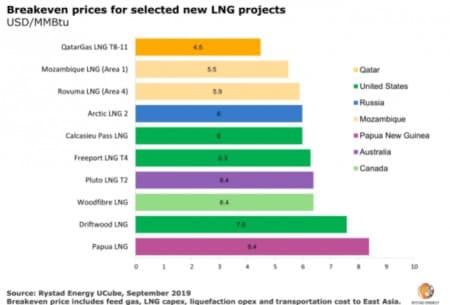

LNG has been discussed as being in an under-supplied state in the late 2020s. Bloomberg has projected a demand forecast in the range ~600 mpta, and supply in the 300-400 mpta range, leaving a gap that could lead to shortages. Come the mid-2020s, the arrival of production from Qatar’s North Field Expansion project has the potential to impact that gap with as much as 126 mpta of new capacity, if the proposed North Field South project is included. Qatar has a global low-cost advantage for LNG, as noted by Rystad, holding the world’s largest non-associated gas reserves.

A recent Reuters article highlighted the impact that this production might have on new project FID’s now being considered that would come online in the 2025-6 time frame.

“With this decision, (Qatar) will once again reaffirm its dominance as the largest LNG supplier in the world,” said Chong Zhi Xin, a director at research firm IHS Markit. “This decision to move ahead has definitely crowded out other players. We anticipate that companies will need to take a long hard look at their projects to determine if they are able to find a competitive advantage versus this field of competition.”

Qatar really means business when it comes to leveraging this cost advantage in global markets. Qatar’s Energy Minister, Saad al-Kaabi noted in another recent Reuter’s article that 2025-27 would be pivotal years for new supplies of LNG.

Related Video: Massive American Pipeline Shut Down in Cyber Attack

“Production from that phase will start by the fourth quarter of 2025 and reach full capacity by late 2026 or early 2027, QP’s CEO Saad al-Kaabi said in a virtual news conference. “The total cost of the project will be $28.7 billion, making it one of the industry’s largest investments in the past few years and largest LNG capacity ever built,” Kaabi said.

He went on to say there might be more to come. “QP is currently evaluating a further increase in LNG capacity beyond the 126 mtpa

Qatar’s strategy for LNG growth and dominance in the coming decade

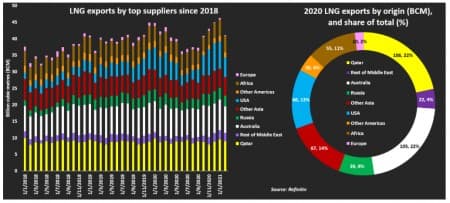

The graphic below clearly shows the country’s current dominance in the LNG trade. The arrival of U.S., Russian, and Australian supplies has created a virtual LNG hegemony among these states, which the tiny Middle Eastern country intends to lead. There are three legs to this strategy.

- Massive supply

- Distribution

- Coordination with other large suppliers, notably Russia

The first is a massive supply position in key markets where seasonal demand is higher, notably Europe, China, and India.

By announcing these ambitious goals Qatar has put other mid-decade FID’s on notice, that without rock-bottom cost economics their projects may not be competitive. The country has, in some respects, softened the blow by investing in other nations’ LNG projects. An example of this would be their partnership with ExxonMobil, (NYSE:XOM), the Golden Pass LNG project that will begin producing 15.2 mpta of LNG. This project processing 2-BCF/D of U.S. shale gas will become operational in 2024.

The bad news for other, higher-cost projects is that with the North Field Expansions, East, and South there will be as much as 70-75 mpta of uncontracted supply coming to market in 2025-27.

Distribution is the next leg of Qatargas’ (QP) strategy for global LNG dominance. In mid-2020 Qatargas signed contracts that called for building as many as 100 new-build LNG tankers. Qatari Energy Minister Al-Kaabi was quoted in an article last year as saying:

“The signing of today’s agreements with the three esteemed Korean companies reflects our commitment to the North Field expansion projects, even during these extraordinary times. As I have previously stated, we are moving full steam ahead with the North Field expansion projects to raise Qatar’s LNG production capacity from 77 million today to 126 million tons per annum by 2027 to ensure the reliable supply of additional clean energy to the world at a time when investments to meet these requirements are most needed.”

