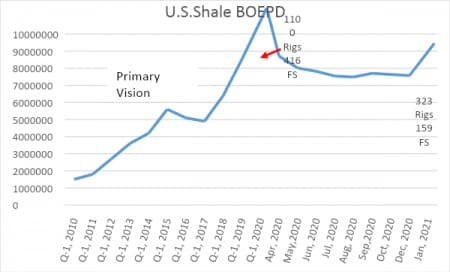

One of the things that had the oil industry worried about a Biden administration was his opposition to fracking, and his promise to ban it on federal lands on his first day in office. In case you haven’t been following closely, American production has soared due to fracking over the last decade. The point must be made, no fracking, no shale oil.

Chart by author

I've made the point in several articles that I doubted whether he would really follow through on this threat, as it would lead to an eventual slowdown in drilling with a commensurate fall-off in oil production. With the first day of his administration nearing, I thought it worthwhile to review some of the companies we follow closely in shale to see what impact they thought this action might have, if he indeed follows through with it. Biden seems to have since backed off earlier position a teensy bit, which makes me even more confident that his position has moderated on this topic. We don't have long to wait to see which version takes office.

More importantly and the larger point of this article, does it even matter in the short term? With as much notice as the big shale frackers have been given about his proclivities vis a vis fracking, most have taken measures to insulate themselves from this impact. In this article, we will look at what a review of public data reveals about the impact of a potential fracking ban on federal lands for several key shale drillers.

The true political risk may not be all that bad

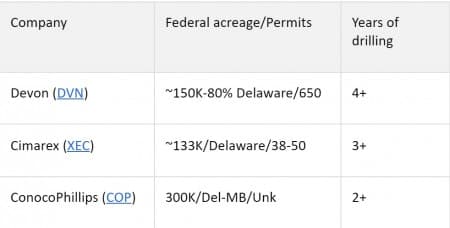

A review of several public companies with regard to preparedness for a ban on new permitting, reveals just what I mentioned above. Here are three where I was able to scan a transcript or view an investor deck and get some information.

Firstly, what we find is that federal lands are a relatively small fraction of most company’s acreage portfolio. The ones I reviewed for this article like Devon, have been working the regulatory side of their portfolio fairly hard.

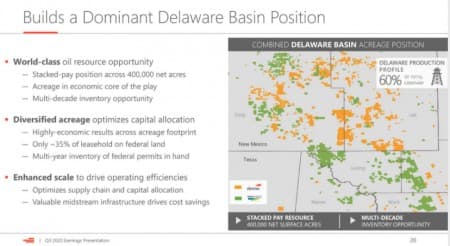

Related: Google Looks To Turn Data Centers Into Energy Storage

Devon for example, with federal acreage comprising about a third of their Delaware position, have compiled a massive bank of 650 permits- 520 approved, and another 130 in process. Even if we assume the last 130 don't see the light of day over the next four years, Devon can drill a hundred and twenty-five or so wells on their acreage before running out of inventory. The slide below highlights the new Devon, with acreage from WPX factored into the mix. Altogether, federal acreage only accounts for about 35% of their total acreage.

Dave Hagar, DVN’s CEO commented on their permit inventory in the Delaware basin.

“Federal permits are issued with a two-year term and then you have the ability to extend them for an additional two years. So certainly, permits that are out would be out past that two year-term, would require us to go through the extension process. But a couple of things I’d point out to you there, we’ve never had an extension denied before. And it’s important to know that the permits are underlied by environmental assessment. That’s done as part of the permitting process and those environmental assessments are good for a period of five years. So the answer to your question is yes, but we don’t foresee many material impacts from that.”

Related: India Oil Demand Falls For First Time In 20 Years Due To COVID

I couldn't find as much data on Cimarex and COP, but each has two-three years of approved permits to carry them forward in case of a new permit ban. I wouldn't be surprised if this is the norm among the shale frackers. The risk has been out there for a year now. Any prudent manager, and I count oil company managers as among the best in the business, would assess the risk of a new permit ban, and staff up his regulatory affairs team to build up a solid buffer.

Your takeaway

As you can see the trend for U.S. shale is down from early 2020. This can be moderated with an increase in drilling that is now underway. I expect we will return to a 400-425 rig market by the end of 2021.

Chart by author- Data through 2020 is averaged, 2021 is specific

This is being driven by a conservative outlook by shale drillers about maintaining production, instead of increasing it. Although some shale companies have announced plans to grow production by single digits in 2021. This is still very much the exception and I expect shale production to decline as the year wears on.

What I am not concerned about as a result of my brief investigation is shale declines to be exacerbated by an inability to drill on federal lands any time soon. Shale drillers have prudently loaded the channel with approved permits, in many cases enough to carry them for several years. Perhaps to a time, four years hence when higher, perhaps much higher, oil prices change the dynamic from a perception of plenty to one of scarcity. In the last scenario, I do not expect that permits will be hard to obtain on any acreage within the continental United States.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Bulls Are Back

- Asian Buyers Rush To Secure North Sea Oil After Saudi Surprise Cut

- Oil, Gas Rigs Increase For Seventh Straight Week