Last month, we reported that energy experts have been growing increasingly bearish on the oil price outlook compared to previous sentiment. Four energy agencies including the IEA and OPEC Secretariat have made their predictions for oil demand growth in 2023, with the only common theme being that all four expect demand to grow compared to 2022, but all are less optimistic than they were a year or so ago.

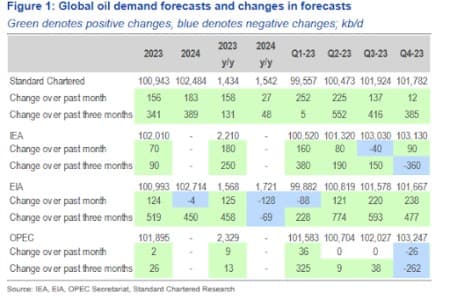

Previously, the OPEC Secretariat was the most optimistic, and had predicted that demand will grow by some 2.3 million barrels per day while the International Energy Agency (IEA) sees demand expanding by 2.0 mb/d. On the lower end of the spectrum, Standard Chartered is the least optimistic, and sees demand growing only 1.3 mb/d while U.S.-based Energy Information Administration (EIA) expects growth to clock in at 1.4 mb/d.

But these economists are now turning more bullish even as the overall market becomes more bearish.

The International Energy Agency (IEA) published its monthly oil balances report on Tuesday

May, about a week after similar reports were released by the Energy Information Administration (EIA) and OPEC Secretariat. Commodity experts at Standard Chartered have created a heatmap of demand forecast changes, including their own, in the latest reports relative to one and three months ago. You will notice that the heatmap provides a positive view of demand, with most estimates for 2023 quarters and the annual average having moved higher over both time periods. Interestingly, the biggest upwards revisions have come from the more bearish agencies namely StanChart and the EIA, while more bullish ones including the IEA and OPEC Secretariat have not changed significantly.

In sharp contrast, there’s a disconnect between what energy economists are seeing in the data and what speculative traders are acting on. Oil prices have touched multi-year lows on several occasions over the past two months, with StanChart speculating that the disconnect could be the result of the increasingly top-down and macro-led nature of oil-market sentiment.

Source: Standard Chartered Research

Short Sellers Take Over

Indeed, short sellers are becoming bolder and threatening to overrun the markets.

The collapse of Silicon Valley Bank in March triggered massive capital flight from oil to precious metals as panic spread that this could be the early innings of yet another banking and financial crisis.

According to commodity analysts at Standard Chartered, the SVB collapse led to the fastest-ever move to the short side in oil markets, with speculative short volumes more than six times larger than those after the collapse of Lehman Brothers and Bear Stearns in 2008. Money-manager positions across the four main Brent and WTI futures contracts became shorter by a record 228.9 million barrels (mb) in the space of just two weeks.

Predictably, oil prices cratered to multi-year lows in a matter of days before mounting a half-hearted rally thanks to the 2nd of April decision of some OPEC+ members to make voluntary output cuts. Related: Chances Of World Reaching Net-Zero By 2050 Unlikely: Exxon

Unfortunately for the bulls, the shorts have now returned with a vengeance.

Last week, StanChart reported that money-manager positions across the four main Brent and WTI futures contracts became shorter by 184.6mb over the previous two weeks, a pace only exceeded by the increase in speculative shorts after the SVB collapse, and at the start of the pandemic.

At this point, it’s not clear whether these sharp swings in the same direction are due to an over-reliance on similar algorithms by traders. And, just like us, StanChart says the excessive bearishness is overdone relative to underlying news flow and fundamental data.

Crude oil inventories have fallen below the five-year average for the first time this year.

Normally, U.S. inventories and oil prices have a strong inverse relationship, with falling inventories pushing prices higher while rising inventories have the opposite effect. However, large inventory draws over the past couple of weeks have failed to prevent significant price falls. As commodity analysts at Standard Chartered have noted, these dislocations tend to be temporary and come at times when prices are moved primarily by other oil market fundamentals, expectations, broader asset markets and financial flows. In this case, recent optimism regarding OPEC+ production cuts has failed to counter worries about demand linked to a weakening economic backdrop and a hawkish Federal Reserve leading to oil prices remaining range-bound. Further, reports have emerged that Russian crude shipments remain strong despite sanctions and embargoes: Reuters reported April oil loadings from Russia's western ports were on track to reach their highest since 2019 at more than 2.4M bbl/day.

Too Bearish

As we have pointed out before, it’s hard to find a proper justification for the growing bearishness in the oil markets.

According to the International Energy Agency, global oil consumption remains on track to rise by 2M bbl/day this year to an all-time high 101.9M bbl/day. Inventories are gradually tightening and should deplete further as OPEC+ implements new production cuts. Crude oil inventories have fallen below the five-year average for the first time this year. Last week, implied gasoline demand rose by 992 thousand barrels per day (kb/d) w/w to a 15-month high of 9.511mb/d.

StanChart has predicted that the OPEC+ cuts will eventually eliminate the surplus that had built up in the global oil markets over the past couple of months. According to the analysts, a large oil surplus started building in late 2022 and spilled over into the first quarter of the current year. The analysts estimate that current oil inventories are 200 million barrels higher than at the start of 2022 and a good 268 million barrels higher than the June 2022 minimum.

However, they are now optimistic that the build over the past two quarters will be gone by November if cuts are maintained all year. In a slightly less bullish scenario, the same will be achieved by the end of the year if the current cuts are reversed around October. This should shore up prices.

Meanwhile, natural gas prices are expected to increase in the latter half of the year as Europe goes on yet another buying spree. Europe has failed to secure enough long-term LNG contracts to offset cut-off Russian gas imports, with Reuters predicting this may prove costly next winter and could sharply tighten the market. The European Union views natural gas as a bridge fuel in the transition to renewable energy, and buyers generally struggle to commit to long-term contracts. This means that Europe might be forced to buy more from the spot markets as it did in 2022, which in turn is likely to push prices up:

"Since the green lobby in Europe has managed to persuade politicians wrongly that hydrogen to a large extent can replace natural gas as an energy carrier by 2030, Europe has become far too reliant on spot and short term purchases of LNG," consultant Morten Frisch has told Reuters.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- 2.7 Million Bpd Of Crude In Alberta Under Extreme Wildfire Threat

- Oil Prices Rise Amid Expectations Of A Tightening Market

- Putin Says OPEC+ Cuts Were To Maintain High Oil Prices