In mid-2017, California Resources, (CRC), took off like a rocket, reaching a peak of over $50 a share before the world changed in early October of 2018.

The CRC long thesis is pretty straight-forward. CRC's insulated market in California, imports almost 60 percent of its crude from overseas. It takes a lot of oil to keep ~50 million people standing still on freeways, trying to get to work or home.

With its production tied to Brent pricing, CRC should be able to sell every barrel it can produce at a nice profit. Combine that with its low decline ratio from convention reservoirs, and investors have flocked to the stock.

It has rallied nicely from its Dec 24th low, but in recent weeks has stalled out under $30, and recently the bottom has just fallen out. Now headed back to recent lows the question naturally arises…what gives with CRC?

Analyst downgrade due to debt

The market has become much less forgiving of corporate debt over the past few months, taking down the valuations of companies with too much of it. It's kind of funny in a way though, when you think about it (as I often do), the same analysts who loved CRC a year ago when it was on its impressive ramp to ~$50-ish a share, and using the same fact-set, essentially, does a 180 on the…

In mid-2017, California Resources, (CRC), took off like a rocket, reaching a peak of over $50 a share before the world changed in early October of 2018.

The CRC long thesis is pretty straight-forward. CRC's insulated market in California, imports almost 60 percent of its crude from overseas. It takes a lot of oil to keep ~50 million people standing still on freeways, trying to get to work or home.

Source A common scene from the 405 in LA.

With its production tied to Brent pricing, CRC should be able to sell every barrel it can produce at a nice profit. Combine that with its low decline ratio from convention reservoirs, and investors have flocked to the stock.

It has rallied nicely from its Dec 24th low, but in recent weeks has stalled out under $30, and recently the bottom has just fallen out. Now headed back to recent lows the question naturally arises…what gives with CRC?

Analyst downgrade due to debt

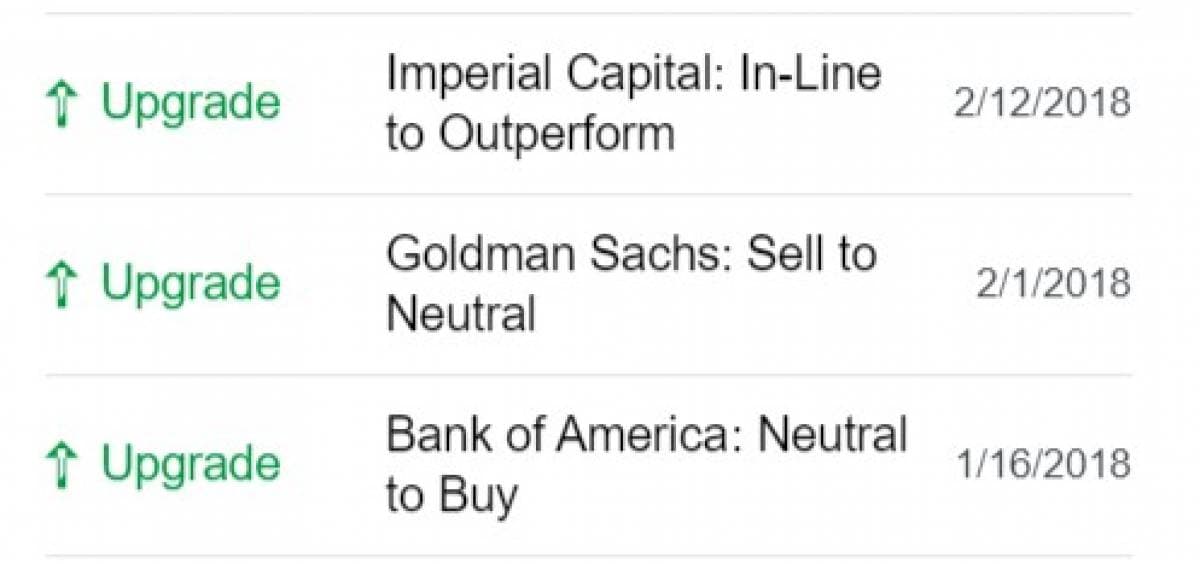

The market has become much less forgiving of corporate debt over the past few months, taking down the valuations of companies with too much of it. It's kind of funny in a way though, when you think about it (as I often do), the same analysts who loved CRC a year ago when it was on its impressive ramp to ~$50-ish a share, and using the same fact-set, essentially, does a 180 on the stock. Not an uncommon situation in analyst world.

