At some point, fossil fuel sales will stop growing. How soon? You can make the projections, the ones that start with overall demand, and the ones that look at each individual use of fuel. We suggest that you might assess their plausibility using a simpler technique. Years ago at an economic seminar, we witnessed one of the world’s greatest econometricians fill an entire blackboard (they had them then) with equations to explain the growth of the economy. Another economist rose to say that he could explain the economy as well with five equations. Then he said he could do an even better job of projecting by connecting the points with a ruler and extending the line. So, let’s get out the ruler.

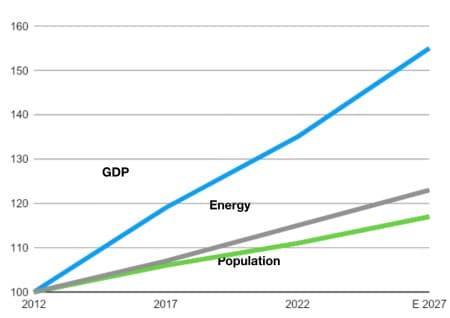

Figure 1 shows the relationship between real gross domestic product, population and energy consumption for the world, real numbers through 2022 and an estimate for 2027 made by extending the lines.

Figure 1. World GDP, population and gross domestic product (2012 = 100)

These trends have prevailed for decades. Energy demand (grey line) grows less than half as much as the economy (blue line), but slightly faster than population (green line). It is difficult to argue convincingly that something will come along big enough to upend these relationships over the short term. After all, the bulk of the buildings, vehicles, machinery and people that account for most of the energy consumption are already in place, and demand patterns change slowly. In 2012-2022, global real GDP grew at 3.0% per year, energy demand at 1.4% per year, and population at 1.1% per year. Related: Iraq Unwilling To Resume Crude Exports From Kurdistan To Turkey

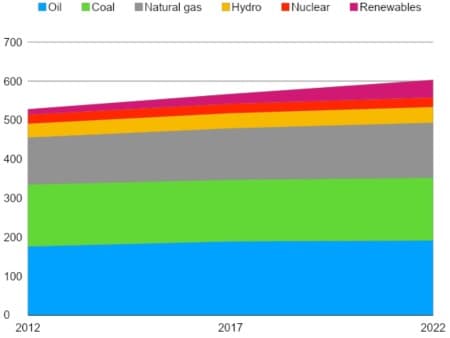

That tells us about the global demand for energy but not about the primary energy sources. Figure 2 breaks down the production by fuel, mainly oil, coal, and natural gas.

Figure 2. Global fuel mix (2012, 2017 and 2022) in exajoules

You might conclude, rightly, that, in the main, nothing much changed. Nuclear power has gone nowhere, and probably won’t revive for a while longer, given the time it takes to build a nuclear generating plant. The really attractive hydro locations have already been dammed up and the difficulty of siting new ones has slowed development, so do not expect much from hydro either. Coal demand has held up, thanks to Chinese demand and the rush to burn coal due to the Ukraine war’s destruction of normal supply chains. But there is little pressure to build new coal plants and a lot of pressure to close old ones down. Over the ten-year period, oil consumption has grown 0.8% per year, natural gas 1.7% per year, and renewables 12.5% per year.

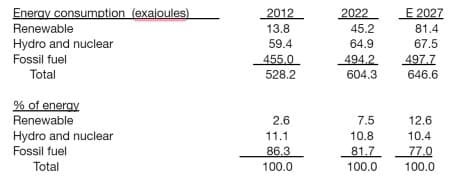

Now for a few vital statistics which we will extend to 2027 using the ruler technique.

The extrapolated renewable estimate for 2027 is relatively close to international government agency projections made by examining the plans of developers. Once the renewables get into service, they, like hydro and nuclear generation, go to the front of the line in the power dispatch queue, displacing fossil-fueled generation either because they have a preference or they are cheaper. That means they will have an immediate impact on usage of coal and natural gas, both electric power-generating fuels, rather than on oil, which does not count much in electric generation.

What might affect the accuracy of these projections? The strength of the economy certainly would. A stronger economy would require more energy, and with hydro and nuclear fixed and large scale renewables requiring several years of preparation, fossil fuels would have to fill the gap. A weaker economy, of course, would require less fossil fuel consumption. European government initiatives to reduce energy demand might succeed, too. And the recent launch of so many hydrogen production projects could raise renewable output and dampen demand for fossil fuels. And there is always war to upend projections.

Bottom line: it looks as if fossil fuel consumption as a whole slows down and peaks in five years (more or less), but oil will peak later because, initially, the renewable boom will reduce the use of fossil fuels in electricity generation faster than electrification of transportation.

Business implications: if you are planning a big project, something like a pipeline for Vaca Muerta or to connect eastern Mediterranean gas to Europe, think about the implications of dumping a big new supply into a barely growing market. Will you get the price you want and your money out quickly enough? Just asking.

By Leonard Hyman and William Tilles for Oilprice.com

More Top Reads From Oilprice.com:

- India Scoops Up Cheapest Russian Oil Since Start Of Ukraine War

- UK Carbon Prices Tumble, Casting Shadows On Decarbonization Efforts

- Distillate Prices Soar On The Back Of Refinery Issues And Expensive Crude