The global oil industry is a highly lucrative sector that is strongly influenced by geopolitical developments. As the Post-Cold War era comes to an end, a new status quo is arising. The U.S. was once the only player with the capability to significantly influence energy markets around the globe. The country’s military and global alliances proved powerful tools in controlling developments in regions such as the highly volatile Middle East. But Washington’s global reach is fading and both Russia and China are on the rise.

Moscow has become a force to reckon with in several regions due to a combination of diplomacy and energy politics. In addition to that, Washington’s foreign policy blunders have created power vacuums for other actors to take advantage, blunders such as the recent unexpected withdrawal from Northern Syria. Arguably, Russia has now become the most important power broker in the Middle East. Moscow's plans, however, are not regional, but global. The first-ever Russia-Africa summit is a testament to the Kremlin's global ambitions.

Moscow has also fostered strong relations with several countries in Latin America. Ever since the Monroe doctrine of 1823, the U.S. considers Central and South America as its ‘backyard’. Countries such as Venezuela, however, have resisted Washington’s power and influence. Therefore, when the rumor spread of the sale of South America’s biggest energy company to Russia’s Rosneft, panic spread in Washington of potentially another foreign policy setback.

Venezuela’s national oil company is estimated to be worth $186 billion and is the country’s economic engine. The Orinoco region, where the majority of the country’s oil is produced, contains approximately 300 billion recoverable barrels of oil and is the biggest in the world. Despite the massive energy reserves, Venezuela is spiraling towards an economic and political meltdown. The country’s political turmoil has been dragging on for years. The opposition-dominated National Assembly, the country's parliament, has been sidelined by Nicolás Maduro and his regime. Related: Protect The Oil: Trump’s Top Priority In The Middle East

Despite international sanctions and mismanagement of PDVSA, Caracas has barely been able to withstand the storm. The country’s debt, currently, is 738 percent higher than the value of its exports. Venezuela's future is in the hands of a small number of countries that own the majority of its $156 billion debt. Russia and China have the lion's share as they aim to gain more influence.

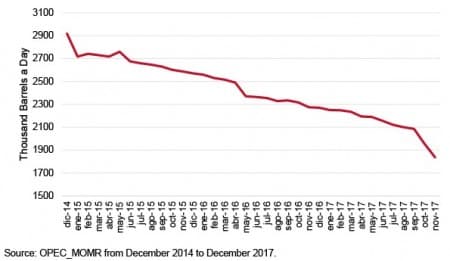

The largest part of PDVSA’s oil production is tied to debt repayments. In combination with the economic and social crises currently unfolding, this has led to a major cash flow problem which is causing a vicious economic cycle. Furthermore, the exploitation of Venezuela's Orinoco Oil Belt requires massive investments to maintain production due to its remote location. The massive brain drain and mismanagement of PDVSA has decreased the country’s oil production by 1.1 million/barrels per day since 2014.

The (partial) sale of PDVSA would create some obvious advantages to both parties. Venezuela’s massive debt burden is preventing any economic revitalization. Debt relief could alleviate financial pressure with hope for recovery. At least that's what policymakers are hoping for. Also, Caracas could count on Russian support in a region still dominated by the U.S. where military confrontation is a lingering threat. Moscow, in its turn, could strengthen its hold on the global oil market and add the world’s largest oil reserves to its growing list of assets. Related: IEA: An Oil Glut Is Looming

However, despite the rumors, it remains unclear whether Venezuela's crown jewels will be sold. First, Caracas’ debt owed to Beijing, approximately $60 billion, is far bigger than what is owed to Moscow. It would make more sense to sell it to the Chinese to receive debt relief especially as China has far greater financial capabilities. Second, the political risks are far higher than Russia can swallow if it gets entangled in the country’s political quagmire. Venezuela’s crisis is far from over and it is extremely difficult to predict its outcome. Lastly, Venezuela is not Syria. Moscow will tread carefully not to provoke the U.S. especially as an election year is looming.

Russian companies, however, will remain investing and the Kremlin will maintain its presence in the South American country. Political risks create uncertainty and chase away businesses. State-backed Russian companies, however, have political goals as well as financial ones. Risk prone investments potentially have far higher financial yields and political results if successful. Venezuela could well end up being a sound political and financial investment from Moscow’s point of view.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Floating Nuclear Power: Chernobyl On Ice Or The Future Of Energy?

- The Key To Iran’s Success In The Face Of Sanctions

- Is OPEC Doing Enough To Counter The Looming Oil Glut?

Normally energy dominance goes hand in hand with geopolitical dominance. Being an indispensable superpower, the United States was once the only player with the capability to significantly influence energy markets around the globe. The country’s military and global alliances proved powerful tools in controlling developments in regions such as the highly volatile Middle East. But Washington’s global reach is fading and both Russia and China are on the rise. Moreover, US shale oil industry will be no more in 5-10 years.

The global economic, geopolitical and moral influence of the indispensable superpower is eroding fast. From the shifting sands of the Middle East to Venezuela’s turmoil to the rising power of China in the Asia-Pacific region, the United Sates is starting to look like a spent force. China, the world’s largest economy based on purchasing power parity (PPP) is wedded to Russia, the world’s superpower of energy with sharp nuclear teeth.

And despite intrusive sanctions, Iran has won the Middle East war without even firing a shot in anger. Its allies, the Houthis of Yemen, have taken the Saudi oil industry hostage. As a result, Saudi Arabia is working now on ending the war in Yemen and seeking some form of a rapprochement with Iran.

Moreover, the historic alliance between Saudi Arabia and the United States dating back to 1945 may have reached a point of no return after the United States rushed to accuse Iran for the attacks on Saudi oil infrastructure but failed to retaliate against it. As a result, Saudi Arabia may have reached the conclusion that the United States has been using Iran as a threat to blackmail the Saudis for money.

With a changing global geopolitical landscape, Saudi Arabia may feel the need to ally itself with the new rising order in the world, namely Russia’s strategic alliance with China.

And despite intrusive US sanctions against Venezuela, the United States has failed to effect a regime change and install an America puppet there. The United States has been ogling Venezuela’s huge oil reserves, the world’s largest, for quite a while. But it will fail miserably as it did with the invasion of Iraq in 2003. The United States went there to grab Iraq’s spectacular oil reserves but left empty-handed leaving the field to China and Iran. Russia and China are openly defying the United States and buying Venezuelan crude oil thus preventing the collapse of Venezuela’s economy. Furthermore, Russia is helping Venezuela sell its crude oil around the world and get paid for it. Russia is not interested in buying PDVSA and Venezuela will never sell it to anybody.

China has already won the trade war with the United States. Therefore, it will not add its name to any agreement that doesn’t specify lifting some of the US tariffs on its goods.

It is not only the global geopolitical influence of the United States that is ebbing but also the morality of its foreign policy. When a retired American General accuses President Trump of turning US forces deployed in Syria’s oilfields of acting like oil pirates, it speaks volumes of a moral decline pervading US foreign policy.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London