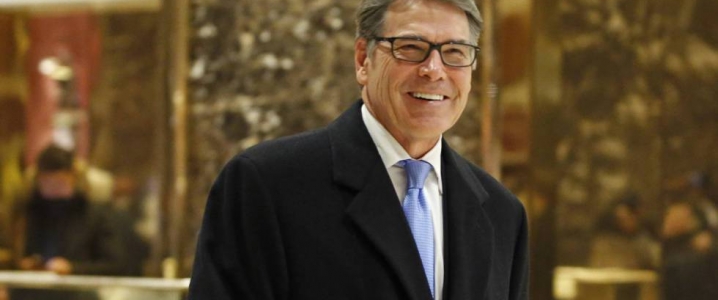

The United States will not sell crude oil from the Strategic Petroleum Reserve to help ensure the global market is well supplied when sanctions against Iran enter into effect, Reuters reports, quoting Energy Secretary Rick Perry.

“If you look at the Strategic Petroleum Reserve and you were to introduce it into the market, it has a fairly minor and short-term impact. The numbers I’ve seen do anyway,” Perry told media, chiming in with arguments some skeptics have voiced about the effect of a SPR sale would have on the market.

Perry’s statement, however, is confusing in light of a notice for the sale of 11 million barrels of crude from the SPR dated August 20th. The notice stated buyers could bid for the crude until August 28, with contracts to be awarded within another seven days. “Deliveries will be take place in October and November 2018,” the notice said. That SPR release is part of a larger planned drawdown, ans one of several this year alone, including FY 2018 mandated and FY 2018 modernization sales, in which billions of the SPR were sold.

Talk of Washington’s readiness to offer additional supply on a market that is bracing up for distress has acted as a cap on prices, especially in the last few days, after the U.S. special envoy for Iran said at the UN General Assembly the U.S. will make sure there is enough supply. Related: $80 Oil: Increased Investment Or Demand Destruction?

If this supply is not coming from the SPR—however moderate effect this crude would have had on prices—then buyers would have to rely on other major producers. Perry also said as much: the market would have to rely on large producers for maintaining ample supply of crude.

“I’m comfortable that the world supply can absorb the sanctions that are coming,” the Energy Secretary said, noting that Iraq alone could add 300,000 bpd of oil to global supply if it allows Kurdish oil to reach international markets. Another 300,000 bpd, he said, could come from a field in the neutral zone between Saudi Arabia and Kuwait when the two agree on how to share the profits.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Don't Underestimate The Trade War Impact On Oil Demand

- Goldman Sachs: Oil Prices Won’t Hit $100

- The U.S. Will Ensure A “Well Supplied Oil Market”