For much of the past year, Standard Chartered's Geoffrey Kendrick has had a nice, round number in mind for his 2024 year-end price target: after (somewhat accurately) predicting in late 2022 that Bitcoin could tumble as low as $5000 in the aftermath of the FTX collapse, Kendrick flipped in mid-2023 at which point - and ever since - he has argued that due to the "seismic changes in the institutional approach to Bitcoin in the United States", the cryptocurrency would hit all time highs in 2024 (it did) and rise as high as $100,000 (it has yet to do that).

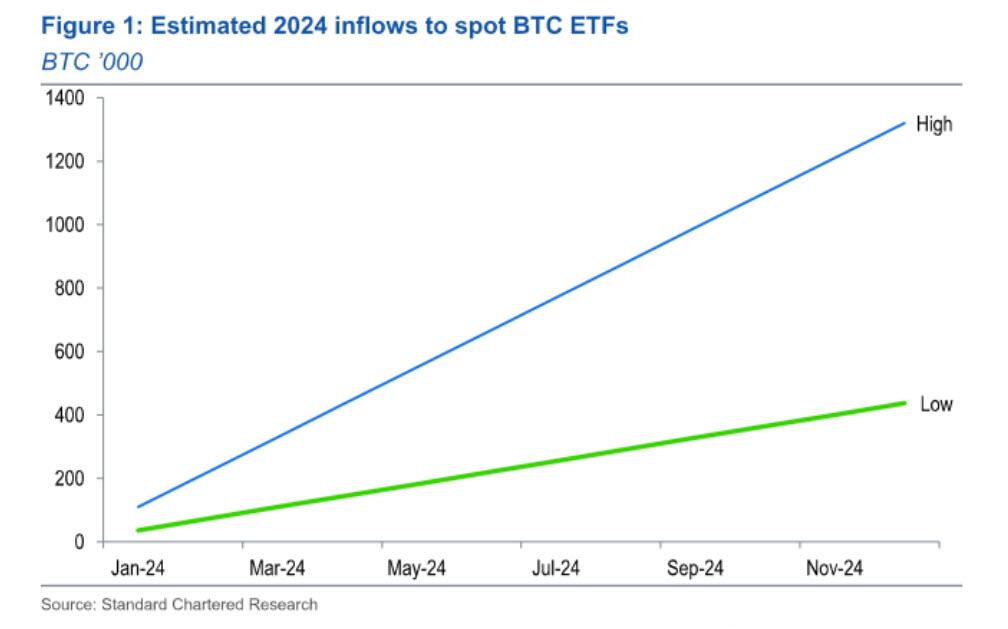

Then, at the start of 2024 and after the SEC approved bitcoin ETFs, Kendrick doubled down on the nice round numbers, and said that based on his ETF inflow assumptions, while he still thinks that an end-2024 Bitcoin price target of $100,000 is realistic, looking further out, the Standard Chartered strategist predicted that an end-2025 level closer to $200,000 is possible. This assumes that between 437,000 and 1.32 million new bitcoins will be held in spot US ETFs by end-2024. In USD terms, this should be roughly USD 50-100Bn.

Then, at the start of May, once it became increasingly realistic that not only did Trump have a fighting chance of defeating Biden but that Gary Gensler's days are likely numbered - with the SEC's relentless pushback against Ethereum ETFs unexpectedly collapsing - Kendrick made a follow up observation in which he once again returned to his nice, round number prediction, forecasting that bitcoin will surge above $100,000 "when we get closer to Trump election victory we can rally hard from say Sept. to year-end."

So here we are, two months later and not only is bitcoin not anywhere closer to the nice, round number but it has in fact dropped somewhat notably from where it traded in late May.

What gives?

As Kendrick explains in his latest note published this morning, "frustrated BTC bulls have come up with a number of theories as to why we are stuck in a range. The most popular (the one I have heard the most which also makes sense) is that longer term holders continue to sell to nearer term buyers. Hence rallies are sold into and dips are bought."

The question then is what macro driver will be enough to make this stop? Kendrick thinks there will be a combination of Treasury yield movement which coalesces with a constructive US political backdrop, both of which he believes "will happen soon."

