There is a vicious circle of warfare that has had oil at its center for decades. Anyone looking for an oil angle on the biggest conflicts of recent history will not have to search far. Oil is what filled the war chest of Saddam Hussein. It’s what filled the war chest of Muammar Ghaddafi in Libya, and it’s what is fueling Vladimir Putin’s invasion of Ukraine.

Those were not wars attempting to grab oil; they were wars funded by huge amounts of fossil fuels that gave autocrats and dictators the power they needed to go empire-seeking, and if more oil ends up making its way into those coffers as a result of expansion–all the better.

Back in 1980, Saddam Hussein’s Iraq had found itself in a situation in which it was dangerously dependent on its Persian Gulf neighbors for empire-building money. He was borrowing left and right from the Saudis, the UAE, Qatar, and even Kuwait and Bahrain to fund his war against Iran. Hussein had designs on a much more significant power role in the Gulf, but his war chest was not his own. In fact, it was Hussein’s empire-seeking ambitions in which he saw an opportunity with a change of regime in Iran that backfired when his war chest could not contain the cost: This is where the rest of the Arab Gulf states took advantage, organizing the Gulf Cooperation Council (GCC), making them all the more potent in their alliance.

Iraq’s war chest simply wasn’t as big as Saddam Hussein’s ambitions. He overstepped and overplayed, and the remainder of his legacy would be an attempt to reverse that damage.

Related: OPEC Sees Smaller Oil Supply Surplus For Q1 2022

By 1981, at the height of Saddam Hussein’s borrowing from his Gulf neighbors, there was an oil glut, and demand for Iraqi oil had subsided. Compounding that problem, the Iran-Iraq war made it nearly impossible to ship Iraqi oil. The war chest that had already dwindled saw an Iraqi oil production cut from upwards of 3 million bpd to around 1 million bpd. Those are some devastating numbers, and this is where dependence on your neighbors begets more dependence.

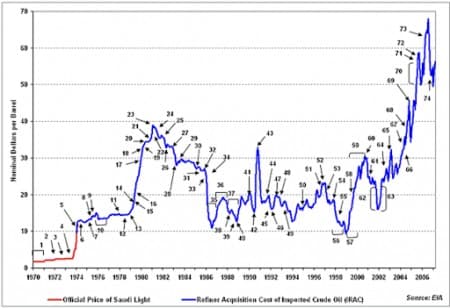

Saddam Hussein hadn’t played his strategy out fully from a market perspective. What he had been eyeing was this set of developments: 1980 looked brilliant. Oil producers were enjoying record-high crude prices as a result of the 1973 Arab oil embargo and the 1979 Iranian Revolution. It’s a lesson that appears only to have been learned in this current decade: Beware the “opulence”; overproducing takes us from riches to rags in short shrift.

As the Houston Chronicle noted about the years that would immediately follow this bonanza: “[...] just a few years later, it all came crashing down with the price of oil. The jets were grounded, cranes dismantled and commercial projects scrapped. Thousands of workers lost jobs and scores of companies went belly up.”

The Iran-Iraq War costs over $1 trillion dollars in economic cost terms. In human terms, it cost half a million lives. In strategic value, nothing was gained. No empire was built. The only thing Iraq got out of this was American support which came in the form of simply choosing the lesser of two evils to ensure neither dictator came out of this too powerful. But that choice would just lead to more wars, including the one in 2003 that toppled Saddam Hussein, who was not, after all, redeemable.

Putin’s war chest is still growing, despite a U.S. ban on Russian oil, and despite indications of declining Russian production since its invasion of Ukraine, and despite traders “self-sanctioning”.

This is a better play than that made by Saddam Hussein. The question is whether today’s soaring oil prices and an impending supply squeeze will be enough to continue to fill Putin’s oil coffers.

For now, that answer seems to be yes.

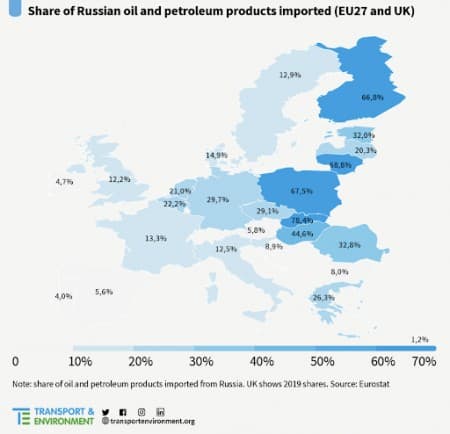

Every day, European countries are paying Russia, in total, an estimated $285 million for oil, according to the Transport & Environment (T&E) think tank, not including the UK’s recent ban on Russian oil.

Europe’s Russian crude oil imports far overshadow its Russian natural gas intake, according to T&E, whose data shows that Europe paid Russia $104 billion for crude, petrol, and diesel in 2021, compared to $43 billion for natural gas shipments.

The think tank concludes that “the European Commission must include Russian crude oil in its upcoming energy independence strategy” because “while the EU is heavily reliant on Russian crude, it is also one of the key revenue streams of Russian exports and has been helping to fund its military.”

Or, as T&E director Willliam Todts more poignantly put it for The Guardian, “Gas is understandably a worry, but it is oil that is funding Putin’s war.”

For now, the markets, and European dependence, suggest that Putin, unlike Saddam Hussein, has not overplayed his hand. He started this war with an estimated $630-billion coffer built on fossil fuels, and led by crude oil. Western sanctions have made an estimated two-thirds of that war chest very difficult to access, though it remains unclear just how difficult at this point. But money is still coming in.

Natural gas may have been his weapon of choice for Europe, but crude oil is the most valuable element of his war chest, and until that oil stops flowing, his war of attrition in Ukraine can continue even if his ground troops aren’t making much headway.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Germany Gets Ready For Gas Rationing

- Russia Threatens G7 Nations As Ministers Reject Gas-For-Rubles Scheme

- Are You Really Being ‘Gouged’ At The Gas Pump?