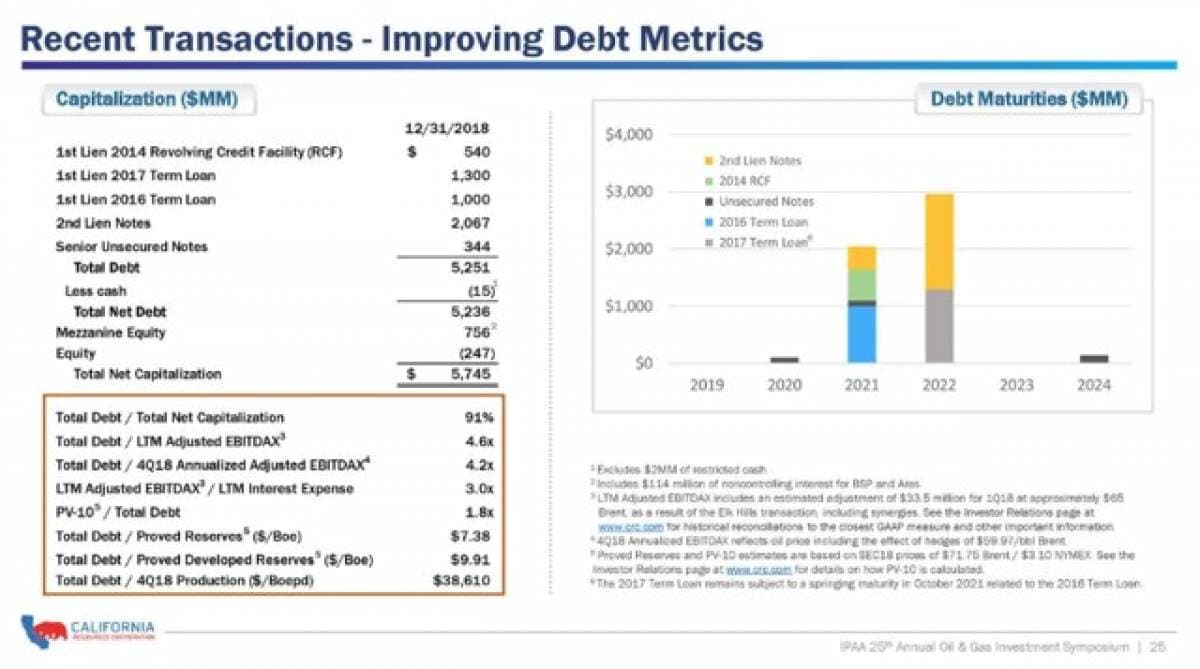

Source

We should acknowledge though for a company with $1.3 bn in market capitalization, having $5.2 bn in long term debt poses, at least an optical problem in the balance sheet. In the last six months "Capital Restraint" has entered the oilfield lexicon, and companies are being held to account.

But, the debt was right there on the balance sheet in February of 2018, when the very same firm, Goldman upgraded CRC to neutral (whatever “neutral” means...maybe, don't buy it, but don't sell it?). About the same time two other firms upgraded it to buy. It then started its ramp to $50. Proving only that you shouldn’t overly rely on investment analyst’s advice when making decisions!

Source

Now, Goldman is downgrading a company with significantly more cash flow, and less debt than a year before. A headscratcher, that one! The debt was a legacy from its former parent, Occidental Petroleum, when the two separated in 2014.

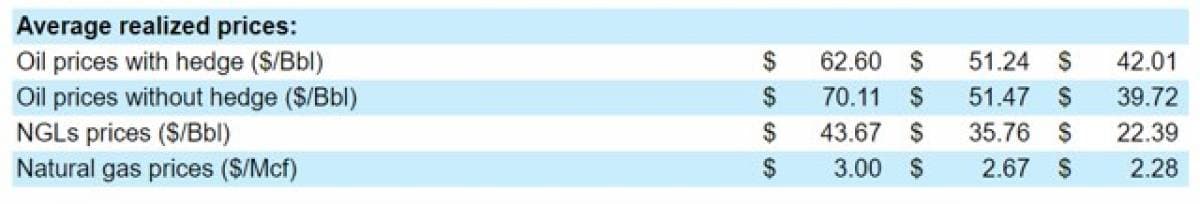

In 2018 CRC repurchased about $230 mm in debt for $199 mm, saving approximately $31 mm in the process. It was able to do this as a result of improving cash flow YoY, and high net realizations from an aggressive hedging strategy. I think this will continue, the oil price allowing. Related: Mexico Puts The Squeeze On Fuel Theft

Bottom-line, I think, absent a big drop in oil prices, debt is a false flag to fly with California Resources. This a well-managed company, that was born with a stone around its neck, and has been gradually working its way to a better Enterprise Value. In the currently supportive price environment, the stock should not be punished for the debt.

