Trade talks and positive economic sentiment have helped prop up oil prices this week, but a cautious bullishness is developing ahead of the new year.

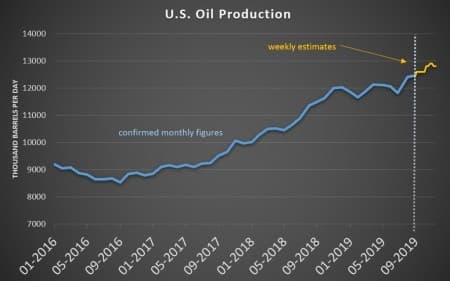

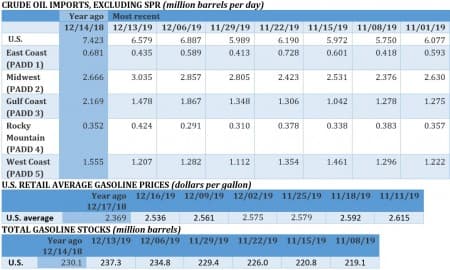

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, December 20th, 2019

Oil didn’t move a lot this week, but it may have consolidated gains achieved earlier this month. The trade talks continue on a positive trajectory, and economic sentiment is slightly upbeat. The U.S. reported a drawdown in crude inventories, although there was a surprising jump in refined product stocks. “A sense of cautious bullishness is developing as we head into 2020,” Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London, told Bloomberg. “Supply-side and demand-side factors are singing from the same supportive hymn sheet.”

Shipping industry proposes $5 billion in research on emissions. Several shipping associations representing the global maritime shipping industry have proposed creating a $5 billion research fund to help the industry develop technologies to slash emissions. The fund would be setup via a $2 per ton fee on fuel used by ships. The shipping industry accounts for 2.2 percent of total global CO2 emissions, and the IMO wants the industry to cut emissions by 50 percent by 2050.

Shell takes $2.3 billion write down. Royal Dutch Shell (NYSE: RDS.A) said that it would take a $2.3 billion impairment in the fourth quarter, due to weaker market conditions and an expected slowdown in sales.

Natural gas prices remain depressed. Natural gas prices could fall even further unless there is a serious cold snap in the U.S. this winter. Investors have staked out the most net-bearish position on gas futures in a decade.

U.S. gives up on Nord Stream 2. The U.S. appears to be giving up on its effort to block the construction of the Nord Stream 2 pipeline, according to Bloomberg. U.S. sanctions are not expected to derail the project, something that U.S. government officials now privately admit.

Libyan civil war tilts towards Haftar. The months-long civil war has largely been a stalemate, but oil deals suggest that multinationals are betting on Khalifa Haftar, and outside powers are also helping the Libyan National Army. Fortune seems to have swung in the favor of Haftar and the LNA.

Record number of CEOs toppled. A record number of corporate CEOs left their posts in 2019, either voluntarily or because they were forced out.

China dumps LNG in Asia. The glut of LNG is so bad that China is offering rock-bottom prices for cargoes in South Asia.

Superior Energy Services shuts fracking unit. Superior Energy Services will shut its hydraulic fracturing unit due to slower activity in the shale patch in West Texas, becoming the second supplier just this month that is closing shop. Around 150 hydraulic fracturing spreads, used to complete oil wells, have been taken off the market since April, according to Reuters.

U.S. SEC to propose disclosure rules for oil and gas companies. The SEC will once again try to impose disclosure rules for oil and gas companies, a decade after the Dodd-Frank bill was signed into law. The SEC has twice tried to adopt such rules, which would require companies to disclose payments made to foreign governments, but those rules have been blocked by courts and overturned by the Trump administration.

Related: The Best And Worst Oil Predictions Of 2019

French refineries interrupted by strike. A strike is affecting refining operations at several refineries in France.

Eastern U.S. states introduce cap-and-trade for transportation. The eastern and northeastern states that are members of the Regional Greenhouse Gas Initiative (RGGI) proposed a cap-and-trade style program for emissions from cars and trucks. More than a fifth of the U.S. population lives in these states, although New Hampshire decided not to participate. The program would cap emissions from fuel suppliers, with allowances able to be bought and sold. The costs would likely be passed onto motorists.

Shell paid no UK corporate income tax in 2018. The FT reported that Royal Dutch Shell (NYSE: RDS.A) paid no corporate income tax last year in the UK, despite earning profits of $731 million.

Texas lost 8,100 jobs this year. Texas lost 8,100 jobs in the “mining” sector through October of this year, according to the Dallas Federal Reserve, a classification that includes oil and gas. That is twice what the Dallas Fed estimated previously.

FERC’s controversial clean energy decision. The U.S. Federal Energy Regulatory Commission issued a controversial rule on Thursday, directing the PJM grid in the mid-Atlantic to raise the minimum bid requirements for subsidized solar and wind. Renewables groups said the decision was a blatantly politicized decision to favor fossil fuels.

Trump admin moves forward with biofuels proposal. The Trump administration is moving forward with the EPA proposal on biofuels for 2020, a plan that angered farmers in the Midwest because of the leniency it granted to oil refiners.

U.S. Congress passes $1.4 trillion appropriations, with tax credits for wind. As part of a massive spending package, the U.S. House passed a suite of tax credits that would favor wind, but the bill did not extend tax credits for EVs.

Canadian oil-by-rail shipments to surge in 2020. Canada’s oil-by-rail capacity could rise to as much as 550,000 bpd as Alberta relaxes mandatory production cuts. Meanwhile, as the need for rail capacity rises, new projects are moving forward.

Colorado approves new regulations, increasing inspections on oil and gas. New regulations from Colorado will increase inspections of well sites intended to find and repair leaks.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- US Proved Oil & Gas Reserves Hit New Record High

- Have Oil Prices Reached An Inflection Point?

- Study: Obesity Worsens Carbon Emissions

However, the oil market should be wary of President Trump’s tendency to change his mind suddenly vis-a-vis a rapprochement with China particularly in the aftermath of his impeachment. Still, China’s roaring oil imports could sustain the momentum of the oil price’s surge.

China’s record-breaking crude oil imports hitting 11.8 million barrels a day (mbd) in November are the clearest indication that China’s economy is healthy and that the fundamentals of the global oil market are positive.

However, the global oil market should also be aware that the current trade war was not about oil or China’s trade surplus or alleged Chinese manipulation of the yuan to achieve trade benefits at the expense of the US. It is about the petro-yuan undermining the supremacy of the petrodollar in the global traded oil market. It is about Taiwan, China’s sovereignty claim over 90% of the South China Sea and the world order. It is, in the final analysis, about who will emerge as the most dominant power in the 21st century.

Political conflicts affecting trade between the world’s two largest economies could erupt every now and then. No incumbent superpower will ever relinquish a pride of a place to a challenger. The superpower is the United States and the challenger is China.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London