Higher oil prices may lead to huge growth in U.S. shale production, according to revised predictions from both OPEC and the IEA.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, January 19, 2018

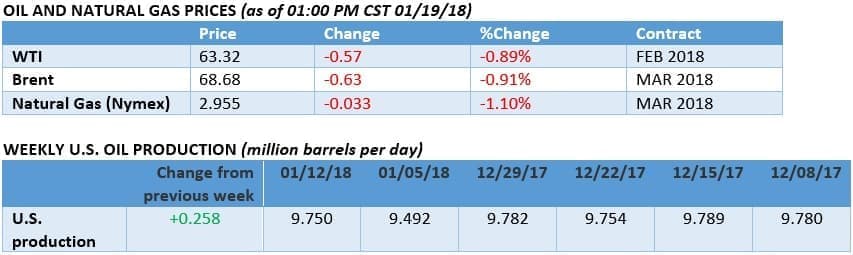

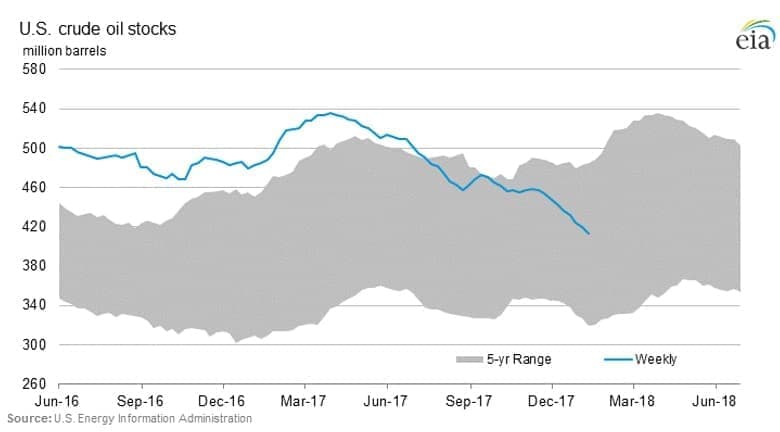

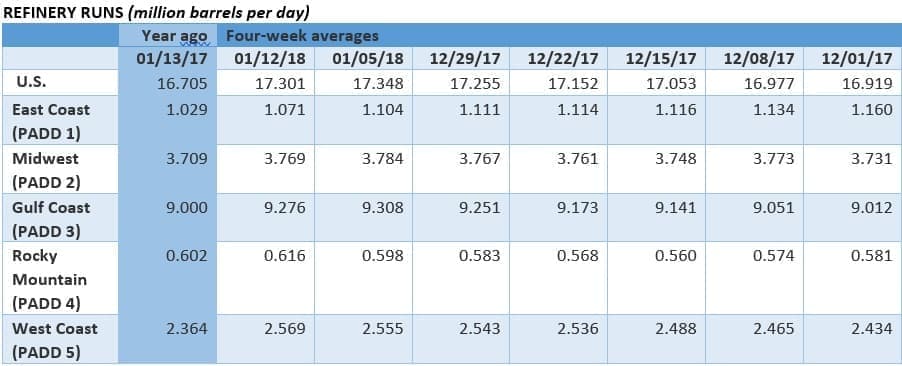

Oil prices fell back a bit at the end of this week. EIA data shows a rise in U.S. production, but also another strong decline in inventories. Brent is struggling to hold above $70, and benchmark prices await some direction.

IEA: Explosive growth in U.S. shale will test oil prices. The IEA’s latest Oil Market Report paints a mixed picture for prices. Clearly, the market is tightening, the IEA says, but it also says that shale growth will be “explosive” this year. The agency revised up its forecasts growth for U.S production from 870,000 bpd to 1.1 mb/d in 2018. That, combined with gains from other non-OPEC countries, could end the price rally, although the IEA says a lot of uncertainty remains.

Venezuelan oil production plunges by over 200,000 bpd. Venezuela’s December output cratered to 1.6 million barrels per day (mb/d), falling by 216,000 bpd from a month before. The shocking single-month decline raises the prospect of a much more serious meltdown in the country’s oil sector than most analysts previously believed. Debt, lack of maintenance, a lack of cash to invest, the decrepit state of PDVSA’s oil assets, and a brain drain are all contributing to the steep decline. Analysts see output falling to 1.3 mb/d this year, perhaps lower. “The only discussion right now is how much is it going to decline by. There is no talk of a turnaround,” Luisa Palacios, analyst at consultancy Medley Global Advisors in New York, told the WSJ. Related: The Biggest Oil Collapse In History

Permian bottleneck looming. Argus Media reports that surging oil production in the Permian could run into a ceiling of midstream capacity in the coming years, threatening the boom. For now, there is enough pipeline capacity to carry Permian oil to the Gulf Coast, but at some point the pipeline network will be maxed out, and there is “going to be a day of reckoning,” Enterprise Products Partners senior vice president Brent Secrest said at the Argus Americas Crude Summit in Houston, Texas. Pipeline companies see the bottleneck beginning in 2019 or 2020.

