By any yardstick, the world's most popular electric vehicle manufacturer, Tesla Inc. (NASDAQ:TSLA), is enjoying a banner year. Tesla's parabolic rally has been nothing short of extraordinary, with the shares at one time exceeding a 1,000% gain over the past 12 months and nearly 500% in the year-to-date. At one point, Tesla was even more overbought than Bitcoin during the mad December 2017 rally after TSLA's 14-day relative strength index (RSI) metric touched 92.5 compared to Bitcoin's all-time high of <91.

The mad rally has forced even permabears such as Morgan Stanley's Adam Jonas and Bank of America's John Murphy to capitulate on their Sell ratings as everything seems to go Tesla's way.

That said, TSLA finally appears to be cooling off, shedding 11% just two days after the company announced a $5B capital raise by selling shares in the secondary market, a move that represents a mere ~1% share dilution.

Still, TSLA's current RSI reading of 72.1 suggests the shares have been burning rubber and have possibly entered bubble territory. Further, TSLA still boasts a market cap of $413B, easily the highest by any automaker.

Is Tesla's steep valuation justified, or has it become just another cult stock and a disaster waiting to happen?

What is fueling the insane rally?

Source: CNN Money

Defying bearish expectation

There is no way to sugarcoat this: Tesla's valuation looks absurd, whichever way you dice it.

Tesla's market cap is now bigger than Toyota Motors' (NYSE:TM) $215B, and several times bigger than the combined valuation of the U.S. 'Big Three': General Motors (NYSE: GM), Ford Motor Company (NYSE: F) and Fiat Chrysler Automobiles US (NYSE: FCAU) with market caps of $44.3B, $27.1B and $17.13B, respectively.

During the last quarter, the Palo Alto, California-based EV manufacturer delivered 90,650 vehicles, easily smashing the Wall Street consensus of 83,000 units. The highest forecast was for ~86,000 units.

Related: Why No One Is Buying Up Shale Assets

A big reason for Tesla's impressive numbers is its new Gigafactory in Shanghai, which remains on course to exceed production of 100K units during its first year in operation. That will help Tesla achieve its goal to sell 500K units in the current fiscal year.

It is noteworthy that all three ICE manufacturers recorded double-digit sales declines compared to a three percent Y/Y fall by Tesla. That is impressive because Tesla has been defying bearish expectations that low gas prices were going to slow down the electrification drive and discourage prospective buyers from shifting to EVs.

Still, Tesla sales are a mere fraction of the 1.29M units sold by the Big 3 during the quarter.

Tesla's current market cap implies that the company will be able to sell more than 6M units, or one-in-four of global EV sales, by 2030, marking a 12-fold increase in production output in just a decade. That won't be an easy feat to pull off considering that Tesla's global EV market share currently stands at 19%, and also when you take into account that Tesla brands will be competing against nearly 500 other brands, or 10X the current number of EV brands globally according to BNEF estimates.

Source: CleanTechnica

Other reasons have been advanced to explain Tesla's crazy rally.

One is that Tesla is emerging as the energy king.

Wall Street has been saying that Tesla's next challenge will be to convince its EV customers that charging their vehicles using coal-based electricity is not very green and urge them to generate and store their own solar power. Piper Sandler's Alexander Potter and Winnie Dong say that their experiment to install a solar system to charge a Model X has already yielded "illuminating" results and "shows significant promise" for Tesla's future in the energy-generation industry.

Related: 30 Years Of Drilling Data Points To A Rebound In U.S. Oil Production

Tesla's acquisition of SolarCity for close to $5bn in 2016 might turn out to be one of its best decisions in hindsight, given how well renewable energy stocks have been doing and the ESG megatrend. Further, Tesla's extreme vertical integration is beginning to yield dividends.

However, solar and battery storage remains an auxiliary business for Tesla, bringing in just ~5% of revenues.

Yet another reason is Robinhood, the zero-commission app that has brought hundreds of thousands of younger investors into the market. Tesla has consistently ranked among the most popular stocks on Robinhood, raising concerns that a group of naive investors is driving the rally. Indeed, Tesla shares have been rallying even harder after the company announced a 5-for-1 stock split., climbing 49% over the past 30 days. The same stock split mania has overtaken Apple Inc. (NASDAQ:AAPL) with the shares up 20% in the space of a month after the company announced a 4--for-1 stock split.

