U.S. West Texas Intermediate and international-benchmark Brent crude oil futures are trading higher on Friday and are in a position to close higher for the week. Both futures contracts are also trading at their highest levels since December 19.

The markets are being boosted by optimism over the announcement of higher-level trade talks between the United States and China on January 7-8. Traders said the markets are also being underpinned by the start of the OPEC-led supply cuts on January 1.

Prices firmed on Friday after China’s commerce ministry said that it would hold vice-ministerial level trade talks with U.S. counterparts in Beijing on January 7-8. Given the recent string of weak economic data from both countries, it seems there would be a sense of urgency to reach an agreement before there is a global recession.

OPEC Production Cuts

OPEC and its allies including Russia, agreed in December to reduce output by 1.2 million barrels per day (bpd) in 2019 versus October 2018 levels. This is supposed to trim the excessive global supply and stabilize prices. However, it’s going to take time. Traders feel that if OPEC can stay true to the deal, the global supply glut could be cleaned up within 3 to 4 months.

Reuters reported on Thursday that…

U.S. West Texas Intermediate and international-benchmark Brent crude oil futures are trading higher on Friday and are in a position to close higher for the week. Both futures contracts are also trading at their highest levels since December 19.

The markets are being boosted by optimism over the announcement of higher-level trade talks between the United States and China on January 7-8. Traders said the markets are also being underpinned by the start of the OPEC-led supply cuts on January 1.

A stronger-than-expected U.S. Non-Farm Payrolls report is also driving stocks higher, which is helping to generate further support for risky commodities like crude oil.

Higher Level Trade Talks

Prices firmed on Friday after China’s commerce ministry said that it would hold vice-ministerial level trade talks with U.S. counterparts in Beijing on January 7-8. Given the recent string of weak economic data from both countries, it seems there would be a sense of urgency to reach an agreement before there is a global recession.

OPEC Production Cuts

OPEC and its allies including Russia, agreed in December to reduce output by 1.2 million barrels per day (bpd) in 2019 versus October 2018 levels. This is supposed to trim the excessive global supply and stabilize prices. However, it’s going to take time. Traders feel that if OPEC can stay true to the deal, the global supply glut could be cleaned up within 3 to 4 months.

Reuters reported on Thursday that OPEC is already making moves to fix the situation. According to a survey, OPEC oil supply fell by 460,000 barrels per day (bpd) between November and December, to 32.68 million bpd. Top exporter Saudi Arabia made an early start to a supply-limiting accord, while Iran and Libya posted involuntary declines.

U.S. Non-Farm Payrolls

This report is important to crude oil because it represent growth in the economy. Today’s solid report numbers suggest financial market traders may have it all wrong and that the economy is not headed toward a recession. The numbers actually suggest the economy still has considerable forward momentum and this may bode well for future crude oil demand.

Weaker Manufacturing PMI Numbers

In the U.S., the ISM Manufacturing PMI came in at 54.1, well below the 57.5 consensus and November’s 59.3, driven by the new orders subindex which slumped to 51.1 from 62.1. The drop in the main index closely mirrors the sharp weakness recently seen in the equivalent China PMI import sub-index.

Earlier in the week, crude oil prices fell in response to weak manufacturing number from the U.S. and China.

Forecast

We’re definitely headed toward confusing times if we continue to see manufacturing weakening and the labor market strengthening. Ultimately, it looks as if the fate of the crude oil market will be determined by whether the U.S. and China can cut a trade deal. Additionally, the tone of the U.S. Federal Reserve should have an impact on crude oil prices since it is moving in lock-step with the stock market. If the Fed remains hawkish and stays on its tightening path in an effort to prevent the economy from overheating, then this could hurt the stock market and subsequently drive crude oil prices lower.

Crude oil is also getting a boost at the end of the week from increased appetite for risky assets. A strong stock market rally should extend the upside move in crude. Stocks could be bolstered if Fed Chair Powell softens his tone toward further rate hikes.

