Oil prices have started the week trending lower, with positive economic news out of China unable to counter the rising fear of another U.S. interest rate hike. One potentially bullish catalyst for oil prices is the upcoming U.S. inventory data, which is expected to show another weekly drop.

Chart of the Week

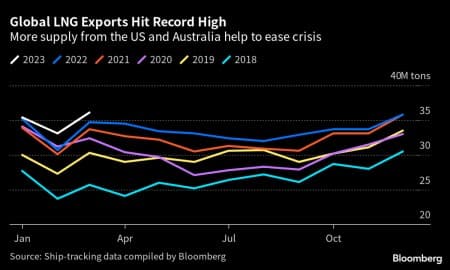

- An extremely tight LNG market that pushed spot prices to $65-70 per mmBtu last year has rapidly transformed into a supply glut thanks to a combination of abundant supply and lower demand.

- With Freeport LNG resuming exports in February, last month’s total exports rose to the highest reading on record (36 million tons), prompting some cargoes to idle at sea for weeks before finding a home.

- European gas inventories are 56% full and should the upcoming months stay within historical weather averages stock refilling may be completed as early as August.

- With JKM LNG spot prices now dropping to $12 per mmBtu, downside pressure on liquefied gas is also coming from weak Chinese demand as imports in Q1 turned out to be even lower than in Q1 2022, coming in at 16.5 million tonnes.

Market Movers

- The Glencore-Teck Resources negotiations are bound to become even more interesting as mining giants Vale (NYSE:VALE) and Anglo American (LON:AAL) are reported to have approached Teck for potential deals.

- US oil major ExxonMobil (NYSE:XOM) declared force majeure on liftings from several terminals it operates in Nigeria as the firm’s in-house workers union started industrial action.

- US major Chevron (NYSE:CVX) is seeking to tender a drilling ship for several years from 2024 onwards as it wants to ramp up exploration activity in offshore zones of Cyprus, Egypt, and Israel.

Tuesday, April 18, 2023

As oil prices have stabilized, with ICE Brent rangebound between $84 and $87 per barrel, macroeconomic prospects have once again come to the fore. This time around, the market’s upbeat sentiment about Chinese economic growth, buoyed by 4.5% growth in Q1, has been counteracted by concerns of looming US interest hikes in May. Should US inventories, however, record another week-on-week drop (as is anticipated), we might be in for another quick jump higher.

G7 Agrees on Stringent GHG Cuts. Meeting in Japan’s Sapporo, energy ministers of G7 countries pledged to reduce greenhouse gas emissions by 60% compared to 2019 levels, aiming to reach peak emissions by 2025 and hit net-zero by 2050 at the latest.

Kurdish Oil Is Still Not Flowing. Almost two weeks since Baghdad and Erbil struck a deal on how to manage Kurdish oil flows exported from the Turkish port of Ceyhan, cargoes are yet to start loading as Turkey disputes the $1.5 billion damages fine and seeks alternative ways to settle the payment.

US Warns on Oil Price Cap Evasion. As Russia’s Far Eastern crude grade ESPO has been trading above the $60 per barrel price cap for months, the US Office of Foreign Assets Control (OFAC) published a warning this week to US companies, warning them of providing services to these trades.

Colombia’s Options Are Narrowing. After the Colombian government decided to halt future licensing activities, US oil major ExxonMobil (NYSE:XOM) joined the list of firms relinquishing their exploration blocks this week, unilaterally quitting the VMM-37 block in the Middle Magdalena basin.

Germany Closes Its Last Nuclear Plant. Ending more than 60 years of nuclear energy in the country, Germany officially shut all its nuclear plants with Isar-2, Emsland and Neckarwestheim-2 disconnected from the national grid over the weekend, equivalent to some 5% of power generation.

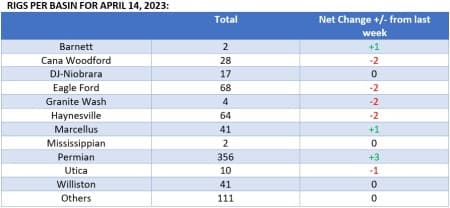

Mountain West Activity Slowing First. According to a new survey published by the Federal Reserve Bank of Kansas City, oil and gas activity in Colorado, Wyoming and Oklahoma have declined in Q1 2023, especially on the side of natural gas as breakevens in the region remain around $3.5/mmBtu.

Mexico Keeps on Subsidizing Pemex. Remaining the world’s most indebted oil company with arrears worth $108 billion, Mexico’s national oil company Pemex is still profiting from government help as the country’s finance ministry announced that it would defer payment of $2 billion in taxes this year.

EU Warns Against Banning Ukraine’s Grain. After Poland, Slovakia and Hungary introduced bans on Ukrainian grain and other food products last week to protect their agricultural markets, the European Union lambasted Central Europe’s unilateral actions and said trade policy is of EU exclusive competence.

Alaska LNG Project Gets the Go Ahead. The White House approved exports of liquefied natural gas from the greenfield Alaska LNG project developed by Alaska Gasline Development Corp for an estimated $39 billion, with the commissioning of the Asia-focused plant slated for 2030.

Russia Sanctions Curb Upstream Cooperation. One of Africa’s most prolific oil discoveries of late, Ghana’s Pecan field, received a great boost after Aker Energy (OSL:AKER) sold its stake in the project to Africa Finance Corporation, wary of sanctions due to Russia’s Lukoil (MCX:LKOH) having a stake, too.

Myanmar Disruption Sends Tin Prices Soaring. Prices of refined tin on the Shanghai Futures Exchange jumped 12% this week to ¥219,000 per metric tonne ($32,000/mt) after a militia in Myanmar’s state of Wa forced all mining operations in the region to halt, squeezing world supply.

Iran Reiterates Its Venezuela Support. Iran pledged to continue upgrading Venezuela’s oil infrastructure, with the Middle Eastern country’s oil minister Jawad Owji signing several documents on oil and gas projects, with key importance given to maximizing gasoline production amidst countrywide shortages.

Chinese Imports of Australian Coal Surge. Only a couple of months after Australia resumed coal exports to China, imports from that country soared to almost 3 million tons in March as the price of Newcastle 5,500 kcal/kg coal dropped to the lowest in 15 months, at $116 per metric tonne.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Natural Gas Jumps 8% On Colder-Than-Expected Weather Forecast

- Could Lithium Become A More Lucrative Alternative To Fossil Fuels?

- Top Oil EFTs See Longest Weekly Run Of Withdrawals In Eight Months