The surprise announcement by OPEC+ of another production cut totaling 1.16 million barrels per day caused oil prices to rally 8%. I previously wrote about this in my weekly research for Primary Vision Network, stating that the likelihood of a cut remained low and that the cartel was aware of the oversupply in the markets and the lack of imminent demand resurgence. However, when viewed from a different perspective, the cut makes sense precisely for the same reason.

For at least the past year, the prevailing narrative in oil markets has been a tug-of-war between two sentiments. Some have worried about a sudden resurgence in demand due to the post-COVID-19 recovery and the reopening of China, while others have been skeptical of these rosy outlooks. Those who are skeptical about a rebound in demand point out that China already filled its inventories when prices were low and that clouds of an impending recession, or at least a serious global economic slowdown, seem to be gathering on the horizon. The recent cuts by OPEC+ would suggest the demand skeptics are correct.

Recently, it was reported that stockpiles at Fujairah climbed "for the first time in a month". On March 22, data from the Fujairah Oil Industry Zone revealed that the stockpiles of all oil products at the UAE's Port of Fujairah saw a gain for the first time in a month. The data showed that the total inventories surged by 10% in the week concluding on March 20, reaching 21.338 million barrels. This gain marked the first increase in stockpiles since the week ended February 20, as per the FOIZ data exclusively obtained by S&P Global Commodities Insights on the same day. Prior to this, stockpiles had declined by 13% in the three previous weeks, which ended on March 13.

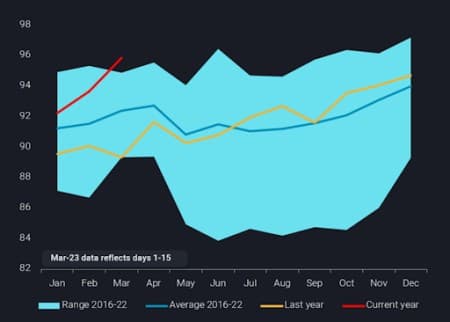

Moreover, data from Vortexa also corroborates the growing bearish sentiment in the oil markets. Total seaborne oil loadings were high, with loading volumes higher than their seven-year range, hitting 50 million barrels per day in March, up by 400,000 barrels per day from February. The demand for products is also at a "multi-year" high in March at 46 million barrels per day.

Russian crude oil exports have also remained stable despite the sanctions. Despite Moscow's announcement of a 500,000-barrel-per-day production cut, Russian crude loadings remained stable month-over-month at 3.6 million barrels per day in March. However, there has been a significant increase in Russian diesel loadings, which have surged by 400,000 barrels per day month-over-month to an exceptionally high 1.5 million barrels per day last month. This upswing in diesel loadings is partially attributed to postponed loadings from February. Nonetheless, it remains at a multi-year high and is contributing to the global market dynamics. I have highlighted in many articles and posts that the entire sanctions-on-Russia saga is not a disruption to oil supply but a re-orientation of global oil flows.

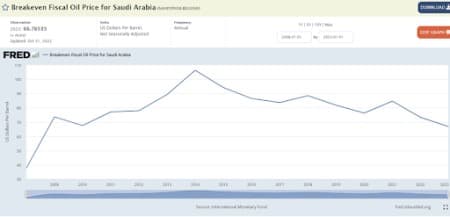

Against this backdrop, it's understandable that OPEC+ producers would be cautious about oil prices in the near future and aim for a level that avoids budgetary issues. Although the breakeven prices for most oil-producing countries have decreased, the countries in OPEC+ are taking into account the grim prospect of a global economic slowdown and adjusting their production accordingly to match the supply and demand dynamics of the market.

Source: FRED

According to the CFTC and ICE data, the same bearish sentiment was evident in the paper markets and the trading of futures contracts before the cut. Interest in short positions started to surpass that of long ones, amid concerns about a potential credit crunch. Hedge funds were reducing their holdings in crude oil and refined fuels, with contracts worth 142 million barrels sold in the week ending March 21, while adding 139 million barrels in the previous week. It was also reported that the total sales were the most in any fortnight since 2017 (May).

In my opinion, the markets are misinterpreting the production cuts. OPEC+ has made it clear that they do not anticipate strong demand, they recognize that markets will be in oversupply, and they do not want to experience the budgetary issues they faced during the 2014 and Covid-19 era. The news, in reality, is bearish.

By Osama Rizvi for Oilprice.com

More Top Reads From Oilprice.com:

- Citi Doesn’t See $100 Oil Despite Shock OPEC+ Cuts

- Inventory Draws Across The Board Push Oil Prices Higher

- Middle East Oil Prices Jump After Surprise OPEC+ Cuts

#canada too

#GLUT