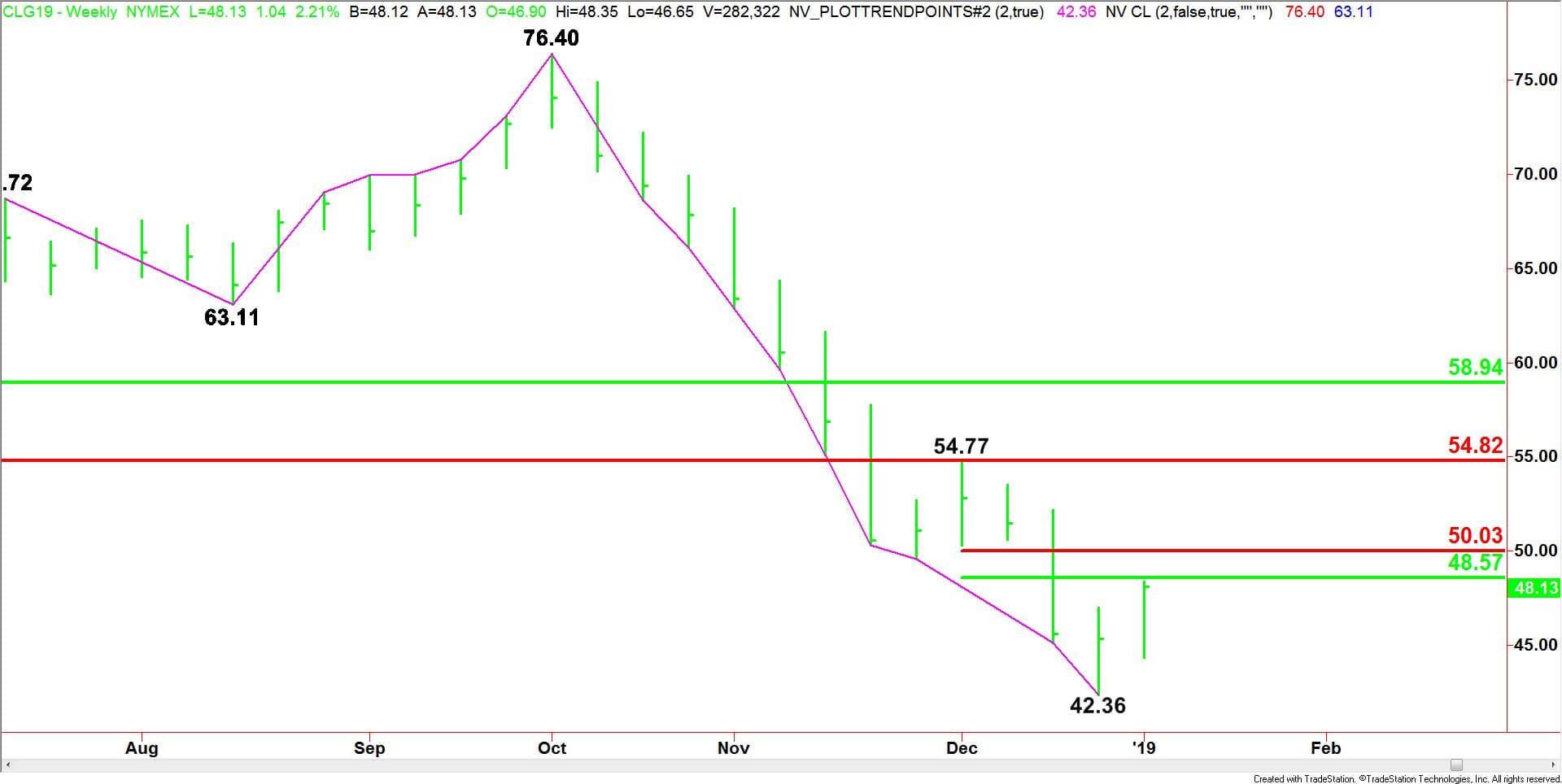

Weekly Technical Analysis

(Click to enlarge)

The main trend is down according to the weekly swing chart, but momentum appears to be shifting to the upside. It’s going to take a while to change the main trend to up. Firstly, the buying has to be strong enough on this first leg up from its low to drive out the weaker shorts. Secondly, the market has to form a higher bottom and build a support base. This type of chart pattern will indicate the presence of new buyers.

The minor trend is also down. This week’s price action helped form the first minor bottom at $42.36 in four weeks. If crude oil can produce a second week of a higher-high and a higher-low then a new main bottom will form. We haven’t seen one of those since mid-August.

The new minor range is $54.77 to $42.36. Its 50% to 61.8% retracement zone is the first upside target. It comes in at $48.57 to $50.03. Since the main trend is down, sellers are likely to come in on the first test of this area.

Taking out $50.03 will indicate the buying is getting stronger. This move is likely to agitate the weaker shorts. If this move can generate enough upside momentum then we could see an acceleration to the upside with the next major targets $54.77 to $54.82.

It’s going to take a change in the fundamentals and increased appetite for risk to drive this market sharply higher. In the meantime, the market is expected to be underpinned by the OPEC-led plan to reduce supply and stabilize prices. As long as they stay true to the plan to cut output and there is optimism over a U.S.-China trade deal then there is a chance the market will build a support base. This will eventually lead to higher prices.