CRC's Strategic Advantage in California

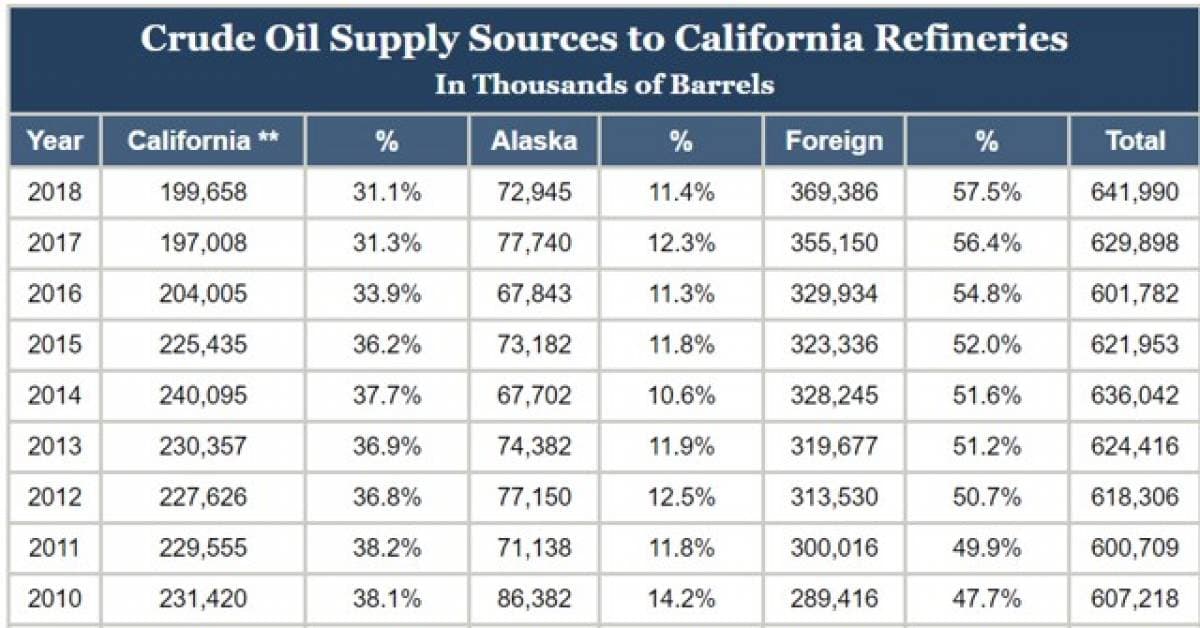

It can't really be over-stated what the importation of ~60 percent of its crude means to California. I've heard higher figures, some approaching 70 percent, but let's go with what the state tells us. What it boils down to is that a significant disruption in shipping could cripple the state, energy-wise.

Source This goes back a lot farther than the 10 year period I captured. If you go back to 1982, California only imported about 5 percent of its needs.

