Many articles have been written this past year about the impending demise of OPEC. Shale oil, it has been argued, has ended the cartel’s stranglehold on oil prices.

There’s some truth to that argument, but it also understates OPEC’s dominant position in the oil market.

I often try to imagine the decisions I would make, given OPEC’s situation and the unexpected emergence of U.S. shale oil production. For decades, OPEC has had the luxury of looking at the global supply and demand outlook, and raising or cutting production as they saw fit.

Shale Oil Emerges

But then the U.S. unexpectedly became the world’s fastest-growing supplier of new oil production.

(Click to enlarge)

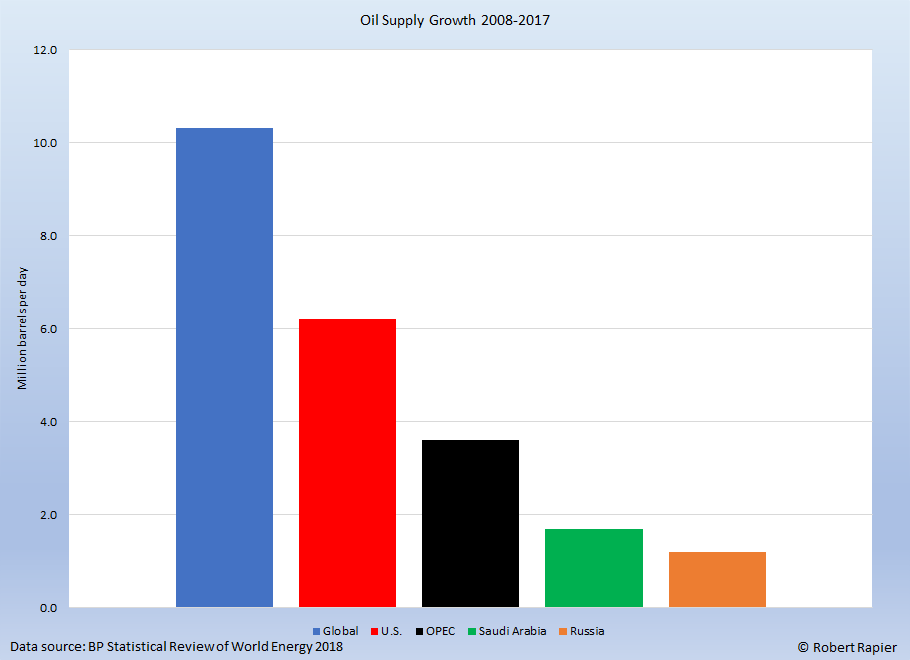

Oil Supply Growth 2008-2017

Of the 10.3 million BPD of new oil production since 2008, the U.S. supplied 6.2 million BPD (60 percent). The world’s two other major oil-producing countries, Saudi Arabia and Russia, saw their production increase by 1.7 million BPD and 1.2 million BPD respectively since 2008.

This surge of new oil production from the U.S. put OPEC under a lot of pressure to either cut production to balance the market, or to defend market share. I thought it was in their best interest to cut production, but instead in 2014 they made the decision to defend market share. I deemed that OPEC’s Trillion Dollar Miscalculation.

Prices Collapse

Five weeks after that Thanksgiving 2014 announcement, oil prices had dropped into the $40s (after already sliding from ~$100/bbl to the upper $70s over the prior four months). Indeed, OPEC realized its dilemma, and in 2016 the cartel made an agreement with several non-OPEC countries (most importantly, Russia) to cut oil production by 1.8 million BPD. Related: 2019 Could Make Or Break OPEC

That was a significant cut, and oil prices ultimately recovered back to the $70-$80/bbl range. But as I noted in an article last year, U.S. production growth could potentially offset those production cuts in a little over a year.

They did. In the past 12 months, U.S. oil production has grown by 1.95 million BPD. This continued growth again puts OPEC in the position of either cutting production to balance the markets, or in potentially letting the price crash. The latter approach had some limited success in 2016, as U.S. production did dip in response to the price war. But as soon as prices recovered, so did U.S. production.

OPEC’s New Paradigm

But OPEC still produced 42.6 percent of the world’s oil in 2017. Add Russia to the mix, and the two entities controlled 55 percent of global oil production and nearly 80 percent of the world’s proved oil reserves in 2017.

Total production from OPEC and Russia is more than 50 million BPD. In theory, they should have substantial pricing power, but the rapid growth of U.S. shale oil production continues to give them headaches.

