Having recently turned even more bullish on the oil market, bringing forward up its year-end $65 Brent price target to the summer on Monday, overnight Goldman's commodity team turned even more bullish on oil, "discovering" an unexpected source of oil demand in the near term, which could lead to even higher oil prices in coming days. Specifically, according to to Goldman's Damien Courvalin, global oil demand will be boosted by at least 1 million b/d in the coming weeks as cold weather spurs the use of diesel for power generation.

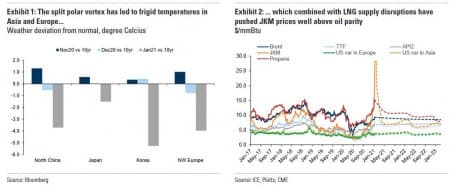

As Courvalin explains, frigid temperatures in Asia and Europe in the face of LNG supply issues have led to a surge in local gas prices. Specifically, the record-high JKM prices we discussed yesterday...

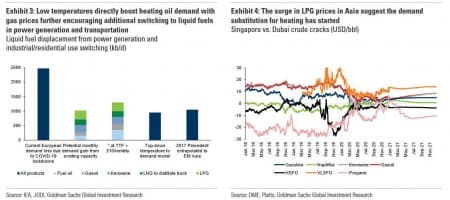

... have moved well past diesel substitution in power generation although the rally in TTF this week is still short of fuel oil parity. Goldman believes this substitution-induced price surge could lead to at least a 1 mm b/d boost to global oil demand in coming weeks, with an upside potential of 1.5mb/d (especially if TTF prices rally past $10/mmBtu).

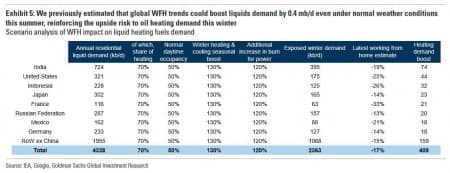

Goldman based this estimate on the precedent of the 2017 cold winter, grossing up OECD data to the rest of Asia. As the bank explains, "a simple top-down weather model on Asia and EU winter heating demand confirms that the recent cold wave would boost demand by 1mb/d, even before the impact of additional fuel substitution under such extreme price dislocations (with working-from-home dynamics pointing to a potentially even stronger demand impact)." Related: LNG Price Boom Obliterates Rally In Bitcoin

The steady decline in oil burn power generation capacity in recent years ultimately limits the magnitude of this substitution, likely explaining the magnitude of the JKM gas rally which is now solving for end-demand destruction in the LNG trucking and industrial sectors. This in turn will provide additional support to on-road diesel and LPG demand, according to Courvalin.

To be sure, such demand support will be transient, with higher expected LNG arrivals in coming weeks and milder Asian weather forecasts. That said, assuming even a mere three-week impact, this transitory demand spike "will nonetheless help offset half of the c.1.5 mb/d decline in global transportation demand" that Goldman expects in January due to spreading lockdowns (with the split polar vortex potentially leading to additional cold spells).

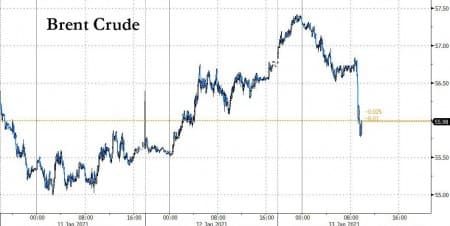

This power boost to oil demand will further be followed in February and March by the unexpected 1 mb/d cut in Saudi production announced last Tuesday, comforting Goldman in the bank's view that oil prices will continue to rally in coming months to reach $65/bbl by July.

While Goldman's reco helped boost oil price in early trading, Brent has since fallen, sliding almost $1/bbl a little after 830am ET and turning red on the day after OPEC secretary general Barkindo warned that while the worst is now over for the oil market, and OPEC is positioning for a strong 2021 rebound, high crude inventories remain a "key issue of market imbalance," a comment which hammered oil prices to session lows.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Bulls Are Back

- Asian Buyers Rush To Secure North Sea Oil After Saudi Surprise Cut

- Oil, Gas Rigs Increase For Seventh Straight Week

fundamentals of the global oil market, OPEC+ production cuts, the rollout of vaccines across the world and China’s and India’s insatiable thirst for oil.

That is why I am projecting that Brent crude will hit $60 a barrel in the first quarter of 2021 and rise to $70-$80 by the third quarter. It is projected to average $60-$65 in 2021. Moreover, global oil demand is projected to reach 2019 level by mid 2021.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London