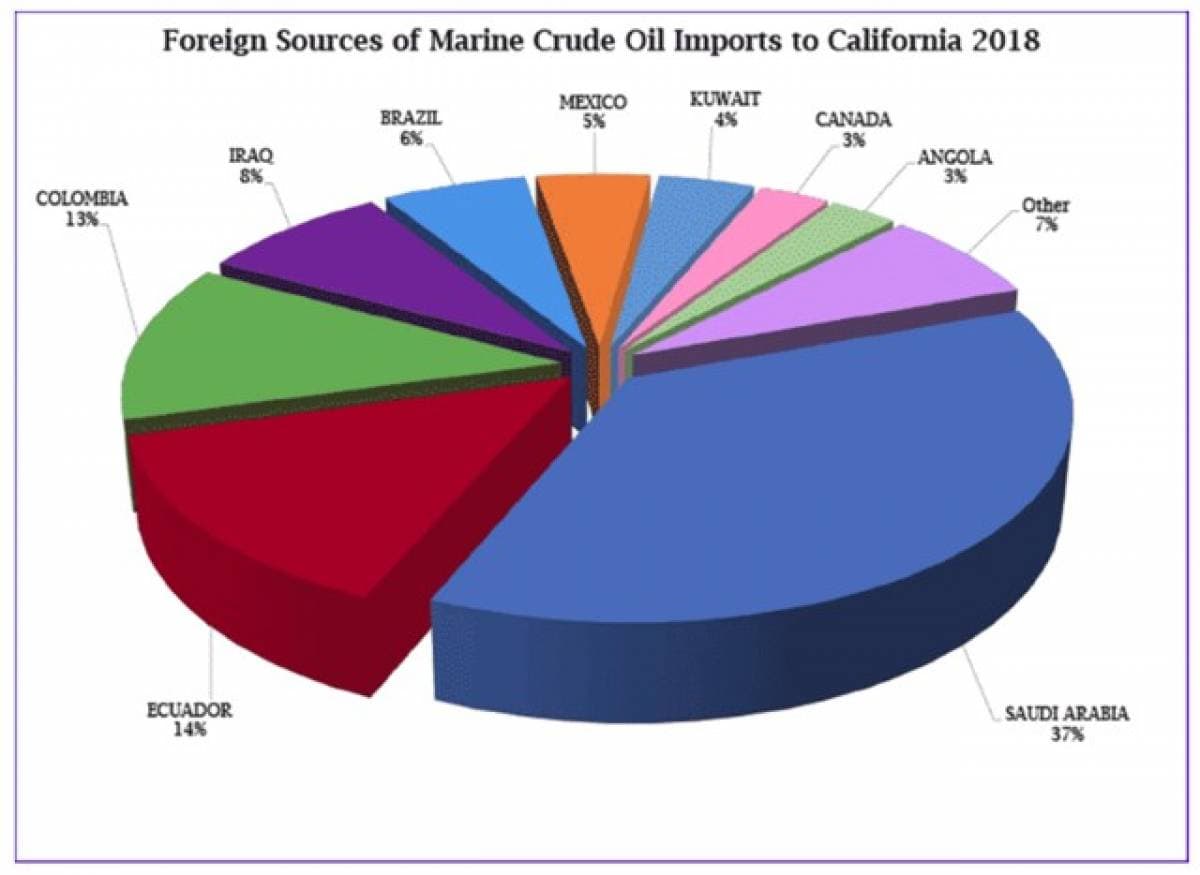

So as California has become more and more addicted to foreign crude it is interesting to note the sources to which it has turned to keep its roadways clogged up.

Source

It's easy to see that over a third of California’s crude comes from the Kingdom of Saudi Arabia-KSA, and KSA has been making the news for one reason alone in the past few months. They are reducing total shipments to the U.S., and other countries (but, the U.S. in particular), in an effort to drive prices up.

IMO 2020

From the table published by the State of California, almost 370 mm bbl of crude were brought into the state by oil tanker in 2018. Let's assume these were all VLCC's that hold a 2-million barrels a pop, that's a hundred and sixty-five loads. I am not going to get all wonky and try and calculate the carbon foot-print of a VLCC, but what I will say is that the cost of crude shipping will be rising due to this IMO 2020 mandate, that restrict the amount of sulfur in diesel used in marine engines. This will make locally produced crude even more competitive. A win for CRC.

Let's not forget, as well, that crude shipping is an interruptible supply, meaning that these boats can go anywhere.

New vapor pressure law in Washington State could shutdown Bakken crude.

As if California drivers shouldn't already be paranoid about having enough gas to fill up the minivan for a trip to the soccer field, now the very 'green' State of Washington throws them a curve ball. You may ask, "What's the legislature in Washington have to do with driving in California?" A fair question. The answer is that that California does not produce all the refined products it needs, and the five refineries in Washington are the marginal suppliers to them.

If the new law mentioned goes into effect, about 150 K BOPD of Bakken crude could have to find another home. I am sure you see where I am going with this line of thought. California crude and refined product supply could come under potentially greater threat, making locally produced oil still more valuable.

Summary of CRC's California advantage

Source

100 percent of CRC's daily production comes from fields within the state. A guy named David Ricardo once postulated what has become known as the Law of Comparative Advantage. I won't get too deep in the weeds here, but the relevance to this article is that CRC has an advantage over other (foreign) producers by being in the state, and can sell every barrel it produces at Brent prices, and a lower net cost.

A new potential problem that is weighing on the stock.

California AB-345 is a red-herring that will never see the light of day as a law, but has made waves as it passed through a key committee. What it does essentially is sunset the entire oil production industry in the state. Here is a link if you would like to read the bill.

