U.S. sanctions on Iran take effect in a little over two weeks, and the Trump administration has already had quite a bit of success in knocking Iranian supply offline. But, at the same time, it is very far from its goal of cutting Iranian oil exports to “zero” as it has promised.

The International Energy Agency estimates that Iran’s oil exports fell to 1.6 million barrels per day (mb/d) in September, down 800,000 bpd from a recent peak in April at 2.4 mb/d. The losses are expected to continue, but few analysts really believe the Trump administration will manage to cut Iran’s exports to zero.

According to Reuters, “an unprecedented volume of Iranian crude oil is set to arrive at China’s northeast Dalian port this month and in early November before U.S. sanctions on Iran take effect.” An estimated 20 million barrels are destined to flow from Iran to China over the next few weeks, up from the usual 1 to 3 million barrels each month.

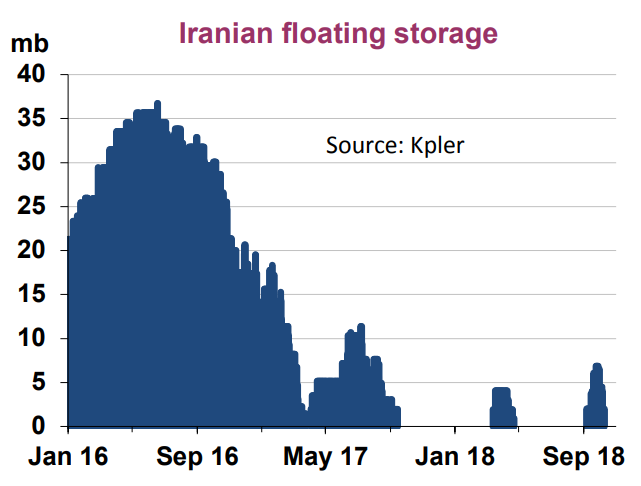

Other data from the IEA backs up this trend. Iran has been storing a portion of its oil production on ships in the Persian Gulf, a practice that it resorted to during the previous period of international sanctions between 2012 and 2016. It is difficult to simply turn off oil production, and with onshore storage filling up, Iran has been forced to store oil at sea. However, while Iran’s floating storage spiked in September, it actually fell back in October, “as several cargoes set sail for China and India, data from Kpler showed,” the IEA wrote in its report.

The surge in shipments demonstrates Iran’s determination to keep its oil flowing. “As our leaders have said it will be impossible to stop Iran from selling its oil. We have various ways of selling our oil and when the tankers reach Dalian, we will decide whether to sell it to other buyers or to China,” a source from the National Iranian Tanker Company (NITC) told Reuters. Related: Is Uranium On The Way Back?

Meanwhile, there is other evidence to suggest that Iran is succeeding in shipping much more oil than is officially reported. NITC tankers have shut off their tracking devices in order to keep up oil shipments in the dark. Some satellite data suggests that a greater number of tankers are heading to India that is thought to be the case. The IEA said in its October Oil Market Report that India’s purchases from Iran jumped from 390,000 bpd in August to 600,000 bpd in September.

The furtive shipments from Iran to India demonstrate the limits of U.S. power. Discounts, off-the-books shipments, bartering and other clandestine maneuvers should keep some Iranian oil flowing even after November 4. For instance, Iran has discounted its oil by the most in 14 years, according to Bloomberg, making it hard to pass up for would-be buyers.

Still, Iran’s oil exports have indeed suffered a significant blow from the looming sanctions. China’s imports from Iran fell to 430,000 bpd in September, the lowest amount since 2016. Sinopec’s trading unit, Unipec, has said that it slashed the amount of oil it is buying from Iran because of pressure from the United States. Europe purchased 420,000 bpd in total in September, down 240,000 bpd from the second quarter. These volumes, in particular, are likely most at risk as European companies are much more intertwined with the United States, and as such, are vulnerable to American sanctions. Related: Saudi Arabia Calls The End Of Russia’s Oil Prowess

The U.S. has repeatedly vowed to take Iran’s oil exports to zero, and has maintained that any waivers would be “few and far between,” as National Security Advisor John Bolton put it. However, the U.S. is also in talks about waivers with countries that depend on Iranian oil, such as Turkey and India. The Trump administration is in somewhat of a bind, as cutting Iran’s oil exports by too much will drive up crude oil prices, which could be a political liability at home.

