As we first noted on Monday in "Hedge Funds Liquidate Oil Positions At A Near-Record Pace Amid Extreme Volatility", and as Bloomberg writes today, "fund managers have shown signs of being cautious when it comes to energy stocks, the only major industry group in the S&P 500 with a positive return so far this year" and certainly today's best performing sector.

But that caution appears to be misplaced yet again (no surprise considering the "smart money" has been dead wrong about energy for the past two years), given the tectonic shift in the petroleum market caused by Russia’s invasion of Ukraine and the ensuing sanctions.

And while most 22-year-old portfolio managers have that deer in headlight looks when given the choice of buying XOM or AAPL, look no further than the Oracle of Omaha himself, who likes to get greedy when others are being too fearful: Warren Buffett’s Berkshire Hathaway disclosed that it raised its stake in Occidental Petroleum to 14.6% with purchases of 18.1 million more shares this week, according to a filing released late Wednesday.

Berkshire has drilled even deeper into Occidental’s stock as surging oil prices buoy the U.S. shale driller. A few weeks ago, Berkshire disclosed that it had built up a common stock investment in the oil giant in addition to its preferred stock holding, a little less than two years after Berkshire exited what was then a modest common stock holding in Occidental. Buffett told CNBC in March 2021 that he started buying the stock after one of Occidental’s earnings calls.

Occidental surged this month after Berkshire’s earlier investment and as the war in Ukraine drove oil prices higher. The company hiked its dividend 1,200% in February and has sought to cut debt by buying back some of its bonds. Even as Occidental benefits from higher prices, CEO Vicki Hollub warned that U.S. oil drillers can’t significantly expand production in the short term to fill the gap caused by sanctions on Russia, citing labor shortages and supply-chain challenges. Translation: oil prices will stay higher, leading to a windfall for drillers and E&P giants. Related: Pierre Andurand: Oil Could Jump To $200 By Year-End

Berkshire initially built its preferred stake in the oil producer when it invested $10 billion to help finance Occidental’s Anadarko Petroleum Corp. acquisition in 2019.

As Bloomberg notes, after a decade of burning through profits in order to boost production in the shale patch, explorers have begun heeding investor demands for greater austerity. They’re expected to keep spending growth limited this year so they can boost free cash flow and return more to shareholders.

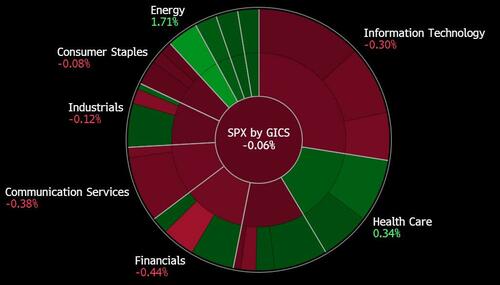

S&P 500 energy stocks are up 28% on the year, the only year-to- date gain among the 11 main industries in the index. Unlike long-term investors like Buffett, those large gains may have pushed some investors to book short-term profits and may be scaring new buyers from taking larger long-term positions, according to Bloomberg.

That's why despite the vast outperformance for the energy group, it appears to be the opposite of a crowded trade. as the latest FMS survey showed, Bank of America clients have been just small net buyers of energy stocks since the beginning of February when Russia-Ukraine tensions escalated, BofA analysts wrote in a recent note, and active funds are still ~30% underweight the sector.

To be sure, some investors are worried that oil - which in just the past two weeks tumbled from $140 to below $100 on Ukraine ceasefire optimism - will run up in price only to crash if the economy falters. As a historical comparison, TD Securities analyst Aaron Bilkoski looked at the 2007-2008 period. Back then, WTI went from the mid-$60-a-barrel range to almost $150, then back to below $40 during the financial crisis. Even if that type of scenario repeats itself, the analyst found that almost all exploration and production companies likely will have positive free cash flow this year and next year, and explains why so many local drillers are leery of boosting output. He added that current valuations are more attractive now than they were then.

For oil-service stocks, Benchmark analyst Subash Chandra believes the recent “pullback in oil prices is ultimately a positive as it reduces recession risk and should help focus attention on the tight market for oil services and equipment.”

Ironically, with President Joe Biden calling out energy companies over prices at the pump, oil in a steady range of $95 to $100/barrel could benefit energy companies overall by limiting attempts to tax windfall profits while also limiting demand destruction. Indeed, a stable price in the low $100s is the best possible outcome for the US energy industry which has optimized tremendously in the past decade, pulling breakeven prices to the low $40s according to some estimates. In a Mar. 11 note, Bank of America reiterated its overweight on the sector, citing inflation-protected yield, near-record low valuations, improving profile with ESG investors and energy companies’ prioritization of capital discipline above production as reasons to stay long.

And while hedge funds - which have failed to outperform the market every year since 2010 when their "expert network" insider trading games blew up thanks to Steve Cohen - continue to dump and short energy names at every opportunity, Buffett is buying, and so - as usual - expect a major squeeze in the coming weeks as the latest hedge fund hotel trade blows up yet again.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Rebounds As Market Fears Russian Supply Shock

- Why Oil Crashed Back Below $100

- Huge Russian-Run Iraqi Oilfield May See Near-1 Million Bpd Output Boost