What hasn’t gotten a lot of ink in the press is the fact, that even in the unlikely event it did become law, all permits to drill that have been issued will remain valid. California Resources currently has over 600 permits to drill approved and I see this bill as non-event in assessing CRC stock.

Related: How The Renewable Revolution Is Reshaping Geopolitics

Notable outtakes from Production Data and other Key Financial metrics for 2018

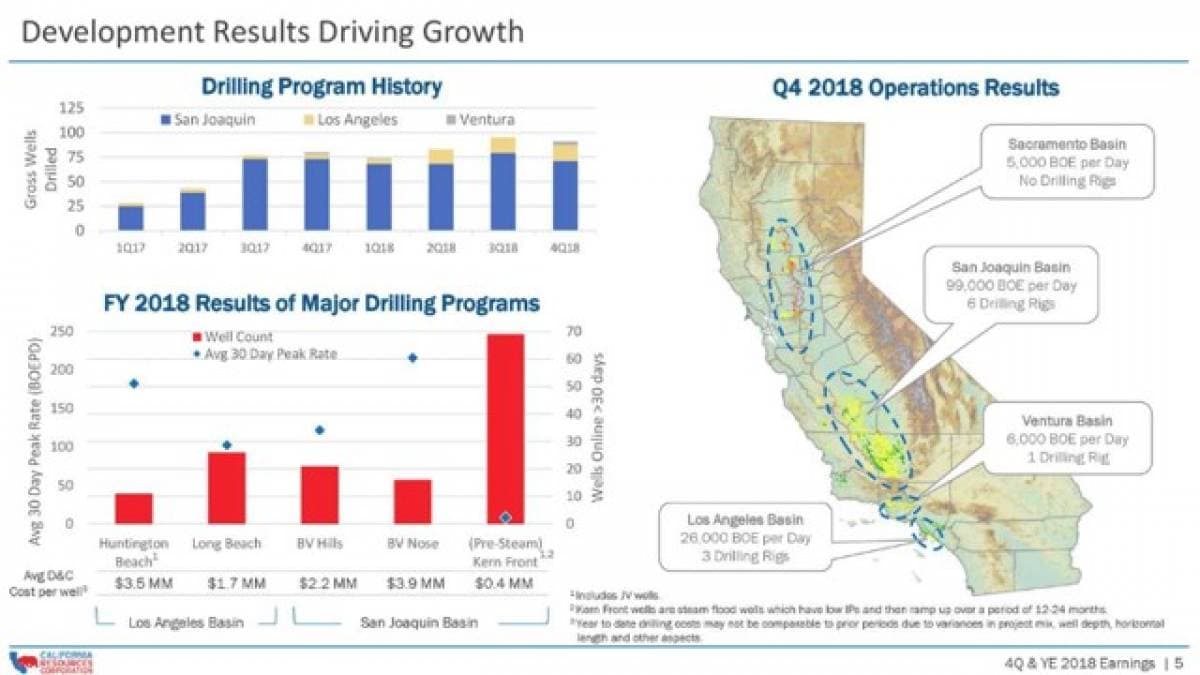

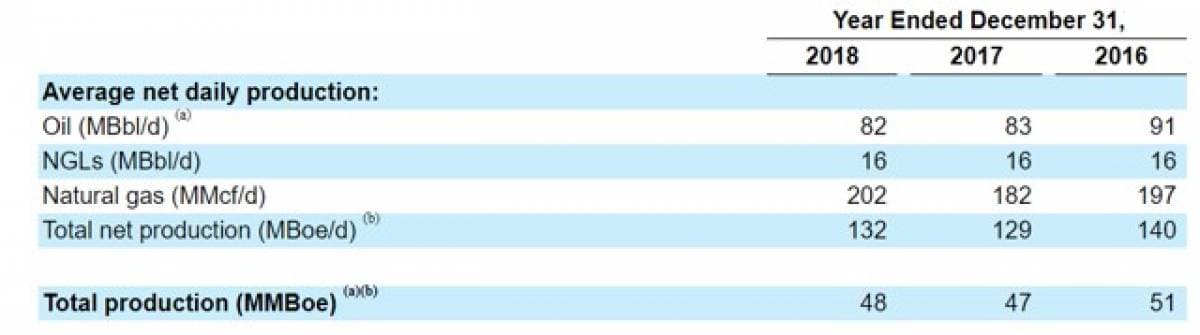

Daily production was132 BPOED, 8 percent higher YoY, and with a slight increase in Q-4 to 86 K from 84 K in Q-3. A trend that it would be nice to see continue in Q-1 of this year. Worth mentioning also was the product skew improved in favor of liquids over gas.

