Oil prices globally have been firmly above $80 per barrel, however, the market at large has kept surprisingly mum about the key factor in the price rally of July-August, namely Saudi Arabia’s voluntary production cuts. Happening at a time of strong demand and low inventories, the output curbs sent backwardation spiraling again so that the Dubai cash-to-futures spread is back to $2 per barrel, all the while providing constant support for refining margins around the world. Were it not for Riyadh, the pressure on refiners would have been significantly lower, likewise with the sourcing of medium sour barrels that suddenly became the most coveted feedstock. Saudi Arabia’s production cuts are gradually moving into their third month of existence, lowering total crude exports out of the country below 6 million b/d, the lowest pace of outflows since the spring of 2021.

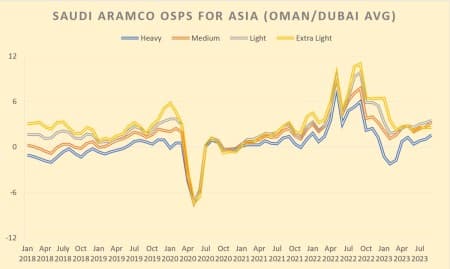

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average). Source: Saudi Aramco.

By drastically cutting the supply of medium sour crude globally and lifting ICE Brent to $85 per barrel, Saudi Aramco has achieved the seemingly unthinkable – in a market where everyone was looking at Chinese demand weakness, the supply-side tightness became the key talking point. As a consequence, backwardation is the steepest in months, the relatively high prices of Saudi barrels allow Riyadh to reach its fiscal breakeven of $80-81 per barrel and even the futures of Dubai (the Middle East’s medium sour benchmark) are at a premium to ICE Brent. As Saudi Aramco was about to issue its September OSPs, the production cut gamble finally started to bear fruit. Refinery margins were outstandingly high throughout July, with both gasoline and diesel cracks above 30 per barrel in both Asia and the Americas, whilst the Dubai cash-to-futures spread was up 40 cents per barrel compared to the previous month.

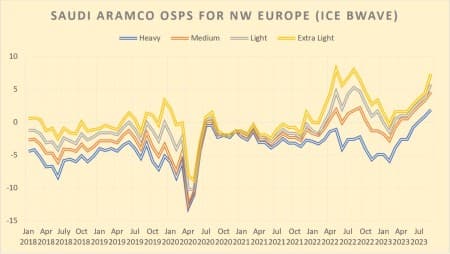

Chart 2. Formula prices of cargoes bound for Northwest Europe by selected grades (vs ICE Bwave). Source: Saudi Aramco.

Despite the extremely healthy external environment, Saudi Aramco lifted Asian prices less than it could. Perhaps out of fear of weakening demand from key buyers such as China, or maybe just to indicate readiness to listen to buyers’ complaints about prices being too high (even though margins are great nevertheless), but the Saudi NOC hiked the formula prices of Arab Light by only 30 cents per barrel to a $3.50 per barrel premium to Oman/Dubai. Arab Extra Light was simply rolled over and the only OSP increases were coming through Arab Medium and Arab Heavy, up by 70 and 60 cents per barrel, respectively. Prices to European customers, however, were lifted quite drastically, especially into Northwest Europe where Arab Light gained $2 per barrel to a $5.80 per barrel premium vs ICE Brent, the highest formula price ever for the grade. The formula price hikes were less marked in the Mediterranean, though even in that region Arab Light went up by a dollar to a $4.50 per barrel premium to Brent, more expensive than any other local spot-traded medium sour. For the United States, prices were rolled over for the umpteenth time, with December 2021 remaining the last month to see any price decreases, since then it was either up or sideways. Related: U.S. Gasoline Prices Rise Ahead Of Labor Day Weekend

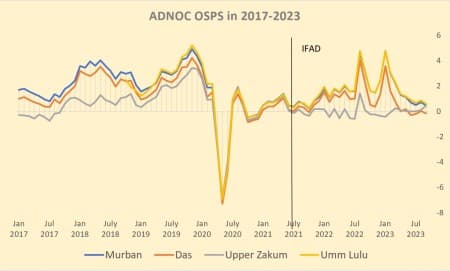

Chart 3. ADNOC Official Selling Prices for 2017-2023 (set outright, here vs Oman/Dubai average). Source: ADNOC.

Unconstrained by production cuts yet limited by the weakness of light sweet grades globally, ADNOC, the national oil company of the United Arab Emirates, has been dispersing its attention at many things at once. Its rumoured takeovers of chemical giants such as Covestro are still on the agenda, simultaneously the NOC brought forward its net zero emissions target by five years to 2045 to please skeptics that continue to criticize the selection of Sultan al Jaber as the host of the COP 28 climtate summit. Add to it a PR stunt with India paying for the first time ever in Indian rupees for Emirati barrels (though IOC also paid part of the cargo in UAE dirhams), and one sees ADNOC’s multi-pronged strategy. When it comes to pricing in September, the strength of Dubai vis-a-vis Murban which continues to be curbed by weak petrochemical margins has seen Murban’s differential weaken even further. At the same time, medium sour grades such as Upper Zakum are enjoying their spot in the limelight, trading at the same level as Murban, i.e $0.45 per barrel above the Dubai futures price. Should this trend continue, Upper Zakum might be even assessed at a premium to Murban in October, a situation last witnessed in February 2021.

Chart 4. Iraqi Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai). Source: SOMO.

