Identifying 2018’s Opportunities In Oil

By Dan Dicker - Dec 22, 2017, 6:00 PM CST

For our last column of 2017, let’s take a look at 2018 – and see what might be in store for oil and oil stocks.

There isn’t an analyst who doesn’t think that OPEC to continue to comply with production cuts for the coming year. That, considering OPEC’s long history of cheating, should be viewed as wildly bullish in itself. In addition, also widely agreed upon is the growth of global oil demand for next year, at a stunning and historically massive 1.5 million barrels/day.

Using those two projections alone would indicate a complete re-balancing in oil stockpiles and an equally massive explosion in the price of oil (and oil stocks) for 2018.

But hold on just a second.

Analysts are quick to insert a few question marks into their projections, making their ultimate predictions for oil far less rosy.

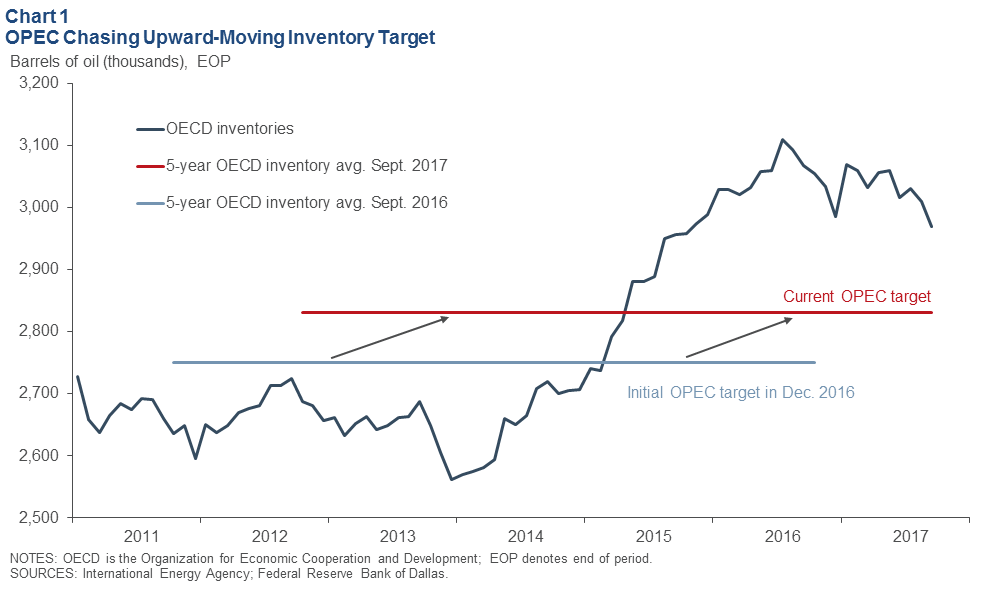

The first is in re-balancing, where several oil watchers (like the Dallas Fed) sneer that OPEC is benchmarking to a 5-year inventory target that has been moving in their favor for the last 4 years of glut overhangs:

(Click to enlarge)

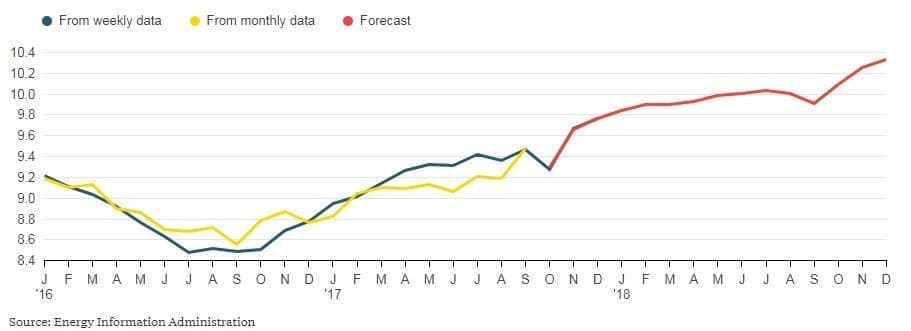

The second and more important wildcard is in U.S. shale production for the coming year, where both the EIA and IEA, as well as several U.S. bank analysts, are expecting another 1 million barrels a day of production to emerge.

(Click to enlarge)

On the other side of this projection are Goldman Sachs and ABN-Amro, who now think shale has run out of money and couldn’t possibly add that much…

For our last column of 2017, let’s take a look at 2018 – and see what might be in store for oil and oil stocks.

There isn’t an analyst who doesn’t think that OPEC to continue to comply with production cuts for the coming year. That, considering OPEC’s long history of cheating, should be viewed as wildly bullish in itself. In addition, also widely agreed upon is the growth of global oil demand for next year, at a stunning and historically massive 1.5 million barrels/day.

Using those two projections alone would indicate a complete re-balancing in oil stockpiles and an equally massive explosion in the price of oil (and oil stocks) for 2018.

But hold on just a second.

Analysts are quick to insert a few question marks into their projections, making their ultimate predictions for oil far less rosy.

The first is in re-balancing, where several oil watchers (like the Dallas Fed) sneer that OPEC is benchmarking to a 5-year inventory target that has been moving in their favor for the last 4 years of glut overhangs:

(Click to enlarge)

The second and more important wildcard is in U.S. shale production for the coming year, where both the EIA and IEA, as well as several U.S. bank analysts, are expecting another 1 million barrels a day of production to emerge.

(Click to enlarge)

On the other side of this projection are Goldman Sachs and ABN-Amro, who now think shale has run out of money and couldn’t possibly add that much oil that quickly. (If you’ve been paying attention, that most assuredly includes me.)

If you’re apt to believe the EIA, you’d make the argument that oil is already overpriced, and oil stocks with it. If you’re more apt to believe Goldman Sachs, some oil stocks look like completely unbelievable bargains.

So, that’s the question for 2018: Who’s right?

For my part, this is my long (30+year) experience and what I’ll tell you: Both government reporting agencies and bank analysts have an obligation first and foremost NOT TO BE WRONG. The worst thing an analyst can do is make a bold prediction that stands out from the crowd. Because if you’re right, you get a pat on the back – but if you’re wrong – you get laughed at and fired.

And I’ll tell you this: You can’t make money investing with frightened milquetoast analysis. You’ll simply miss the move, every time. To make money, you have to understand the markets and get to the opportunities before they happen.

For my part, not only do I see Jeff Currie at Goldman Sachs as on the right side of the coming oil equation for 2018, but even conservative in his projections. While government and bank oil prognosticators have clients or other bosses looking over their shoulders, watching out that they just don’t get anything egregiously wrong, they often concurrently assure that they don’t get much else right. I don’t have those pressures or need those skewed viewpoints.

To put it simply, not only do I see oil markets re-balancing in 2018, but also a full-blown supply shortage beginning to appear, making the next year possibly the most exciting for oil investing in the last ten years that I have seen.

In short, we’ll have lots of amazing energy opportunities to look forward to in the New Year. I hope to see you then.

By Dan Dicker