On New Year’s Day, President Trump tweeted:

(Click to enlarge)

President Trump’s tweet on gasoline prices.

I have written many times about the limited impact a sitting President can have on gasoline prices. Presidents can pursue policies that over a period of time can influence gasoline prices in one direction or another, but their ability to impact prices quickly is pretty limited.

However, this year President Trump did indeed impact gasoline prices.

Gasoline prices fell sharply because oil prices collapsed. President Trump influenced that by conning Saudi Arabia into increasing production and then letting Iran continue to export oil.

I would also point out that gasoline prices at this time of year are usually low, because seasonal demand is low (and it’s cheaper to produce winter gasoline).

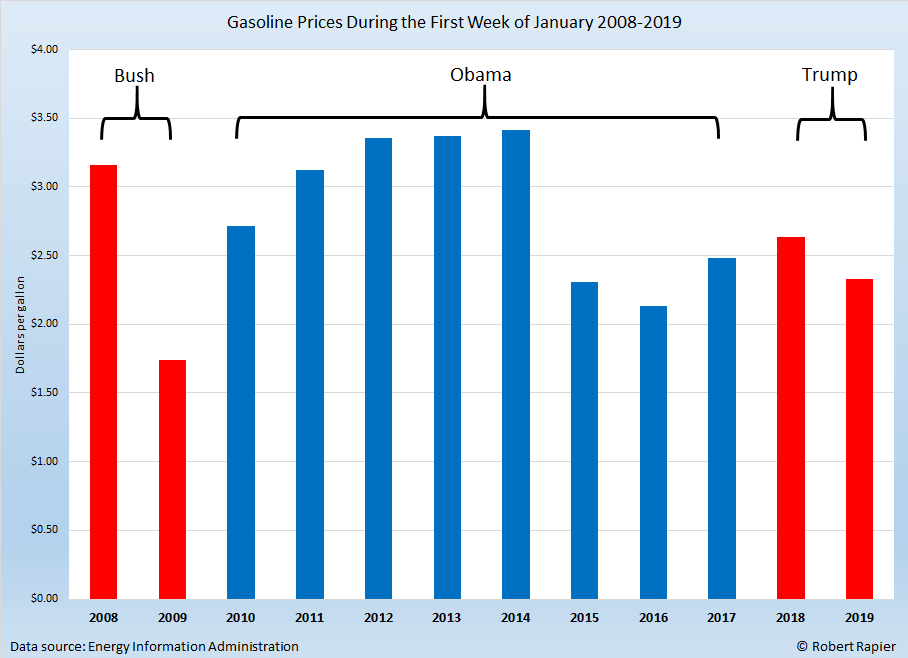

For comparison, below is the national average retail gasoline price during the first week of January over the past 12 years.

(Click to enlarge)

Average national retail gasoline price during the first week of January.

President Bush was still in office in January of 2008 and 2009. Oil prices had collapsed in 2008 in response to the financial crisis, and gasoline prices followed. In January 2009 — just a couple of weeks before Barack Obama’s inauguration — gasoline prices had fallen by nearly half from the previous year. That price, $1.74/gallon, is the lowest on the graph. Related: BP Remains Bullish On Oil Demand Growth

The second lowest price, $2.14/gallon, happened in 2016 following another oil price collapse. That same collapse had also impacted the price of $2.31/gallon in 2015, the third lowest price on the chart. President Obama was in office at that time.

This year’s price of $2.33/gallon is the fourth lowest on the graphic. However, I would acknowledge that President Trump probably had more impact on this price than Bush or Obama had on the other low prices.

Nevertheless, if we return to President Trump’s tweet and the question of whether it’s just luck that gasoline prices are low — I think it’s clear that sometimes it is just luck. President Bush’s energy policies weren’t responsible for gasoline prices being below $2/gallon in 2009. Nor did President Obama’s energy policies cause gasoline prices to fall in 2015 and 2016.

But the jury is still out as to whether President Trump’s impact will be more than fleeting. The short-term benefit of lower gas prices came at a cost. Saudi Arabia is already reducing oil production and pushing oil prices higher. It is doubtful they will be as compliant when it comes to future requests that they pump more oil.

By Robert Rapier

More Top Reads From Oilprice.com:

- Saudi Arabia: We’ll Pump The World’s Very Last Barrel Of Oil

- U.S. Set To Pump More Oil Than Russia And Saudis Combined

- Canadian Heavy Crude Producers Find New Ways To Ship Oil