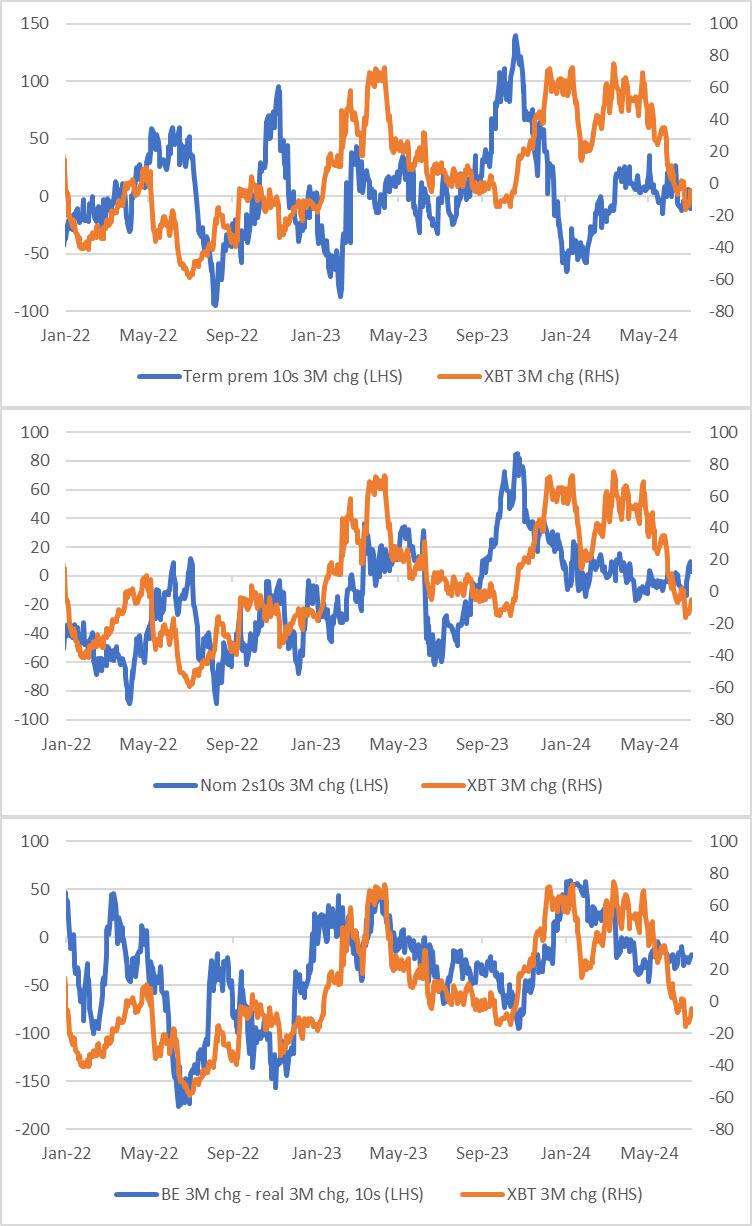

Starting with the first, on Treasury yields the strategist previously identified 3 drivers that should be constructive BTC in the attached note:

- A steeper nominal 2Y/10Y curve

- A greater increase in breakevens than real yields

- An increase in term premium

And while far from perfect, Kendrick believes that there is a "reasonable correlation" between each of these and BTC prices, shown here as 3 month changes. Interestingly, in recent weeks the UST movements have started to improve for BTC direction (or have at least started to go sideways) whereas BTC prices have been weak, which suggests that there is something else holding back the prices.

But if the increasingly favorable moves in rates are not having an impact on bitcoin prices, then what is it: "why have BTC prices been weaker than the UST drivers would suggest?"

Here, Kendrick thinks it has to do with the current state of the US Presidential election.

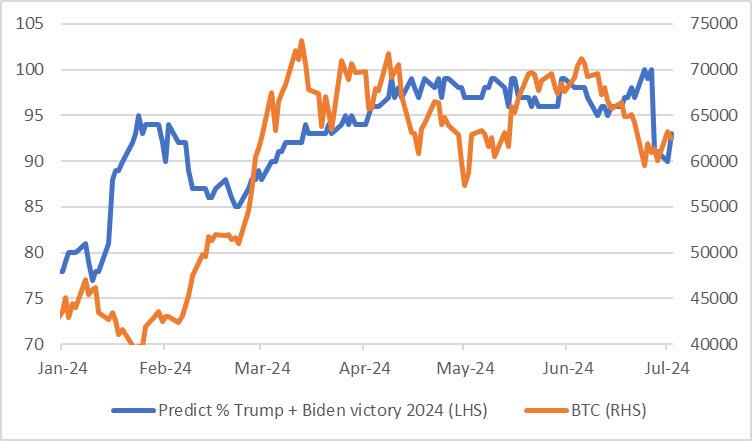

Recall the previously discussed positive relationship between Trump's electoral odds (shown here as the % probability of victory as reflected in betting markets) and BTC prices. The logic here is that both regulation and mining would be looked at more favorably under Trump:

Looking at the above chart, it is safe to say that BTC prices got ahead of Trump probabilities on ETF inflows, but BTC prices are now lagging. Why the lag?

Kendrick believes that this time BTC prices are lagging Trump probabilities because the probability of Biden stepping down/being replaced has been increasing. Specifically, the combined odds of Trump and Biden have now fallen to as low as 90% this week, the lowest level since March. That is, betting markets are saying there is a 10% chance someone other that Trump or Biden will win the Whitehouse.

Indeed, today's story sources by the CIA's favorite mouthpiece that Democrats are now in disarray and that Hunter Biden is effectively in charge of the country...

... has sent Kamala Harris' odds of becoming the Democrat nominee soaring.

In a probability sense, this means the market is now saying Trump is most likely to win (BTC positive), followed by Biden (BTC negative) but with a reasonable non-zero chance Biden is replaced and someone else - Michelle Obama, Kamala Harris or Gavin Newsom - wins (BTC negative). From a bell-curve perspective this is the equivalent of a fat left tail event.

From here Kendrick sees 2 possible outcomes:

- Biden stays in the race and, given market pricing, will be expected to lose to Trump (BTC positive)

- Biden exits the race and the newcomer will be perceived to have more chance to beat Trump than Biden had (BTC negative)

The good news is that we won't have long to wait to find out the answer: the key date is 4 August, that's when Ohio law requires Presidential candidates to be registered. So, if Biden is still the Democratic nominee on 4 August he will still be so in the first week of November.

Going forward what the Standard Chartered analysts expects to see is the following:

- Most likely (90%) - in late July we conclude that Biden will run, Trump probabilities increase further, the fat left tail is removed. BTC moves higher, vol and skew moves higher. A fresh all-time in August is likely, then $100k by US election day

- Least likely (10%) - in late July Biden steps aside, BTC prices dip to $50-55k. If the new Democratic candidate is very credible (Michelle Obama) BTC prices stay soft. If not, it is a fantastic buying opportunity. BTC prices bounce back to $100k by US election day

Watch this space for early moves in BTC vol and skew.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Inside Orban's Ceasefire Proposal and Controversial Moscow Trip

- Energy Independence: What It Means and How We Measure It

- Iran to Purchase 10 Billion Cubic Meters of Turkmen Natural Gas Annually