Source

CRC is guiding for capex of about $500 mm for 2019, with about 2/3 of that generated internally. That's a slight step back from 2018, and reflects a conservative outlook with respect to price realizations. Speaking of which, CRC benefits from its exposure to Brent pricing and aggressive hedging.

Source

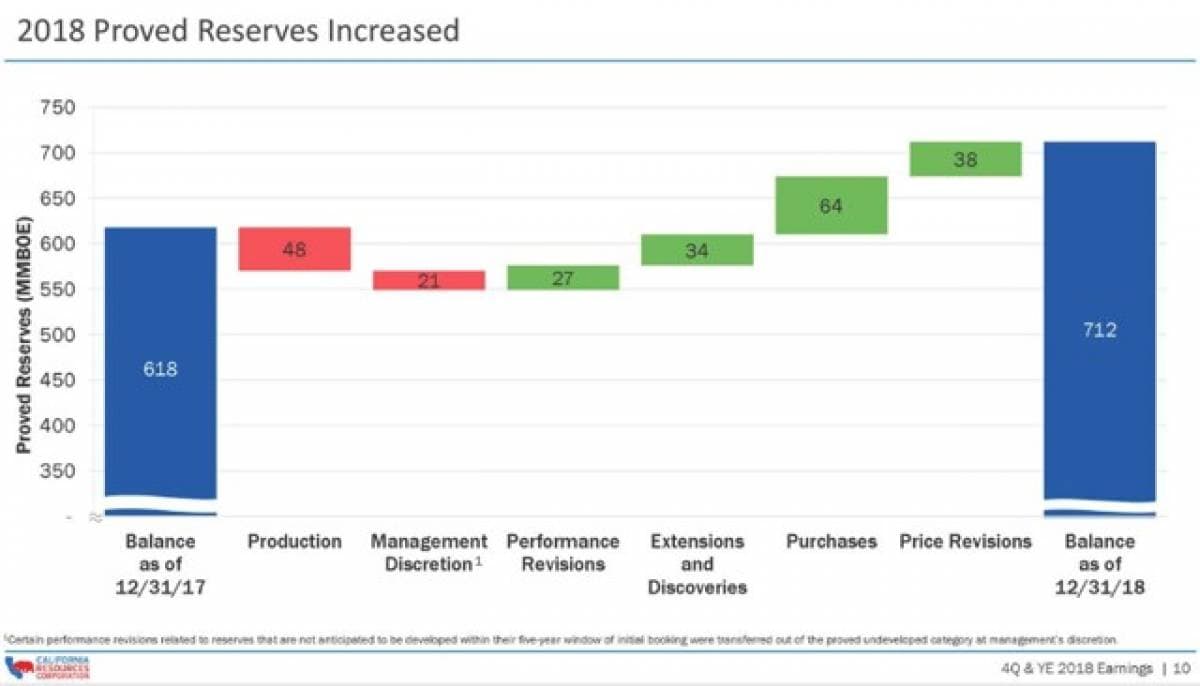

CRC also built its reserves base YoY while cutting costs.

Source

CRC is telling us to expect daily production of about 132K BOPED for 2019, or ~$2.9 bn in gross revenue at hedged prices. If you back out roughly $2.3 bn in core costs, that leaves about $250 mm in free cash. If you give them a multiple of 10 it suggests a price of $48-52 might be in a fair range for CRC. A 100 percent upside from current pricing, making CRC an easy 2-bagger, assuming favorable oil price conditions persist.

Your takeaway

The market is currently whacking CRC like it had the same fundamentals as shale players. It doesn't. CRC produces from predominantly conventional reservoirs with a low decline curve, (about 10 percent a year), as opposed to the much higher curves for shale.

As I've said, I think too much is being made by the analysts of CRC's debt. In my view they are taking the same metrics applied to shale drillers without considering CRC reservoirs and unique sales scenario in California.

When the market comes to its senses, CRC is well positioned to see some gains.

By David Messler for Oilprice.com

Disclosure: The writer does not hold and does not intend to obtain a position in this stock within the next 72hrs. The author expresses his own opinions and has no business relationship with any company whose stock is mentioned in this article.

More Top Reads From Oilprice.com: