With oil prices having crashed this week and demand concerns only mounting, it seems bullish traders will have to forget about triple-digit oil prices for now.

Friday, October 6th, 2023

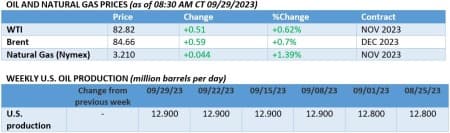

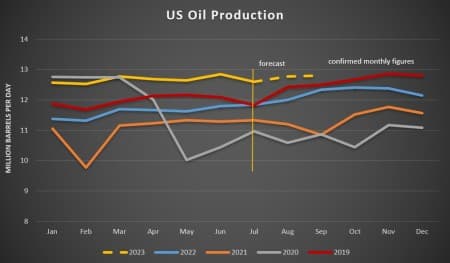

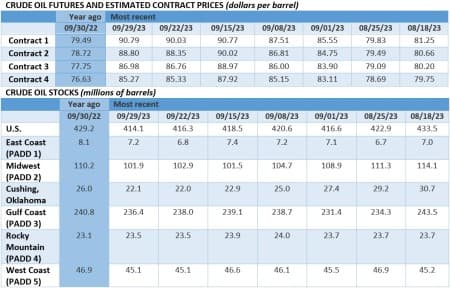

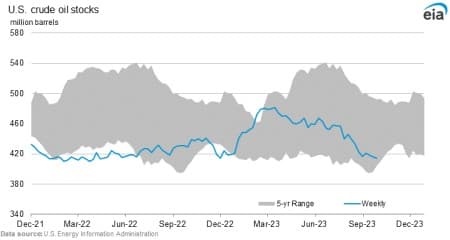

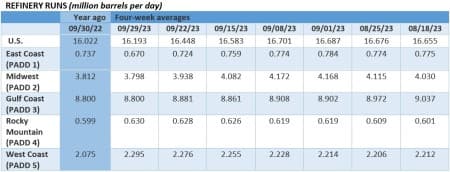

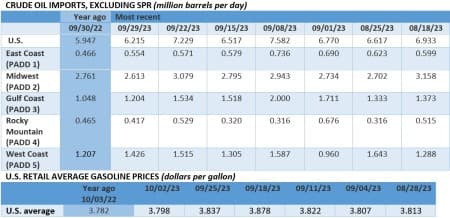

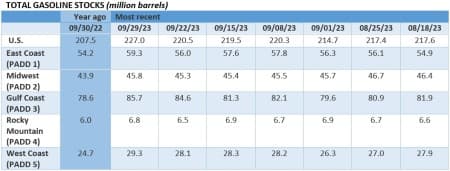

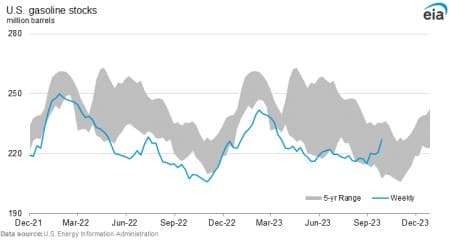

The worst week for crude since March, oil prices have shed $10 per barrel this week, pressurized by the US bond selloff that soured the economic outlook into 2024 and then suffered another blow from this week’s EIA numbers that indicated a steep drop in gasoline demand across the US. With Friday focused on US non-farm payroll data, ICE Brent climbing to triple digits is firmly out of bounds for now, currently hovering at $84 per barrel.

Saudi Arabia Sticks to Charted Course. Saudi Arabia announced it is sticking with its 1 million b/d production cut until the end of the year 2023, with a press communique issued this week signaling Riyadh would review its decision again next month and may deepen the cut if required.

White House Acquiesces on Delayed Oil Auction. The Biden administration said it would hold a delayed offshore auction in the Gulf of Mexico on November 8, offering 72.7 million acres on the Outer Continental Shelf, including 6 million acres that the US DoI had initially withdrawn from the lease.

