Colombia

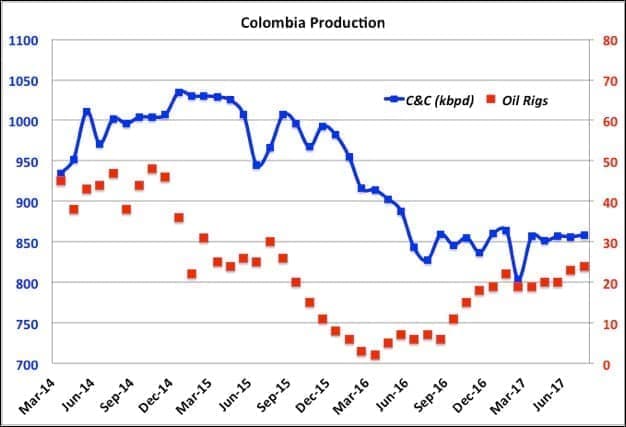

Colombia production is holding a plateau over the past year after a large decline in the last part of 2015 and first half of 2016. August value was 858 kbpd (down 0.04 percent y-o-y).

(Click to enlarge)

Colombia oil reserves at the end of 2016 were 1.66 Gb (down 16.8 percent from 2 Gb in 2015 which followed a drop from 2.31 Gb in 2014). At the average 2016 production rate of 885 kbpd this gave an R/P of 5.1 years, the lowest for any significant producing country. Most of their production is heavy oil. Ecoptrol, which accounts for more than three quarters of Colombia’s crude and natural gas reserves and output, estimated about 45 percent of their decline was due to the “pronounced fall in oil prices”.

Individual field production is reported through the Colombian hydrocarbon agency (ANH), but data is only available to June. The previous decline mainly seems to have come from the many smaller fields (there are almost 500 total producing fields listed for 2017) and the largest one, Rubales. A few smaller fields were added in 2015, but the main cause of the plateau seems to be an arrest of the previous declines in the mature fields. Some of that may have been to do with the cessation of insurgent sabotage on pipelines.

(Click to enlarge)

It’s unlikely they will be able to maintain a plateau without new discoveries. Exploration has dropped significantly in the last couple of years; Anadarko has been one of the few companies to maintain some activity but they only found gas and the latest news from them would appear to indicate they are going to use money for share buybacks rather than expansion. Even EcoPetrol look more interested in opportunities abroad (e.g. offshore Mexico).

Mexico

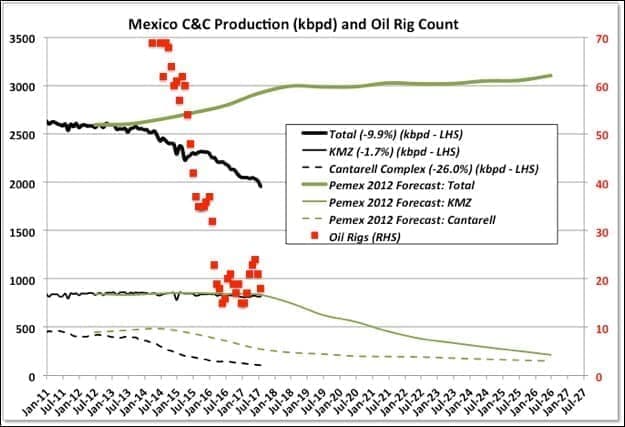

After a stable plateau for the first six months of 2017 Mexico’s C&C production dropped in July and had another big drop of 56 kbpd in August (down to 1960 from 2175 last year, or 10 percent). Almost all the decline came in the Southwestern Region offshore; some of it is maintenance, but the major turnarounds were meant to be finished in early August. Total liquids (including NGL) were down 75 kbpd from July to 2196 (a 10.8 percent decline y-o-y). KMZ is still holding up, but Pemex forecasts from 2012 indicate it should be starting to come off plateau soon. The KMZ oil is, on average, heavy but not consistent across the fields with Maloob and Zaap at API 12° and Ku at 22°. The production facilities have segregated systems for each, which may impact how the decline curve looks (for comparison Cantarell is API 21°, the heavy end of medium).

(Click to enlarge)

(Click to enlarge)

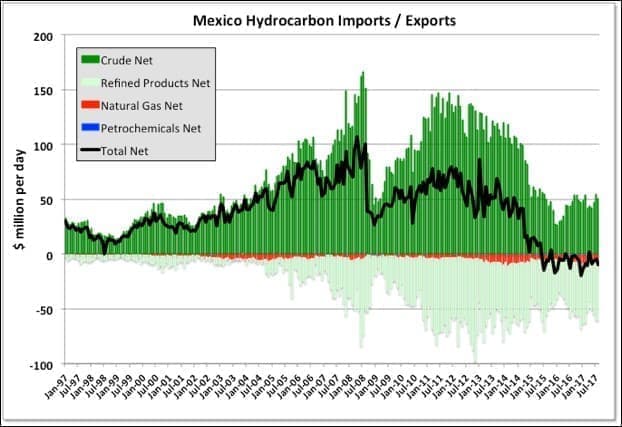

Overall it looks like Mexico’s net import of hydrocarbon products, which switched from a net export in early 2015, is starting to creep up.

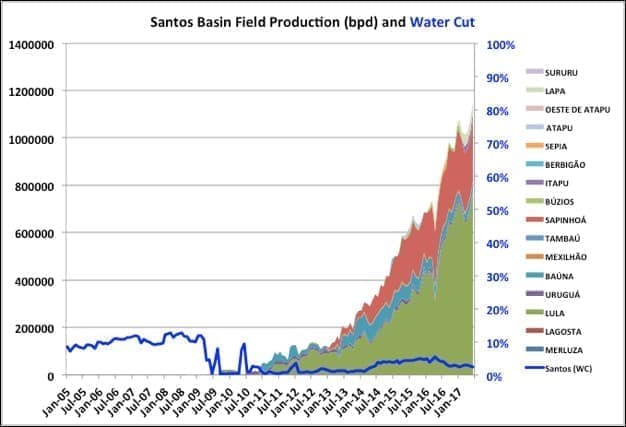

Brazil

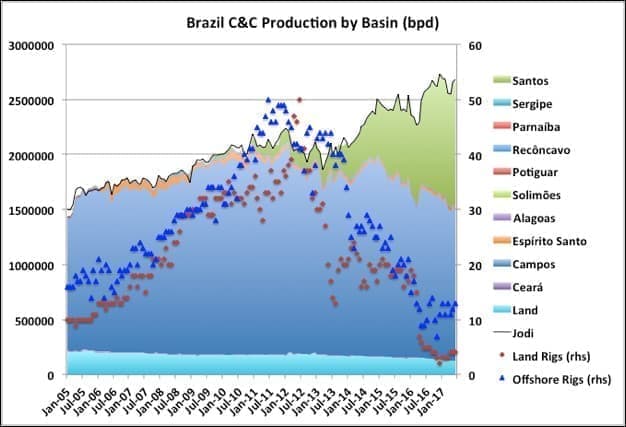

Brazil field data is available from ANP through June. Total production for July has also been issued and is about the same as June. Overall production is generally on a plateau, with newer production from the Santos basin replacing declines in the Campos and other offshore basins, and land wells. There are another three FPSOs with 450 kbpd nameplate due this year and another eight due in 2018 and 2019, with about 1 mmbpd nameplate. Decline rates in the mature deep-water wells are very high, but the new developments should mean new production records are continually set for a couple of years (barring accidents). However, beyond that, activity in Brazil for exploration and approving new developments has been going much slower than expected by some, there are reports that three other FPSO contracts are being negotiated, but they have been around for about a year, and there are five other identified deep-water developments. Related: Why Petrol Powered Cars Aren’t Going Anywhere

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Brazil continues to be a net exporter of hydrocarbons (by value), although slightly declining at the moment.

(Click to enlarge)

By Peak Oil Barrel

More Top Reads From Oilprice.com:

- Can Trump Drive A Wedge Between Saudi-Russian Alliance?

- A New Oil Crisis Is Developing In The Middle East

- Russia Goes All In On Arctic Oil Development

Their total petroleum liquids production fell at 3.7%/year, but their net exports fell at 9.6%/year over the same time frame, i.e., another example of "Net Export Math."