Following many months of rather restrained pricing, Iraq’s state oil marketing company Somo has become the most adventurous this month, recording the highest price hikes to Asia. The Iraqis lifted the September OSP of Basrah Medium by $1 per barrel to a $1.40 per barrel premium vs Oman/Dubai average, more than either Arab Medium or Arab Heavy. Even with this, the Iraqi medium sour flagship is priced lower than Arab Heavy, a heavier and sourer grade, suggesting that the price recalibration might take several months. Whilst it might be argued Iraq lost some oil revenue in the process, its competitive pricing has also helped to maintain a stable pool of buyers. India, to provide just one example, cut down on Saudi imports quite tangibly, however, has been maintaining a stable intake of some 900,000 b/d Iraqi crude, Russian incoming flows notwithstanding. With HSFO cracks bordering positive territory, the heavy sour Basrah Heavy saw some positive momentum, too, being hiked by 75 cents per barrel to a -$1.90 per barrel discount to Oman/Dubai.

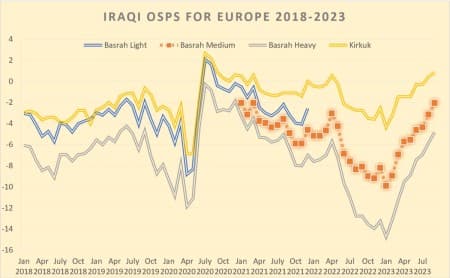

Chart 5. Iraqi selling prices for Europe-bound cargoes (vs Dated Brent). Source: SOMO.

With no Kurdish crude flows since late March, the European continent has been warming up to Iraqi barrels, especially considering the price difference between formula prices issued by the state oil marketing company SOMO and other Middle Eastern NOCs. For September, SOMO’s Europe-bound OSPs were hiked by $1.10 and $1.00 per barrel, respectively, for Basrah Medium and Basrah Heavy, largely in line with Saudi Aramco’s pricing. At the same time, Iraq’s formula prices will be boosted by the fact that they’re based off Dated Brent which soared as high as $1 per barrel above ICE Brent this month, so there’s an unforeseen pricing advantage hidden there. Iraq is set for the best year in Europe in history, with exports to the continent so far averaging 700,000 b/d, up 17% compared to last year. The attractiveness of Iraqi crude should remain in place for as long as there’s a discernible difference between Iraqi and Saudi prices – even now Basrah Medium is more than $3 per barrel cheaper for a European refiner than the heaviest Saudi grade, Arab Heavy, so the remaining months of 2023 should see more of the same.

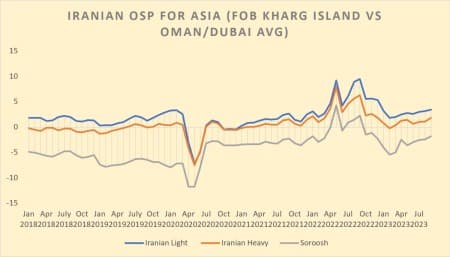

Chart 6. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average). Source: NIOC.

An increasingly assertive Iran has been spamming the low season of August trading with a string of news about its production ramp-up, saying its crude output is now just shy of 3.2 million b/d and would rise even further by the end of this summer. Whilst Tehran’s claims need not be necessarily truthful, they do reflect an upswing in Iranian matters. Regardless of actual numbers, Iranian production and exports have not been this high since the re-introduction of sanctions by former US President Donald Trump in November 2018. China has been the key customer for NIOC and whatever further increases there will be, they will be happening by virtue of higher Chinese buying, too. The likelihood of higher output is certainly there, especially after the un-freezing of 6 billion Iranian oil revenues that were held in South Korean bank accounts as part of a mutual prisoner release deal between Washington and Tehran. In the meantime, Iran’s national oil company replicated the moves of Saudi Aramco and hiked its formula price for Iran Light to $3.45 per barrel vs the Oman/Dubai average, a 30 cent per barrel increase compared to August prices. Iran has to add steep discounts for its exports to China to entice regional refiners, however even with double-digit discounts NIOC is raking in the highest revenue in years.

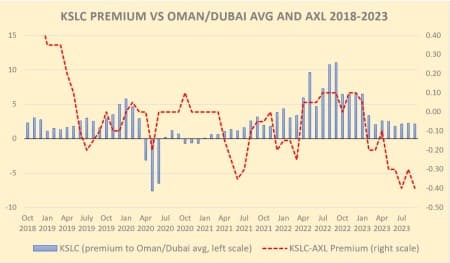

Chart 7. Kuwait Super Light Crude official selling prices into Asia, compared with Arab Extra Light (vs Oman/Dubai average). Source: KPC.

Whilst Saudi Arabia is busy cutting its production, Kuwaiti oil exports have declined by a similar order of magnitude (down 600,000 b/d compared to 2022 levels, as low as 1.3 million b/d in July) but for a different reason. With the announced start-up of the third distillation unit of the 615,000 b/d Al Zour refinery, Kuwait’s grand downstream strategy is now finally reaching the endgame. The Middle Eastern country is now the largest supplier of jet fuel into the European Union and the fourth-largest external diesel provider of the European continent, seeing its total product exports soar by 60% year-on-year to 800,000 b/d. When setting crude formula prices for September-loading cargoes, the Kuwaiti national oil company KPC increased its Kuwait Export Crude (KEC) differential for Asia by 60 cents per barrel (to a $2.85 per barrel premium to Oman/Dubai), mirroring the price hike of Arab Medium. Given that Kuwait remains a solely Asia-focused exporter with no flows to the United States or Europe, the respective roll-over and increase in formula prices carries no immediate impact for the Atlantic Basin.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Saudis Pour Money Into American Lithium

- U.S. Consumer Oil Demand Has Exceeded Expectations

- Chevron Evacuates Gulf Of Mexico Oil Platforms As Hurricane Idalia Approaches