Bullish messaging from the IEA and the unexpected launch of U.S. SPR repurchases have bolstered oil prices today, limiting the downside ahead of the next OPEC+ meeting.

Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, Global Energy Alert is an absolute must-read. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week.

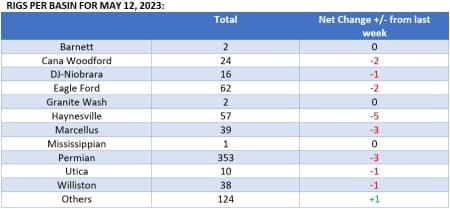

Chart of the Week

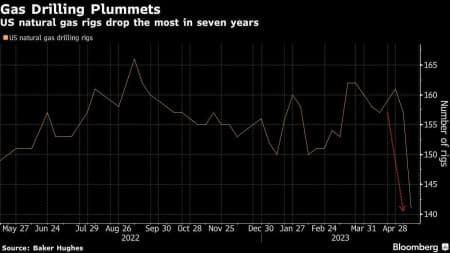

- The anticipated plunge in natural gas drilling is starting to take shape as Baker Hughes reported the biggest week-on-week decline in natural gas rigs since February 2016, falling by a whopping 16 rigs to 141.

- The prospect of production cuts further down the line buoyed front-month Henry Hub futures, adding more than 5% on the week to $2.4 per mmBtu, simultaneously boosting gas-focused equities such as EQT (NYSE:EQT) or Antero Resources (NYSE:AR).

- Despite weaker drilling data, US natural gas production has been maintaining record production levels from April and trending at 101.4 billion cubic feet per day in the Lower 48 states.

- Investor positioning in Henry Hub futures remains nevertheless bearish, with hedge funds’ net short expanding to 54.5 thousand lots, the largest short position since late February.

Market Movers

- Global commodity trader Trafigura keeps on investing in downstream assets, raising its stake in Italian refiner Saras (BIT:SRS) to 12.46% from 5.23%, only a week after it finalized its offtake agreement with Italy’s second-largest refinery, ISAB.

- US natural gas midstream firm ONEOK (NYSE:OKE) agreed to buy pipeline operator Magellan Midstream Partners (NYSE:MMP) in a cash and stock deal valued at some $18.8 billion.

- Days after first rumors surfaced of ADNOC wanting to buy Brazil’s petrochemical giant Braskem (NYSE:BAK), the country’s oil champion Petrobras (NYSE:PBR) was reported to have stepped into the bidding game.

Tuesday, May 16, 2023

The unexpected launch of US SPR repurchases combined with the IEA reiterating its belief in strong demand growth into the second half of 2023 have buoyed oil prices, lifting ICE Brent to $75 per barrel. The strong messaging will likely meet resistance from weak manufacturing data reported by China, but it seems the downside is limited for crude ahead of the upcoming OPEC+ meeting.

US to Start Refilling SPR. In a surprise move, the US Department of Energy said it will purchase 3 million barrels of oil for the Strategic Petroleum Reserve for August delivery, specifying that the crude should be sour and going to the Big Hill, TX site.

IEA Turns Suddenly Bullish. Acknowledging that oil has been pressured by weak industrial activity growth and higher interest rates, the IEA nevertheless warns that it expects a 2 million b/d discrepancy between global oil demand and supply, raising its demand growth forecast to 102 million b/d.

EU Mulls Russian Pipeline Oil Ban. The European Union is considering banning Russian crude flows via the Druzhba pipeline to Germany and Poland even though both had stopped imports earlier this year, whilst keeping the sanctions waiver for the southern branch of the same pipeline.

LME Tightens Warehouse Rules. After several cargoes of LME-approved nickel turned out to be stone this year, the London Metal Exchange now pledged to tighten checks on warranted nickel including “touch inspection” and obligatory weighing of nickel bags.

Shell Halts Production at World’s Largest FLNG Plant. Plagued by power cuts and industrial action, UK-based oil major Shell (LON:SHEL) has suspended production at its 3.6 mtpa Prelude LNG facility off the western coast of Australia, describing the issue as a “process trip”.

PDVSA Pins Hope on Big Data for Production Rebound. Venezuela’s national oil company seeks to increase its crude production by a third to 1 million b/d by end-2023, using new seismic surveying data and “reinterpreting” 3D data to improve recovery.

Canada Shut-Ins Ease as Wildfires Subside. A relative decrease in wildfires across Canada’s Alberta province has allowed some oil producers to resume operations, with shut-in volumes halving from the 320,000 barrels per day of oil equivalent seen last week.

No Kurdish Restart Until Elections Are Settled. Iraqi federal authorities informed Turkey that exports of Kurdish crude from the port of Ceyhan could restart from the 13th of May, but there has been no formal response from the Turkish side amidst hotly debated elections.

LNG Developers Fret About Permit Overhaul. The US DoE will no longer provide permit extensions to LNG developers that fail construction deadlines, following last month’s rejection of Energy Transfer’s (NYSE:ET) Lake Charles project delay, weighing heavily on smaller firms without a track record.

Tight Availability Lifts US Sour Grades. Spot prices for the US’ main sour grade Mars have climbed to a $1.60 per barrel premium to WTI, the strongest since September 2020, as strong refining demand, the end of SPR releases and force majeure in Shell’s Zydeco pipeline provided support.

Hedge Funds Sell Copper on Chinese Weakness. As copper prices fell to a 5-month low below $8,150 per metric tonne, investor positioning on CME copper contracts has turned even more bearish as the net short rose to its largest since August 2022, aggravated by China’s falling manufacturing figures.

EU Tightens Renewables Target Again. The European Union is set to increase its renewable energy target to 42.5% by 2030, up from the current pledge of having a 32% share of renewables in energy consumption, also hiking hydrogen sourcing requirements to the same 42%.

South Africa Cuts Emissions Thanks to Blackouts. South Africa has started to lower its greenhouse gas emissions even though this was supposed to happen only after 2025, but the regular breakdowns of coal-fired power plants in 2022-2023 and rolling blackouts have achieved just that.

Russia and Kazakhstan Eye a Gas Pipeline to China. According to the Kazakh Energy Ministry, Russia and Kazakhstan have established the route for a future gas pipeline that would send natural gas from the two countries into China’s northern provinces, without any mention of the conduit’s capacity.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- IEA: Oil Bears Are Disregarding An Imminent Supply Shortage

- Texas Natural Gas Prices Turn Negative

- $70 Oil Creates Opportunity In Canadian Oil Stocks

$slb Slumberger looks on sale to me quite suddenly.

Long $kmi Kinder Morgan Energy strong buy