Oil prices rallied this week as geopolitical risk and supply issues added to bullish sentiment, although concern that the Fed might not cut interest rates this year could counter that sentiment.

Friday, April 5th 2024

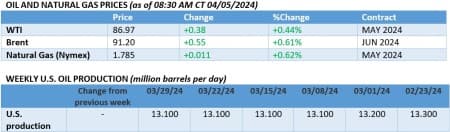

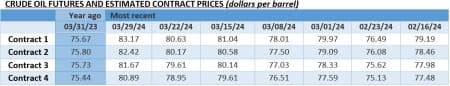

Aided by a whirlwind of bullish news, Brent prices surpassed the $90 per barrel threshold and surged past the $91 per barrel mark on Friday morning. The anticipation of Iran’s retaliatory strike on Israel, a developing Mexico export shortage, and the continuation of OPEC+ cuts have boosted sentiment in the oil market recently. On the other hand, the potential of the Fed not cutting interest rates this year could pour some cold water on the oil price rally.

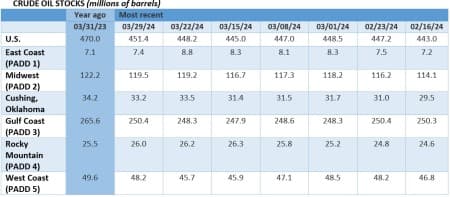

US Government Cancels SPR Repurchases. The US Energy Department announced it would “keep the taxpayer’s interest at the forefront” and scrapped its tender to buy 3 million barrels of strategic petroleum stocks in August and September as WTI rose to $86 per barrel this week.

Official TMX Pipeline Launch Sooner than Expected. The Trans Mountain Expansion pipeline announced it would start commercial operations on May 1, one month before market expectations, as Canada’s government wants to start the $25 billion project as soon as possible.

Investors Flee Diesel as Gasoline Reigns Supreme. Hedge funds and other money managers have been quitting their diesel positions, with CFTC data showing 25 million barrels sold in the NYH ULSD and ICE gasoil contracts the week ending March 26, as gasoline has become the product of preference.

Russia to Scale Back LNG Ambition. Russia’s LNG exporter Novatek might scale back its ambition of building a 19.8 mtpa liquefaction facility at the Arctic LNG 2 plant and only build two trains instead of three, reusing one for a new project that would be built in ice-free waters.

Senegal’s New President Launches State Probe. Bassirou Faye, the newly elected President of Senegal, has oil companies on tenterhooks after he called for a nationwide audit of the oil, gas and mining sectors, potentially affecting the launch of Woodside’s (ASX:WDS) Sangomar project.

Shell Asks for Long-Term Venezuela Guarantees. UK-based oil major Shell (LON:SHEL) asked the US government for a long-term license before it takes an FID on the 4.2 TCf Dragon offshore gas field in Venezuela, with the current White House waiver running out in October 2025.

Mexico Goes on an Oil Export Cancellation Spree. Mexico’s state oil firm Pemex asked its trading unit to cancel up to 436,000 b/d of crude exports in April to have enough crude for the Dos Bocas refinery, just as the country’s crude production has fallen to a 45-year low in recent months.

Some Fields Are Too Good to Give Up. The Dutch parliament’s vote on a bill that would permanently ban gas production from the giant Groningen field has been delayed indeterminately, and despite a preliminary shutdown in October 2023 it could still be reactivated in exceptional cases.

US to See Extremely Active Hurricane Season in 2024. The annual hurricane forecast released by CSU sees the Atlantic season well above average hurricane activity, expecting 23 named storms out of which 5 could transform into major hurricanes, higher than the 3.2 per season average.

Petrobras Readying for Corporate Turmoil. Brazilian media are reporting that the top executive of Brazil’s national oil company Petrobras (NYSE:PBR) Jean Paul Prates might be replaced in the coming days amid an ongoing dividend spat between him and the country’s Energy Minister.

US Tightens Screws on Iranian Oil Tankers. The US Treasury Department sanctioned 13 oil tankers and their UAE-based operator Oceanlink Maritime for allegedly transporting Iranian oil on behalf of the country’s military, bringing the number of sanctioned ship to 258 tankers.

Copper Rallies on Resurging Supply Risks. The price of copper has jumped to the highest since January 2023 above $9,360 per metric tonne as reports of Ivanhoe Mines’ (TSE:IVN) giant DRC Kamoa-Kakula complex seeing a 6.5% drop in Q1 production alerted the market to the risks of tight supply.

Myanmar Conflict Might Threaten Chinese Infrastructure. Internecine strife in Myanmar might soon endanger Chinese crude supply as separatist militias from the Arakan Army have seized territory only miles away from Kyaukpyu port, feeding Petrochina’s 260,000 b/d Anning refinery in southwest China.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Biden Charges Forward With Historic Auto Emission Crackdown

- Why Do We Still Have Investor-Owned Utilities?

- StanChart: Oil Demand Set for All-Time High in May