Royal Dutch Shell and BP agree to buy Libyan oil. Royal Dutch Shell (NYSE: RDS.A) and BP (NYSE: BP) agreed to annual contracts to purchase oil from Libya, a sign that the North African OPEC member is continuing its recovery after years of war. Libya’s oil output has been rebounding for more than a year, but buyers have been wary from unstable shipments. Shell’s deal with Libya’s National Oil Corp. was “the first of its kind since 2013,” Bloomberg reports. Libya’s production has climbed to 1 mb/d from less than half of that amount in 2016.

EIA: U.S. shale to jump by 111,000 bpd in February. The latest EIA Drilling Productivity Report predicts a rise in shale production by 111,000 bpd in February. The gains will be led by the Permian (+76,000 bpd), the Eagle Ford (+15,000 bpd), and smaller contributions from other shale basins. Meanwhile, the drilled but uncompleted well (DUC) list continues to mushroom, rising to nearly 7,500 in December, a monthly gain of 156 wells. Part of the backlog is thought to be the result of a shortage of fracking crews and other bottlenecks.

OPEC revises up shale expectations. In its monthly Oil Market Report, OPEC acknowledged that U.S. shale is growing faster than it previously thought. The group revised up its forecast for U.S. oil production growth this year to 1.15 mb/d, an increase of 160,000 bpd from last month’s report. The revision indicates that the OPEC cuts are helping tighten the market, but the knock-on effect is that it is providing more leeway to shale producers, something the cartel had hoped to avoid.

TransCanada eyes 2019 to break ground on Keystone XL. TransCanada (NYSE: TRP) said that it received enough commitments from buyers for the capacity on its controversial Keystone XL pipeline for it to move forward with construction. The Canadian pipeline company said that it has interest in 500,000 bpd of oil shipments for 20 years, enough for the project to move forward. TransCanada hopes to begin construction next year, although it still has not made a final investment decision. There are still some obstacles in Nebraska, where regulators recently approved an alternative route through their state, not the one preferred by the pipeline company. That means TransCanada has some more permits to obtain.

Lithium stocks fall on new supply. On Wednesday, SQM (NYSE: SQM), one of the largest lithium miners in the world, resolved a dispute with Chile, would paved the way for an agreement expand production. As a result, lithium stocks tumbled on fears of fresh supply. Albemarle (NYSE: ALB) fell 8 percent and FMC Corp. (NYSE: FMC) fell by 5 percent.

Related: China's Gas Production Hits Three-Year High

BP inks deal with Iraq for Kirkuk. BP (NYSE: BP) signed an initial agreement with the Iraqi government to ramp up production at a Kirkuk oil field, according to the FT. “The fields in Kirkuk have a [current] capacity of about 450,000 b/d at the moment but are only producing around 150,000 b/d,” Alan Mohtadi, head of T&S Consulting Energy and Security, told the FT. The deal comes several months after the central government retook Kirkuk from the Kurds. It also comes just days after Chevron (NYSE: CVX) said it would return to Kurdistan to increase production. Instability in Iraq is far from over, but the return of several oil majors suggests that some level of truce is holding. Meanwhile, Shell (NYSE: RDS.A) is looking to sell off its stakes in two large oil fields in southern Iraq, mostly due to the tough terms offered by the government.

Kinder Morgan delays Trans Mountain pipeline again. Kinder Morgan (NYSE: KMI) once again delayed its expected startup date for the Trans Mountain expansion, pushing it off 3 months to December 2020. That is a year later than the original expected start date. The pipeline is one of a few pipelines – in addition to the Keystone XL and Enbridge’s (NYSE: ENB) Line 3 expansion – that would significantly increase the takeaway capacity from Alberta. But Trans Mountain has run into problems obtaining permits.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Are Hedge Funds Pushing Oil Prices Too High?

- $70 Oil Cripples European Refiners

- Oil Rig Count Declines Amid Falling Prices