The flip side of this is the possibility of a release from the U.S. strategic petroleum reserve (SPR). In fact, it is somewhat surprising that this has not already happened. The loss of supply from Iran and the sudden tightness in the market would offer some justification for an SPR release, Jason Bordoff of Columbia University's Center on Global Energy Policy said in an interview with S&P Global Platts.

An SPR release is a one-off affair, and many analysts – and even the U.S. Secretary of Energy Rick Perry – have said that it would do very little to ease a supply shortage. However, it would have a significant psychological impact on the market, suppressing prices in the short run while also giving the Trump administration more leeway to take a harder line on countries buying oil from Iran.

Nevertheless, the U.S. is going to have to swallow some bit of cheating because Iran’s oil exports are unlikely to fall to zero over the next few weeks.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Hedge Funds Continue To Reduce Bullish Bets On Oil

- What Killed The Oil Price Rally?

- China Can’t Get Enough Of The World’s Cheapest Crude

If you don't like islam stop israel and church the reason of islam and isil settling all jews in usa asking for denuclarisation of israel.

9.11 was because of zionism support usa.

Judaism, Islam & christianity from levante

all as local land nomadic semitic tribe withoit own script conflict starting over 3300 years ago spread around the world.

Energy, water and food problem coming from all bad installed systems in the world.

Global eternal 1 Cent-€/kWh no problem only blocked by systems and people not knowing how also in high tech company and with that much seawater desalination and artificial light 24h all year agrartowers.

Solution short described not published new RBN-Th pebble bed HTR zero risk all cases and cheap using white diamind cubic boron nitride isotopes B-11 and N-15 latest lucky 1/100 absoption of C-12 graphite for only ThO2 30years pebble runtime hard up to 2800°C unburnable insoluble open secure just baking nuclear fuel powder into BN etc.

I best in world know more secure types and new turbines efficiency jump near 100% also with low waste heat not using waste condensor centrifugal compressor at end, cooling all with backflow thermal isolated only electricity out and CO2 instead H2O.

For the desert home of jews glas green houses cooled but delivering energy not needing water condensed out with CF compressor there hot cooled with CO2 for turbines inside plants, humans & animals.

Jews are stupid and bad guided by JHWH

like proved plagiator dork Albert Einstein

not telling about Henri Poincare E = m • c² always believing in world ether stupid dork talking with Nils Bohr JHWH not playing dices proved wrong nether finding world formula and E = h • f was from Max Planck

in letter to friend today every bounder knows what is a photon only he not.

Photon is aton rotator of massless load points mass only from rotation like spinner with electron radius e-neutrino with center load point electron or positron and shells of rotator pais of that with spin is neutron with center positron without outer shell pair is proton or antiproton all from decay of absolute nothing into just relative existent invers quantum entangled aton rotators other rotator combinations are particle zoo.

Idea for funny movie A. Einstein helping dork loving scientist woman own case !

Originator only kayuweboehm@yahoo.de

Iran’s oil exports have been averaging at 2.2 million barrels a day (mbd) this year. Claims that they have fallen from 2.4 mbd to 1.6 mbd are fake news aiming to give the impression that Iranian crude oil exports are starting to decline in anticipation of US sanctions in November.

Iran is reported to have shipped an estimated 20 million barrels of Iranian crude to China. Moreover, India’s purchases from Iran jumped from 390,000 b/d in August to 600,000 b/d in September.

Furthermore, China could singlehandedly nullify US sanctions altogether by importing the total Iranian oil exports amounting to 2.2 mbd and paying for them in petro-yuan. Moreover, the petro-yuan has made the US sanctions useless and has provided a way by which Iran could bypass the petrodollar and the sanctions altogether.

My analysis of the realities of the global oil market suggests that US sanctions against Iran's oil exports are doomed to fail miserably and Iran will not lose a single barrels from its oil exports.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London