In desperation, Maduro’s autocratic regime has turned to Iran, another pariah state, for assistance. The collapse of Venezuela’s once-mighty oil industry has not only caused the Latin American country’s economy to implode, but it has triggered massive gasoline and other shortages. U.S. sanctions are biting deeper, sharply impacting what was once South America’s richest economy. As of the final week of October 2020, the U.S. effectively ended sanction exemptions which allowed India’s Reliance Industries, Spain’s Repsol, and Italy’s Eni to receive Venezuelan crude oil. Those measures form a key part of Washington’s concerted effort to block Maduro’s regime from accessing global energy markets, as it ratchets up the pressure to oust him from power. This, along with Caracas’ desperation to generate hard currency from export earnings, has seen Maduros’ regime actively seek Teheran’s assistance. Iran’s foreign minister arrived in Caracas this week to start a tour of Latin America which includes stops in Cuba and Bolivia. That highlights how eager Teheran is to cozy up to Maduro and become a crucial ally in his fight for survival in the face of U.S. sanctions and the international recognition of Juan Guaidó as Venezuela’s legitimate ruler. Caracas’ desperation is illustrated by it buying fuel cargoes from Teheran in exchange for gold. Iran has sent two flotillas to Venezuela already this year to alleviate the Latin American country’s crippling gasoline shortages. This, however, has done little to ease the considerable economic and social pressure on the Maduro regime. It is Venezuela’s slump in oil production, the near failure of state oil company PDVSA, its inability to access global energy markets, and an increasingly dire economic outlook which is forcing Maduro to seek further assistance from Teheran. According to news agency Reuters, Teheran and Moscow have been providing considerable assistance to Maduro’s regime to circumvent sanctions and prop-up Venezuela’s ailing economy. Reuters states this was achieved by falsely identifying tankers as part of a strategy developed by Teheran so that Caracas can continue exporting oil. The news agency goes on to claim that phantom oil trading companies, most of which are based in Russia, have hired a fleet of around 30 tankers to transport Venezuelan crude oil. These strategies have been implemented since Washington blacklisted shipowners who provided tankers to Venezuela and imposed sanctions on publicly listed Russian state-controlled oil company Rosneft. While these actions have facilitated the export and sale of Venezuela crude oil, they will provoke stricter sanctions from Washington aimed at completely cutting Caracas off from the outside world. A combination of ever-tighter U.S. sanctions, weaker oil prices, and the COVID-19 pandemic have seen the IMF predict that Venezuela’s economy will shrink by 25% during 2020. That is after a calamitous 35% decline in 2019 and 20% in 2018.

Related: EIA Sees WTI Crude Averaging $44 In 2021

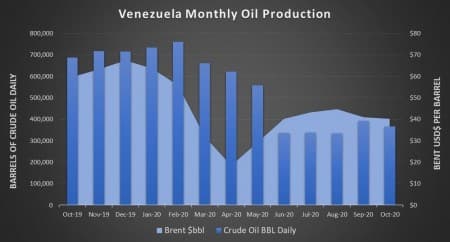

The Whitehouse views sanctions as a key measure of ousting Maduro’s dictatorial regime and strengthening U.S. hegemony in Latin America. That last point is particularly crucial because Moscow and Teheran are using Venezuela’s crisis as a lever to gain control over its vast oil reserves and regional influence. The impact of ever-tighter sanctions on Venezuela’s rapidly deteriorating oil industry is palpable. Oil production in the crisis-stricken petroleum-dependent country keeps tumbling lower. The OPEC November 2020 Monthly Oil Market Report shows that Venezuela pumped 367,000 barrels of crude oil daily during October 2020 which was 6% lower than September and less than half of the 796,000 barrels pumped daily for 2019.