Related: Oil Rises On Hopes Of A U.S.-China Trade Deal

It is certain that the U.S. oil production surge broke OPEC’s stranglehold on global oil prices. If the shale oil boom in the U.S. hadn’t happened, OPEC and Russia would have enjoyed the fruits of $100/bbl oil for the past decade. The U.S. trade deficit would have ballooned.

So now OPEC has to look at the supply/demand picture and try to estimate just how much further U.S. production can expand. If we are reaching the limits of shale production growth, then OPEC can go through a couple of cycles of production cuts, and they will be back in the driver’s seat.

But if U.S. production can expand for another decade, OPEC will have lost complete control over oil prices. In that case, U.S. production will likely only slow when electric vehicles are starting to take a serious bite out of global oil demand.

Speaking of which, oil demand continues to grow at more than 1 million BPD every year. That helps mitigate the impact of U.S. production growth. But as long as U.S. production grows annually at a faster pace than global demand — which it has several times in recent years — OPEC is going to have to live with either production cuts (which also help prop up marginal U.S. producers) or lower prices.

By Robert Rapier

More Top Reads From Oilprice.com:

- Flurry Of Bullish News Sends Oil Higher

- Oil Is At The Mercy Of Financial Markets

- Oil Buyers’ Market In Asia Set To Continue

The claim by the author that US shale oil has ended OPEC’s stranglehold on oil prices is false since the organization has neither had a stranglehold on oil prices nor aspired to have one. Moreover, depicting OPEC as a cartel shows a lack of understanding of what a cartel is.

A cartel is defined as an association of manufacturers and suppliers whose goal is to increase their collective profits by means of price fixing, limiting supply, preventing competition or other restrictive practices.

How could OPEC be a cartel when it was founded as a counterweight against the previous “Seven Sisters” (Exxon, Mobil, Chevron, Gulf Oil, Texaco, BP & Shell) cartel which dominated every aspect of global oil through price fixing, limiting supplies and suppressing competition for the sole purpose of maximizing its profits.The main purpose behind the founding of OPEC was to give producers more control over their own oil.

One would expect a cartel to curb production in order to raise the price of its product as well as to share market among its members. However, OPEC has never once tried to fix a specific price nor has ever been able to achieve this goal. The fundamentals of the global oil market are the ones that have always determined the oil price helped occasionally by geopolitics. OPEC has no control on these fundamentals and therefore has no control on the movements of prices. For instance, OPEC was not able to prevent prices from falling in the 1980s even after it adopted the production quota system in 1982. Moreover, OPEC was neither able to temper oil prices in 2008 when prices rocketed to $147 a barrel nor was it able to stop the 2014 oil price crash.

Whatever, influence OPEC has had emanates from the fact that it accounts for 42.6% and 71.8% of global oil production and proven reserves respectively.

On the other hand, the US has been manipulating oil prices for quite a while through the EIA’s hyped claims about rising US oil production and significant build-up in US crude and products inventories and also alternating the value of the dollar by which global oil has been priced and sold until the petro-yuan came on the scene on the 26th of March 2018.

To mitigate the adverse impact of such malpractice on oil prices and also on oil export revenues of OPEC members, OPEC is well advised to cut its oil exports to the United States altogether since these exports help augment US crude oil inventories. Moreover, OPEC is also well advised to adopt the petro-yuan in preference to the petrodollar since 80% of their oil exports go to the Asia-Pacific region particularly China.

With the petro-yuan gaining real ground at the expense of the petrodollar, US manipulation of oil prices will be seriously undermined.

The disclosure by the Wall Street Journal (WSJ) that US shale companies have over-hyped the production potential from thousands of shale wells comes as no surprise as many authoritative organizations including MIT have been accusing the EIA of overstating US oil production. According to the WSJ, two-thirds of projections made between 2014 and 2017 in America’s four hottest drilling regions appear to have been overly optimistic according to the analysis of some 16,000 wells operated by 29 of the biggest shale producers in oil basins in Texas and North Dakota.

The EIA’s claim that US oil production reached 11.7 mbd in 2018 is overstated by at least 3 mbd made up of 2 mbd of liquid gases and 1 mbd of ethanol all of which don’t qualify as crude oil. In fact International Exchanges around the world don’t consider them as substitutes for crude oil. And if the International Exchanges don’t accept them as substitutes, then they are not crude. Therefore, US oil production could have been no more than 8.7 mbd in 2018.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

There are still doubts emanating from the various experts as to what the break even price is for shale production to be profitable which by the way is touted to be much higher than the projected $40. Added to which, shale production falls more rapidly than conventional oil rigs which contributes to the profitability dilemma. In a nut shell shale drillers would very much prefer higher oil prices and may be influenced sometime in the future to work together with OPEC to achieve this goal.