12.4 million barrels a day (mbd) in 2019 compared with 10.9 mbd in 2018 and averaging 13.2 mbd by 2020. No end in sight for the hype by the EIA.

Another bullish element at play now is that China’s imports and exports rose faster than expected in January dispelling unfounded fears about a slowdown in the Chinese economy. Moreover, China’s oil imports are projected to hit 11 mbd this year from 10.43 mbd in 2018.

And contrary to your claim about a quid pro quo between Germany and the US over Nord Stream 2, there is no connection whatsoever between Nord Stream 2 and Germany’s plans to build LNG infrastructure. Germany has always planned to build at least two LNG terminals as part of its energy diversification and not as a concession to President Trump. Germany needs more gas supplies since it is on the way to phasing out coal-fired generation by 2038 and also nuclear electricity by 2022. Nord Stream 2 is unstoppable whether the European Union (EU) buys US LNG or not. Moreover, Germany and the EU will only buy US LNG if it matches the price of Russian piped gas.

The days of the dollar as the world reserve currency and global oil currency are numbered with the success of the launch in March 2018 of the crude oil contract in Shanghai (the Petro-yuan). The petro-yuan currently accounts for 32% of global traded oil. The decline in the global importance of the dollar will be accelerated by the EU's intention to promote the euro in an effort to break the dollar dominance and also by a possible decision by OPEC to drop the petrodollar in favour of the petro-yuan as a retaliation against the US should it try to sue OPEC and its members for alleged manipulation of oil prices.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London