Bearish sentiment appears to have taken hold of oil markets lately, with demand concerns dragging prices lower. Oil bulls will be looking to OPEC+ to lift prices at its upcoming meeting.

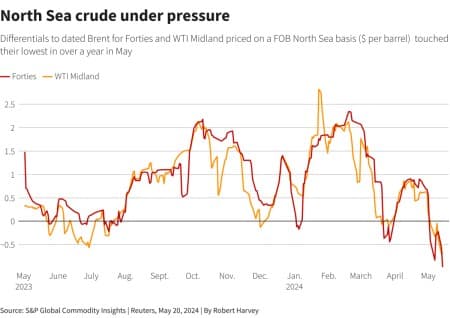

- European crude differentials have dipped this week after the continent’s return from maintenance has not seen a recovery in crude buying, with ample crude inventories allowing refiners to stave off purchases.

- The North Sea’s Forties grade fell to a -$1 per barrel discount to Dated Brent, the physical benchmark in Europe, whilst WTI Midland dropped to a -$0.70 per barrel discount, the lowest since it became part of the Brent basket.

- Short-term Brent swaps flipped into contango in the past few days, with crude for prompt delivery traded at a more than $1 per barrel discount to the July ICE Brent futures contract, a stark change after months of backwardation.

- Refinery curtailments in Asia, US refinery throughputs consistently trending lower year-over-year, and now European demand concerns indicate there might be too much oil amidst weakening global demand.

Market Movers

- US refiner Phillips 66 (NYSE:PSX) agreed to acquire pipeline company Pinnacle Midland Parent from PE firm Energy Spectrum Capital for $550 million in cash, expanding its midstream gas and processing footprint.

- Leading US natural gas producer Chesapeake Energy (NASDAQ:CHK) started laying off employees after its divestment of Eagle Ford assets, having missed Q1 earnings estimates after its announced production cuts.

- ADNOC, the national oil company of the United Arab Emirates, has acquired an 11.7% stake in NextDecade’s (NASDAQ:NEXT) Rio Grande LNG facility in Texas, simultaneously signing a supply agreement.

Tuesday, May 21, 2024

The death of Iranian President Ebrahim Raisi has failed to awaken oil prices from their slumber, with ICE Brent sticking to the $83-84 per barrel range so far this week. As several Fed officials managed expectations regarding a potential interest rate cut, market sentiment has been souring, with hedge funds continuously cutting their long positions in both Brent and WTI. OPEC+ might be the last hope of oil bulls out there.

Copper Prices Hit New LME Record. Copper prices have soared to a record high this week, with intra-day LME quotes surpassing $11,000 per metric tonne for the first time, prompted higher by last week’s Comex short squeeze as market participants anticipate supply shortages down the line.

Australia’s Power Woes Turn Ugly. Delays in installing transmission lines tied to wind and solar farms might trigger blackouts across Australia between 2024 and 2028 as the country continues to mothball gas- and diesel-powered generation capacity in southern states.

Russia Lifts Gasoline Export Ban. Russia’s government suspended a ban on gasoline exports until June 30 after inventories of the fuel started to build up in the country’s ports on the back of higher refinery run rates across the country, reimposing the ban from July 1 to August 31.

Mexico’s New Refinery Sees Another Delay. The pet project of Mexico’s outgoing president Andres Manuel Lopez Obrador, the 340,000 b/d Dos Bocas refinery, is unlikely to be commissioned before the country’s elections this week as Pemex is supplying only 5% of the plant’s total capacity.

Shell Shareholders Reject Tighter Climate Goals. Shell (LON:SHEL) shareholders rejected a resolution filed by activist shareholder Follow This, urging the UK-based energy major to include Scope 3 end-user emissions in its targets, with 78% of votes backing the firm’s current climate goals.

Tankers Start to Move Out of Baltimore. The refloating and removal of the 116,851 dwt Dali tanker from the Port of Baltimore has made it possible for deep-draft commercial vessels to resume movement in and out of the port, with Consol Energy (NYSE:CEIX) already loading a coal tanker this week.

Niger Joins Rank of Oil Exporters. Benin’s port of Seme has approved the loading of Niger’s first crude cargo after the country’s government sought to normalize relations with the military junta in Niamey, with the Front Cascade vessel carrying a cargo of heavy sweet Meleck crude to Spain.

Oil Discovery Lifts Suriname Outlook. Malaysia’s national oil firm Petronas found oil with its Fusaea-1 exploration well, marking the third commercial hydrocarbon discovery in the offshore Block 52, developed jointly with US oil major ExxonMobil (NYSE:XOM), increasing the likelihood of a floating LNG unit.

TMX to Load First Cargo This Week. The port of Vancouver will see the first-ever loading of a cargo from the expanded Trans Mountain (TMX) pipeline this week, with the Emirati tanker Dubai Angel expected to load 550,000 barrels of China-bound Access Western Blend this weekend.

Chile Allows Lithium Giant to Boost Production. Chile’s government reached an agreement with the world’s largest lithium producer Albemarle (NYSE:ALB) to expand its output in the country by 240,000 mt provided it complies with its National Lithium Strategy, using cleaner energy and reducing water usage.

Russia Wants Another Pipeline to China. Russia’s president Vladimir Putin wants to build an oil pipeline alongside the Power of Siberia-2 gas pipeline, using a mainland route via Mongolia, despite still not having agreed on commercial terms for the long-anticipated 50 BCm/year gas conduit.

Nigeria’s Refining Jewel Seeks US Barrels. Nigeria’s 650,000 b/d Dangote refinery, the largest plant coming online this year, seeks to sign a 12-month supply contract for the delivery of 2 million barrels of US light sweet WTI each month as it continues to prefer third-party barrels to domestic oil.

Turkey Becomes Europe’s Largest Coal Market. Turkey surpassed Germany as Europe’s largest producer of coal-fired electricity in January-April 2024, having generated 36 TWh against Germany’s 34.6 TWh, largely due to the latter’s steep 32% year-over-year decline.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Under Pressure as Demand Pessimism Grows

- Consumers Sue U.S. Shale Alleging Collusion to Boost Oil Prices

- Europe Needs To Address Intermittent Renewables Generation

Only when the United States starts refilling the SPR energetically we will be sure of weaknesses in the global oil market. Until then, such claims are pipedreams.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert