Venezuela is seeking more than 13 million barrels of fuel imports by the end of the year, which constitutes about a third of what the South American nation needs annually. The information is from tender documents seen by Bloomberg, and suggests deepening troubles for the country’s oil industry.

Refineries are operating at less than 50 percent of their installed capacity—which is 3.1 million bpd—due to insufficient supplies of crude oil and to insufficient maintenance, the latter according to BMI Research. The firm noted that refinery maintenance is being overlooked as the state oil company focuses its efforts on producing enough oil to repay debts accumulated over the last few years mainly to China and Russia amid the oil price crash.

In late May, Platts quoted Oil Minister Nelson Martinez as saying that it was business as usual for Venezuelan oil, despite technical reports suggesting that PDVSA had problems blending its diluted heavy crude from the Orinoco belt because of problems with its upgraders. Martinez then said that one of the four upgraders in the country would soon have higher capacity, at 100,000-120,000 bpd, from the current 80,000 bpd, but did not mention the state of the other three facilities.

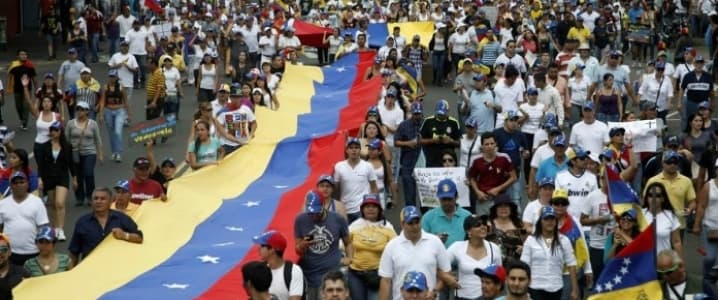

Long-time mismanagement of Venezuela’s oil resources and equipment is widely seen as one big reason for the current crisis, in addition to the 2014 price crash. The changed fortunes of the socialist state plunged Venezuela into a severe recession, with shortages of basic foodstuffs and consumer products, which naturally led to protests and calls for the government to resign.

Caracas has leaned heavily on Moscow and Beijing in order to avoid defaulting on its debts. Russia and China together have lent Venezuela over US$50 billion so far, on an oil-for-loan basis, and the falling production is making it hard for Venezuela to keep its end of the bargain.

Yet, as CNBC’s Fred Imbert recently wrote, a default is not an option for Caracas: it would cost it access to foreign markets at a time when the country is increasingly dependent on imports of various goods and commodities, and could eventually topple the government, which is hanging by a thread. Related: Saudi Reshuffle Could Completely Shake Up Oil Markets

A default would endanger Venezuela’s oil industry, Imbert noted, which is now more vital than ever for the country—it is basically its only source of export revenues. This source could potentially be shut down if Washington decides to go ahead with sanctions against PDVSA, an idea that has been discussed, according to sources close to the White House, as a way of removing Nicolas Maduro and his government from power.

Yet, sanctions could have the opposite effect and solidify the regime by boosting public support for it – the U.S. is traditionally seen as a meddler in Venezuelan politics.

Venezuela pumped 1.95 million bpd as of this April, according to the May S&P Global Platts OPEC survey. According to Caracas, production in April averaged 2.19 million bpd. Whatever the actual number, it’s below the average of 2.31 million bpd from April 2016. The decline is not huge, but it is significant in the context of the oil-for-loan deals and the capacity utilization rate of Venezuelan refineries. It is likely, as one analyst from local consultancy Ecoanalytica told Bloomberg, that Caracas will seek to import more fuels to satisfy its daily needs of 200,000 bpd.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Underperforming Energy Sector May Soon See M&A Wave

- Once Again, Tensions Are Rising In Nigeria’s Oil Sector

- OPEC Oil Basket Falls Below WTI