Back in June, we reported that legendary oil trader Pierre Andurand has seen his hedge fund suffer the worst ever loss after oil prices reversed course. Andurand’s main Andurand Commodities Discretionary Enhanced Fund, which makes leveraged bets, lost more than half of its value in the first half of the year, a sharp contrast to the more than sevenfold return it recorded in the previous three years.

The fund, which Andurand runs with no set risk limits, suffered catastrophic losses after Andurand earlier this year predicted that oil prices may exceed $140 a barrel by the end of 2023. Unfortunately, elevated inventory levels, rising supplies by Russia, Iran and Venezuela, weak global demand and sub-par recovery by the Chinese economy have all taken a toll on oil prices.

Andurand was not alone. Short sellers in the oil futures market were running amok, with commodity analysts at Standard Chartered revealing that speculative short volumes were at one point more than six times larger than those after the collapse of Lehman Brothers and Bear Stearns in 2008.

Luckily for the bulls, the oil price outlook has improved quite dramatically, with hedge funds now rushing back into the oil market with their most bullish wagers in more than a year after the extension of cuts by Saudi Arabia and Russia have sent crude surging 30 per cent since mid-June. Data released on Friday showed money managers were now the most bullish on U.S. crude since June 2022. And, Andurand is finally laughing all the way to the bank after his fund notched one of its best months ever in July.

“A considerable amount of dry powder had been sitting on the sidelines, meaning the recent strong tape could set off a further chase and catch-up in positioning. This oil market has evolved into as much of a momentum-based market as it is a fundamentally based one,” Michael Tran, a global energy strategist at RBC Capital Markets, has told Bloomberg.

Demand Exceeding Expectations

Earlier in the year, Wall Street was mostly bearish about the U.S. economic outlook with many warning of a looming recession. Not surprisingly, many oil punters expected oil demand to crash as unemployment rose and companies cut output thanks to aggregate demand falling. Related: China’s Influence In Central Asia Continues To Expand

These predictions have turned out to be dead wrong. So far, the economy has proven to be remarkably resilient, managing to expand at a respectable annual clip of 2.4% in the second quarter after growing 2% in the first quarter. The unemployment rate currently stands at 3.6%, close to a 50-year low, while employers are still adding hundreds of thousands jobs every month. In early July, 71% of forecasters in an NPR survey said a recession is unlikely in the coming year.

Oil demand has generally held up much better than predicted.

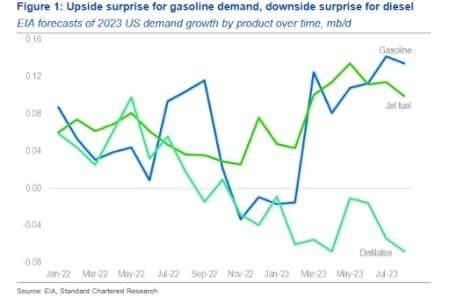

According to commodity analysts at Standard Chartered, gasoline and jet fuel demand--both closely associated with household behavior-- have outperformed strongly relative to the start-of-year expectations by the Energy Information Administration with gasoline demand having risen 98 kb/d y/y.

In contrast, the industrial side of things has been below par, with demand for distillate (including diesel) failing to meet expectations with distillate demand down 169 kb/d y/y; gasoline demand has risen y/y by 98kb/d.

StanChart notes that a strong deflationary price effect from U.S. gasoline has all but disappeared, with gas prices only marginally lower than year-ago levels. The national average of regular gasoline is hovering above $3.80 per gallon for the fourth consecutive week and may represent a headwind to gasoline demand.

Nevertheless, the analysts have predicted that the pattern of stronger-than-expected oil demand from consumers and weaker-than-expected demand from industry is likely to continue in the coming months. StanChart has also revealed that whereas volatility in the oil prices remains low, there’s been plenty of activity with Brent trading volumes over the past week 23%Y/Y higher and open interest 19% higher y/y.

Thankfully, the U.S. shale sector is likely to remain in good health.

After years of rising production costs amid post-pandemic inflation, the U.S. Shale Patch can finally breathe a sigh of relief after the cost trajectory hit a turning point. Production costs fell 1% year-on-year in the second quarter, marking the first time they have shrunk in three years. Drill pipe prices have halved this year, daily rig rates are down by more than 10% and the costs of steel and diesel are also trending lower.

According to Goldman Sachs via Bloomberg, Drill pipe prices have fallen by 50% this year; daily rig rates are down by more than 10% while the costs of diesel and steel have been gradually declining. Only labor has been defying this trend as wages continue rising.

Whereas a decline of a single percentage point might not make much of a difference on the bottom line, Goldman says costs will be 10% lower in 2024, enough to boost profits and cash flows significantly. Easing price pressures are most welcome: after two years of bummer earnings and copious cash flows, the U.S. oil and gas sector is set to record a decline on both metrics in the current year.

Source: Standard Chartered

Slowing Demand In India

On a global scale, Reuters market analyst John Kemp has warned that India’s slowing oil demand growth will act as a drag on oil prices despite consumption recently hitting record highs.

India’s oil consumption grew by ~255,000 barrels per day (bpd) during the first seven months of the current year, helping to grow total consumption to 135 million metric tons in the first seven months of 2023 compared to 128 million metric tons for last year’s corresponding period. However, that growth clip was considerably slower than 415,000 bpd posted in 2021/22 as economies rebounded from the coronavirus pandemic and lockdowns.

In comparison, consumption growth in the U.S. clocked in at 1.0 million bpd in the first five months of 2023, although, in fairness, the U.S. consumes nearly 4x as much oil as India.

But not everybody shares that bearish view. Commodity analysts at Standard Chartered have weighed in, saying that fundamentals in the oil markets remain strong despite the recent reversal by the oil price rally following weak economic data from China.

Global oil markets remain tight, with StanChart estimating that the August global inventory draw clocked in at 2.8 million barrels per day (mb/d), with a further 2.4 mb/d draw forecast for September. The experts have predicted that inventory tightening will remain the dominant price driver in the coming months, but have warned the markets are still capable of slipping back into the macro-driven angst that we witnessed in the second-quarter for periods.

According to StanChart, highly effective producer output restraint, led by Saudi Arabia, will create the conditions for a price rally that will take Brent prices above this year's high at $89.09/bbl onto their Q4-average forecast at $93/bbl, with a likely intra-quarter high above $100/bbl.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- The Oil Market Hasn’t Felt The Full Impact Of Saudi Arabia's Cuts Yet

- Oil Prices Falling Back But Set For Another Weekly Gain

- Chevron LNG Workers Begin Strike