Chevron’s Australian Strike Nightmare Continues. Despite Australia’s industrial arbitrage compelling Chevron (NYSE:CVX) and its trade unions to strike a compromise, workers at the Gorgon and Wheatstone platforms voted to restart strikes accusing the US major of reneging its commitments.

ADNOC Splashes the Cash on New Gas Fields. ADNOC, the national oil company of the UAE, awarded contracts worth $17 billion for the Hail and Ghasha offshore gas fields that it intends to operate with net zero carbon dioxide emissions, choosing Italian firms Maire (BIT:MAIRE) and Saipem (BIT:SPM).

Low Rhine Levels Jeopardize German Navigation. Dry weather across Germany is preventing tankers from sailing fully loaded on the Rhine river, with the Kaub chokepoint reporting water levels as shallow as 1.05 meters, prompting shipping companies to add surcharges to usual freight rates.

Copper Sell-Off Shows No Sign of Abatement. LME three-month copper futures have broken down through the $8,000 per metric tonne mark, the lowest in five months, prompting hedge funds to ramp up their short positions to 77,276 contracts in the week to September 26, the highest since March 2020.

Trinidad to Offer Even More Blocks to Bidders. The island nation of Trinidad and Tobago launched an auction of 13 shallow-water exploration blocks, more than double the oil and gas leases during the last auction in 2019, as it seeks to rejuvenate gas production for its 15 mtpa capacity LNG terminals.

Specter of Rebounding Diesel Demand Looms in US. Manufacturing business activity in the US is slowly improving with September’s PMI reaching 49.0, leaving depleted US diesel inventories at risk of depletion once the industrial cycle turns back to growth after 11 straight months of contraction.

Russian Oil Major Grants Loan to Turkish Refiner. Russian privately-owned oil company Lukoil will lend the state oil firm of Azerbaijan Socar $1.5 billion as part of a wider deal that would trigger an exclusive supply agreement for some 100,000 b/d of Russian crude going into Turkey’s Star refinery.

BlackRock Moves into Italian LNG. US oil major ExxonMobil (NYSE:XOM) chose investment fund BlackRock (NYSE:BLK) as the buyer for its 70.68% majority stake in Italy’s Adriatic LNG offshore terminal, valued at approximately $900 million.

India’s Key Refiner Unveils EV Battery Portfolio. Indian oil refining giant Reliance (NSE:RELIANCE) presented its multi-purpose battery storage technology for EVs that could also be used for household appliances and could be swapped or re-charged using rooftop solar panels, also developed by the Indian refiner.

Nigeria Blast Highlights Illegal Refining Risks. Falling victim to illegal refining in the oil-rich Niger Delta, at least 37 people were burned to death by a major blast in Nigeria’s southern Rivers State, just as the country’s long-delayed Dangote refinery is still yet to start operations.

Majors Seek Wind Project Farm-Outs. French energy major TotalEnergies (NYSE:TTE) is considering selling a 25% stake in Seagreen Wind Energy, Scotland’s largest offshore wind farm it operates, a 3.6 billion project that would generate enough electricity to power 1.6 million UK homes.

Vitol Sells Its Permian Acreage to Civitas. US shale producer Civitas Resources (NYSE:CIVI) agreed to buy the Permian Basin assets of Vencer Energy, Vitol’s US upstream subsidiary created in early 2020, for $2.1 billion in cash and stock, thereby adding some 44,000 net acres in the Midland Basin.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Can Oil Prices Remain Below $90?

- Oil Prices Set For Their Sharpest Weekly Drop In Six Months

- Exxon Eyes A Potential $60 Billion Acquisition Of Pioneer Natural Resources

I am still betting on a Brent crude hitting $100 a barrel before the end of the year.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert

It was this unexpected supply which engineered the recent crash across the board in energy, goaded on by liberals with huge amounts of giveaway government cash and nothing better to do with it than to short oil and its derivatives, and mo-mo investors jumping on the bandwagon.

Meanwhile, worldwide demand continues to outstrip worldwide production.

Prices are made at the margin, and investors these days change their minds with the rapidity of electric current.

We will never see prices this low again.