Last year, U.S. crude production surged to all-time high, blunting efforts by OPEC+ to keep global markets constrained, and Energy Intel has predicted that robust non-OPEC oil supply is likely to cap oil prices even in the event demand surprises to the upside.

To wit, Energy Intel predicted that non-Opec-plus supply growth would clock in at 1.5 million b/d (crude 1 million b/d) in the current year, enough to offset demand growth in the 1.5 million-2 million b/d range. This leaves OPEC with little room to unwind its production cuts.

However, another prominent agency has dispelled the view that oil markets will be heavily oversupplied this year.

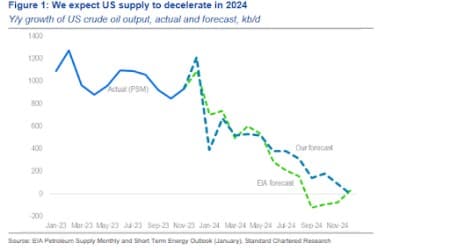

Now, Standard Chartered has predicted very little incremental growth in US crude oil supply in 2024, saying y/y growth will decelerate strongly and even turn negative in December 2024 from above 1.2 million barrels per day (mb/d) in December 2023.

StanChart is not alone in this view. The U.S. Energy Information Administration (EIA) is even more pessimistic on supply, and has predicted supply growth will turn negative as early as September.

The latest EIA Petroleum Supply Monthly (PSM) showed U.S. crude oil supply hit a record high of 13.308 mb/d in November 2023; however, StanChart has forecast that supply will grow from that base by just 39 kb/d by December 2024 and 175 kb/d by December 2025, implying growth of just 0.5 mb/d over six years from the November 2019 pre-pandemic peak. Related: Oil Jumps Despite Crude Inventory Build

StanChart says the deceleration in supply growth is the result of capex barely meeting high natural decline rates in shale oil production. The analysts note that oil drilling activity fell sharply in 2023, with the current U.S. rig count just enough to maintain output at current levels and not increase it – even allowing for productivity gains.

Source: Standard Chartered

StanChart's has predicted an average 2024 call on OPEC crude oil will clock in at 29.3 mb/d, 1.4 mb/d higher than 2023 output. Call on OPEC is the difference between global oil demand and oil supply by non-OPEC members. If OPEC is unable to meet this call, a deficit ensues while exceeding it leads to oversupplied markets.

OPEC belongs to the bull camp, too, and has predicted that global oil demand growth will far outpace non-OPEC supply growth over the next two years. OPEC has forecast global demand growth will clock in at 2.25 million b/d in 2024 and 1.8 million b/d in 2025 thanks in large part to a stronger Chinese economy, well above non-OPEC supply growth at 1.34 million b/d in 2024 and 1.27 million b/d in 2025.

Previously, Standard Chartered has argued that oil markets have been heavily discounting ongoing geopolitical risks. The commodity analysts have noted that the markets responded weakly to the recent drone attack that killed three and wounded more than 40 U.S. servicemen at a military base in Jordan near the Syrian border. According to StanChart, traders are betting that the U.S. will only issue a light response to the attack that likely will be limited to Iraq and Syria.

But StanChart says that, following the attack, we are likely to see a significant change in the policy dynamic between the U.S. and Iran, with Iran’s surging oil production very likely to be in the crosshairs. The Biden administration had been increasingly less hostile to Iran as the U.S. and its allies hoped to strike a new nuclear deal with Tehran. Iranian oil production crashed to less than 2 mb/d in late 2020 from 3.8 million barrels per day in early 2018 following the imposition of severe sanctions by the Trump administration. However, production has once again surged to 3.2 mb/d under Biden. Ever since the Middle East conflict erupted last year, market experts have been debating whether the U.S. would allow the status quo with Iran to remain or whether the West would attempt to roll the clock back to early 2022 or even to late 2020. The latest attacks, however, leave little doubt as to the direction Washington intends to move after the U.S. Secretary of State Antony Blinken declared that the West’s response will be“multi-leveled, come in stages, and be sustained over time”.

By Alex Kimani for Oilprice.com