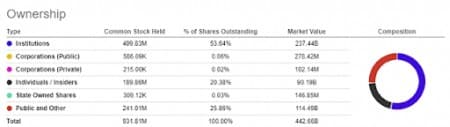

Tesla's latest 13G filing has revealed that individual shareholders and insiders own about 20% of the company, certainly big enough to cause some havoc.

Cracking the Tesla code

Whereas all these catalysts could be working in tandem to propel Tesla to its stratospheric valuation, perhaps nothing explains the torrid run better than Bank of America's John Murphy, who appears to have cracked the Tesla code:

"Building capacity in the automotive industry is expensive and often generates low returns. Even if there is a future software/service/ride-hail play for TSLA (and we have our doubts), the vehicles/platform still need to be manufactured. It is important to recognize that the higher the upward spiral of TSLA's stock goes, the cheaper capital becomes to fund growth, which is then rewarded by investors with a higher stock price. The inverse of this dynamic is also true, and it is this self-fulfilling framework that appears to explain the extreme moves in TSLA stock to the upside and downside."

Murphy says that whereas Tesla may or may not become dominant in the long-term, investors are more focused on the fact that it can continue funding outsized growth with almost no-cost capital driving capacity expansion.

Long-time Tesla investor, Baillie Gifford, has pretty much a expressed a similar sentiment:

"...We remain very optimistic about the future of the company. Tesla no longer faces any difficulty in raising capital at scale from outside sources but should there be serious setbacks in the share price we would welcome the opportunity to once again increase our shareholding."

Given the amount of goodwill Tesla is enjoying, it might even decide to buy the ICE heavyweights themselves or even highly profitable companies in other sectors, thus boosting its profitability overnight.

However, that does not mean that Tesla does not carry significant downside risk. As one analyst has warned, TSLA stock could very well take Amazon Inc.'s (NASDAQ:AMZN) early trajectory that saw the e-commerce giant crash to earth during the Dotcom burst before later becoming the most dominant player in the sector.

By Alex Kimani for Oilprice.com

More Top Reads from Oilprice.com:

- Kuwait Looks To Ease Dependence On Saudi Arabia With New Oil Development

- Brent Crude Hits 5-Month High On String Of Bullish News

- World’s Largest Oilfield Services Provider Sells U.S. Fracking Business

The answer is NO. Yearnings and Earnings are different things. You ask Why?

Maybe someday but the pre-season is nearly over and real earnings are nowhere in sight. I'm not talking about lumping in funny-money credits that can be taken away as quickly as they came by political bodies who don't understand the technology, the markets, or even what they are doing.

To make things worse, the big cats are now starting to prowl. By that I mean the likes of VW, Hyundai and others who are very good and have long experience scaling cars at a profit. Tesla makes wonderful machines but those are not 'cars for the rest of us' and they don't make money. They are competing with the likes of BMW and Benz who have no intention of letting Elon steal their thunder. Donner and Blitzen on coming and now that the EV market is about to cross the chasm to bring in mainstream and even conservative car buyers, arguably around 84% of the market (see Bell Curve if that number puzzles you), the moment of truth will come crashing into the Yearners.

When the X-15 is lying on the ground, whether in flames or pieces, it will be easier to get a sense of when or even if Tesla will justify that figure you mentioned. Most likely though it will be the lead story in the next chapter of Extraordinary Popular Delusions and the Madness of Crowds: 21st Century edition.

As a final note, Mr. Investor, the first loss is the sweetest.

Despite all the media attention and the huge government subsidies, Tesla only managed to sell 90,650 EVs during the last quarter. Even with a production of 100,000 EVs by its Shanghai-based factor, this will total almost 200,000 EVs. Still, such a number doesn’t under any circumstances justify a market valuation OF $413 bn.

In a way, the sudden rise in Tesla’s market valuation isn’t dissimilar to the huge hyper-rise rise in the US housing market whose bubble eventually burst causing the 2008/9 financial crisis which almost brought the US banking system and the global economy to the point of collapse.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Unsurprising crash in technology today should make for a wild open tomorrow. Oil and natural gas prices have held up very well in this market crash so far. Insofar as to how Tesla reacts to this fact bears watching as they have discussed the possibility of building a "Model 2" compact car to compete directly with General Motors and Nissan. Default rates look set to soar in the coming weeks and Months on account of "fear of Covid-19" as the cover story. US unemployment rates are of course set to soar as well. Meanwhile the US Financial System will have to be bailed out yet again. Still waiting on the Tesla Semi as well of course..