True to its perpetually optimistic form, OPEC, which last month for the first time conceded to the threat posed by rising U.S. shale production...

(Click to enlarge)

... sharply raised its demand forecast for cartel oil in 2018, ahead of the OPEC meeting at the end of November.

And, according to OPEC's latest market report for the month of December, demand is set to continue rising, with global oil demand projected to grow at around 1.53 mb/d in 2017, in line with last month’s forecast. China is projected to lead oil demand growth in the non-OECD, followed by Other Asia – which includes India – and OECD Americas. Which means that an unexpected Chinese landing, whether hard or soft, will have an adverse impact on oil in addition to all other commodities.

(Click to enlarge)

Separately, in 2018, world oil demand is expected to grow by 1.51 mb/d according to the latest OPEC forecast. OECD will contribute positively to oil demand growth, adding some 0.28 mb/d, whereas the bulk of the growth will come from the non-OECD with 1.23 mb/d of potential growth.

For 2018, the main assumptions behind the forecast are firm economic growth, lending support to industrial and construction fuels in both OECD and non-OECD. Expansion in the transportation sector is expected to provide the bulk of oil demand growth. Growth in petrochemical demand is projected to be one of the fastest-growing contributors in U.S., China, South Korea and the Middle East. As such, world oil demand growth is estimated at 1.51 mb/d in 2018, compared to 1.26 mb/d in the initial forecast.

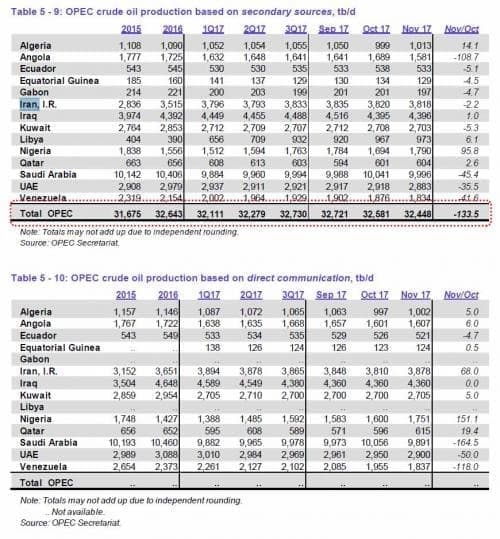

More important than demand, however, was the November supply of OPEC oil, which declined by 133.5K to below 32.5 million bbl, a fresh six month low if only 195K bbl lower than last year's output, confirming that ahead of last year's production cut agreement, OPEC furiously ramped up production effectively offsetting the subsequent output limit.

Crude oil output increased in Nigeria by 95.8kb/d while declining in Saudi Arabia, UAE, Angola and Venezuela.

(Click to enlarge)

For 2017, OPEC crude is estimated at 32.8 mb/d, which is 0.6 mb/d higher than 2016 level. Looking ahead, OPEC crude production in 2018 is expected to stand at 33.2 mb/d, which is higher than the OPEC production levels seen this year. Combined with continued efforts by OPEC and non-OPEC to support oil market stability, this should lead to a further reduction in excess global inventories, arriving at a balanced market by late 2018. The second half of 2018 is expected to reach nearly 34.0 mb/d. Related: OilCoin: The World’s First Compliant Cryptocurrency

Among non-OPEC countries, OPEC writes that "oil supply growth 2017 performed well above initial market expectations to now stand at 0.81 mb/d. Higher-than-expected supply growth in the U.S., Canada and Kazakhstan have been the key contributors to the upward revisions, particularly US tight oil."

As a result, OPEC continues to be concerned about shale output, noting that "US oil output is now expected to grow at 0.61 mb/d this year. The momentum seen this year is expected to continue in 2018 on the back of increased investment in US tight oil and improved well efficiency. Higher output from Canada, due to already sanctioned oil sands projects, will also contribute to next year’s growth. As a result, non-OPEC supply is expected to grow by 0.99 mb/d in 2018. The forecast is associated with considerable uncertainties, particularly regarding US tight oil developments."

Keep an eye on very tightly hedged U.S. shale producers, who after looking at today's 2-year high oil prices, have unleashed a torrent of production which will hit the market some time over the next 2-3 weeks, sending global inventories surging once again, resetting the entire production cut process from square one.

By Zerohedge

More Top Reads From Oilprice.com:

- UK Gas Prices Rise Most In 8 Years On Explosion, Outages

- Why Is Canadian Oil So Cheap?

- Are NatGas Prices About To Explode?