There are signs Venezuela’s oil production will fall further, potentially to zero despite assistance from Tehran and Moscow. The Baker Hughes rig count showed only one active drilling rig for June to September 2020 and no data was provided for October. PDVSA’s critical energy and refining infrastructure is in a parlous state. A refinery in Northern Venezuela, with a processing capacity of 955,000 barrels daily making it one of the largest in the world, was rocked by an explosion three weeks ago. While Maduro claimed it was a terrorist attack, sources published by Argus Media pointed to a water leak and vapor ignition in a distillation unit, which if true highlights how far the condition of PDVSA’s refineries, along with other critical energy infrastructure, has significantly deteriorated. Surging crude oil stockpiles, which according to Bloomberg soared by 84% by mid-October 2020, highlights the collapse of Venezuela’s once world-leading oil industry. There are fears that stockpiles will grow further as a lack of refining capacity, caused by the disintegration of crucial downstream infrastructure and a lack of export customers due to U.S. sanctions, will force PDVSA to shut-in production once again. That would cause exports to fall further, which, in a stunning development during October 2020, reached their lowest level since the 1940s. It is the significant decline in the value of crude oil exports which is responsible for Venezuela’s near economic collapse. Related: Growing Crude Inventories Put A Cap On Oil Prices

This explains the desperate measures being undertaken by Caracas and state oil company PDVSA to ensure that crude oil export cargoes are loaded and shipped. These include having oil tankers turn off their transponders, making multiple cargo transfers, and changing ship names, flags, and owners, to ensure that the origin of the cargo cannot be traced. Those sanction beating strategies and the considerable assistance provided by Teheran and Moscow are propping up Maduro’s pariah regime but doing little to generate sustained oil production growth or ease the substantial pressures on Venezuela’s shattered economy. There is no recovery in sight until Maduro is ousted from power and an internationally recognized government takes power. That is unlikely to occur any time soon despite Washington ratcheting up pressure on Caracas through ever-stricter sanctions that have effectively cut Venezuela’s government off from global energy and capital markets.

There is considerable evidence suggesting that economic and financial sanctions will fail to trigger regime change and will not remove Maduro from power. If anything, they have pushed Maduro and his supporters to strengthen their grip on power while weakening Venezuela’s opposition. As identified by Foreign Affairs “the cost of relinquishing power will always exceed the benefit of sanctions relief,”. This means there is no motivation for Maduro to step aside. Worse still, Washington’s crippling financial and economic sanctions have further fomented Venezuela’s economic collapse, substantially reducing the resources and human capital available to the country’s opposition. Most Venezuelans are reduced to a subsistence day to day existence with the very act of survival consuming their time and energy, thereby preventing them from opposing Maduro’s regime. Those who are not required to live in such a manner, such as the military and security forces, are unwilling to give up the meager means of survival made available to them. For these reasons, it is difficult to see how regime change can occur and Venezuela can start the long road to rebuilding its ravaged economy.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- The Road To Recovery Is Long For Oilfield Services

- Is This The Key To Cheaper Solar Power?

- M&A Heats Up In Canadian Oil Patch

The Venezuelan people know that their country was in a terrible economic state long before the US sanctions because of corruption and bad management of the country’s oil wealth. They also know that it is the harsh US sanctions that have exacerbated their hardships and pushed the oil industry and the economy to near collapse.

Still, Venezuela’s economy can’t and won’t collapse because Russia, China and Iran won’t let it collapse. This is so because Russia and China have vested interests in the survival of Venezuela’s economy and its oil industry. Iran is lending a hand to a friend in need suffering like itself from the atrocious US sanctions and is helping repair Venezuela refineries and enhance their output in addition to providing the essential diluents.

And yet, Venezuela’s crude oil exports Crude oil exports have risen to 690,000 barrels a day (b/d) in September and they are today estimated at 359,000 b/d most probably as a result of a declining global oil demand triggered by a resurgence of the COVID-19 pandemic.

Venezuela like Iran has perfected the art of evading US sanctions and exporting more of its crude to the world. It is very possible that its exports are far more than official data suggest using barter trade and ship-to-ship transfers.

Soon Venezuela will see the back of President Trump who has never hidden his love of sanctions and tariffs. There is a glimmer of hope that President-elect Biden might remove or at least ease US sanctions on Venezuela.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London