With these contracts, Qatargas estimates that it is has tied up +/- 60% of the world’s tanker building capacity for the next seven years. Orders have been spread among the key Korean shipbuilders. Among them, Daewoo Shipbuilding and Marine Engineering (KOSPI: DMSE), Hyundai Heavy Industries (KOSPI: HHI), and Samsung Heavy Industries (KOSPI: SHI), have all received ship orders from QP. Related: Big Oil Eyes Wave Of Buybacks After Blowout Earnings

Having these new-build vessels, which will be greener than the typical competitive ships as they are being manufactured to use LNG as a fuel, gives QP flexibility in choosing landing ports for its LNG. It also gives them an edge in low carbon marketing of its fuel.

The final leg of Qatar’s strategy is coordination with other major producers. While Qatar will become the sole owner of QP in 2022, deciding not to renew PSCs with the former IOC partners. It is offering as much as 30% of North field’s first phase to bidders in an attempt to distribute risk and create an atmosphere of cooperation. Announcements for participation in North Field are expected this year.

Qatar is also reaching out to other key producing countries to explore areas of mutual interest. For example, while there are no firm reports of talks between Russia’s main oil and gas companies, Rosneft (OTC: RFNTF) and Gazprom (OTC: OGPZY), reports have cited areas of mutual interest. Qatar has already taken a 19.5% interest in Rosneft, giving it a stake in the company’s success. Notably, one aspect of this is the Novatek gas pipeline that will carry LNG from the Yamal gas fields to Eastern Europe. Novatek will have the capacity to deliver 17.5 mpta annually when Phase I is complete later this year.

Your takeaway

Qatar has positioned itself with infrastructure, a distribution network that will be unmatched in the industry, and strategic partner alignments to achieve dominance over the LNG market for the next couple of decades. In so doing, it has put non-aligned, higher-cost producers, notably those shipping from Australia and North America, on notice that their projects may face overwhelmingly competitive pressures. Time will tell how this plays out, but it is clear that Qatar is playing to win.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Big Oil Hikes Dividends After Blowout Quarter

- The Wider Ramifications Of A China-Aramco Deal

- Oil Investment Lags Jump In Crude Prices

This is evidenced by: (i) the lifting of the Saudi-led blockade against it. Qatar has emerged from the blockade with a more resilient and stronger economy; (ii) and while the pandemic has had an immense impact on most countries around the world, especially the oil rentier states in the Arab Gulf, Qatar was the only country in the Arab Gulf and one of the few in the world to run a fiscal surplus in 2020.

Qatar’s LNG industry displays this same grit and business acumen. Qatar has a fully integrated LNG industry meaning it has the world’s third largest proven natural gas reserves after Russia and Iran, a fully owned and paid for LNG plants and LNG shipping fleet and it is also the world’s largest producer and exporter of LNG and the cheapest producer.

Qatar has a well considered strategy to maintain its dominance in the global LNG market well into the future.

The first pillar of this strategy is that it is currently expanding its production capacity by 43% from the current 77 million tons per annum (mtpa) to 110 mtpa with production starting from the new production phase by the fourth quarter of 2025 and reaching full capacity by late 2026 or early 2027. Qatar is also evaluating a further increase in LNG capacity beyond the 126 mtpa. This means that it will have a massive supply position in key markets where seasonal demand is higher, notably Europe, China, and India.

The second pillar is expanding its LNG tanker fleet by ordering 100 new LNG tankers extending its ability to distribute its LNG exports to all corners of the world.

The third pillar is coordination with other major producers. It is offering as much as 30% of North Field’s first expansion phase to bidders in an attempt to distribute risk and create an atmosphere of cooperation. Qatar has also taken a 19.5% interest in Russia’s oil giant Rosneft, giving it a stake in the company’s success.

Finally, Qatar tends to buy the opposition when it senses any threat from them to its pre-eminent position in the global LNG market.

Despite these advantages, Qatar will eventually face tough competition from Russia’s giant gas company, Novateck which will have an LNG export capacity of 70 mtpa by 2030, competitive prices of a little over $3 per million British thermal units (MMBtu) and faster delivery of LNG to the world’s two largest markets, namely China and the EU through the Northern Sea Route (NSR) via the Arctic.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London