Bullish sentiment has returned to oil markets in 2019, with Saudi Arabia cutting production while China and the U.S. look to end the trade war.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, January 4th, 2019

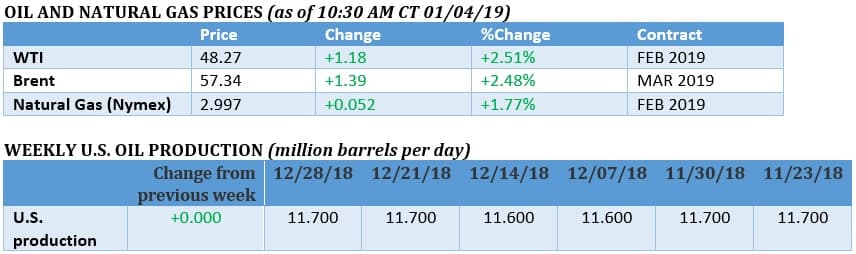

Oil prices popped on Friday as signs of a trade thaw emerged and data showed strong OPEC cuts in December.

Oil prices poised for large weekly gain. Brent and WTI are set to close out the week with the largest weekly gain since December 2016. This week, crude benchmarks could gain as much as 10 percent, owing to Saudi production cuts and a broader sense that the oil selloff has gone far enough. “Underpinning this wave of buying is mounting evidence that Saudi Arabia has taken an axe to its oil production,” Stephen Brennock, an analyst at PVM Oil Associates Ltd., told Bloomberg.

Strong U.S. employment data. The U.S. Labor Department reported strong job figures for December, with employers adding an estimated 312,000 jobs for the month, higher than expected. The data suggests the U.S. economy remains in solid shape, even as signs of a global slowdown have continued to mount. The downside of the jobs report is that it undercuts the case for the Federal Reserve to abandon interest rate hikes. It could also embolden the Trump administration to take a harder line in trade talks with China.

U.S.-China trade talks. U.S. and Chinese officials are set to meet on Monday to resume trade talks, and news of the meeting bolstered sentiment in financial markets. The three-month truce in the U.S.-China trade war ends in March, but the tone from officials from both countries has thawed recently. The shakiness in the global economy, which the trade war has contributed to, is also putting pressure on both sides to back away from the brink. “China has a strong desire to have a truce on trade war,” Shi Yinhong, a professor of international relations at Renmin University in Beijing, told the FT. “[T]he probability of the two sides reaching an agreement within the 90 days is growing”.

Related: Moody’s: The Shale Band Is Back, And Here To Stay

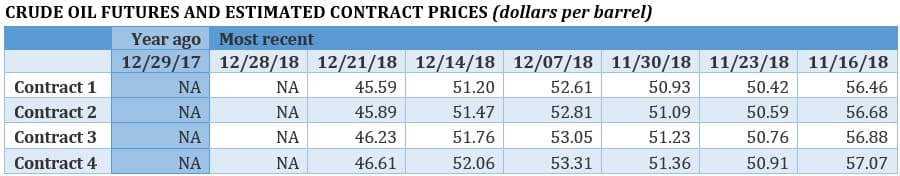

U.S. shale activity slowed in fourth quarter. The collapse of oil prices in the fourth quarter of 2018 led to a slowdown in the shale patch. The business activity index published by the Federal Reserve Bank of Dallas show that activity decelerated and production growth slowed. The data suggests that the U.S. shale industry was very responsive and sensitive to lower oil prices. The average prediction for year-end WTI prices from oil and gas executives was $59 per barrel.

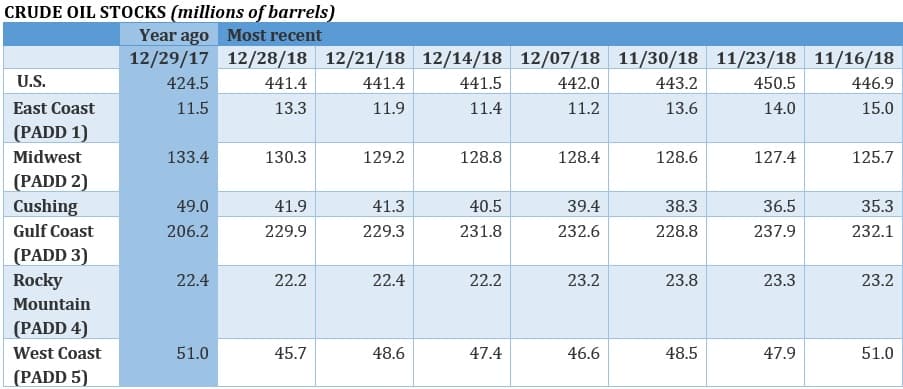

OPEC production fell in December. OPEC’s oil production fell in December to 32.68 mb/d, down about 460,000 bpd from a month earlier, according to Reuters. It was the largest monthly decline in two years. The reductions came ahead of the OPEC+ deal, which begins this month, and suggests that Saudi Arabia wanted to unilaterally tighten up the market. Saudi Arabia alone slashed output by 400,000 bpd, and Saudi officials said they would cut deeper in January.

U.S. shale production problems. The Wall Street Journal reported that U.S. shale companies have over-hyped the production potential from thousands of shale wells. “Two-thirds of projections made by the fracking companies between 2014 and 2017 in America’s four hottest drilling regions appear to have been overly optimistic, according to the analysis of some 16,000 wells operated by 29 of the biggest producers in oil basins in Texas and North Dakota,” the WSJ wrote. “Collectively, the companies that made projections are on track to pump nearly 10% less oil and gas than they forecast for those areas.” The WSJ calculated that the lower-than-expected production adds up to nearly one billion barrels of oil and gas over 30 years, worth more than $30 billion at current prices.

Libya’s Sharara field sees more trouble. Libya’s largest oil field, the Sharara field, was hit with more bad news this week. “An inspection team reported the theft of key operational equipment, including transformers and cables from several wells. The incident will reduce Sharara's output by approximately 8,500 barrels per day even after the main system restarts operations,” Libya’s National Oil Corp. said in a statement. The Sharara field, which has typically produced in excess of 300,000 bpd, was temporarily shut down last month. “We are very concerned these attacks are not simple robberies but are part of a systematic attempt to destroy the Sharara system,” NOC chairman Mustafa Sanalla said.

Related: 2019 Could Make Or Break OPEC

Offshore drilling plans delayed on government shutdown. The U.S. Interior Department delayed the release of a proposed plan for offshore oil and gas leasing sales from 2019 through 2024 due to the ongoing government shutdown, according to S&P Global Platts. The plan was supposed to be released in mid-January but is now likely delayed.

Oil tanks in Permian caught fire. A series of oil tanks caught fire near a Noble Energy (NYSE: NBL) well site in the Permian in the early hours on January 2. The well was shut down and no injuries were reported.

Michigan to review Line 5 pipeline plans. The eleventh-hour deal between Enbridge (NYSE: ENB) and Michigan’s outgoing Republican governor is now being scrutinized by the new Democratic Governor and the state’s Attorney General. The plan calls for Enbridge to build a new line next to the aging Line 5 system, which is over sixty years old. Environmental groups and native tribes have vociferously opposed the plan, which they argue could spoil the Mackinac Straights. Line 5 carries crude oil and natural gas liquids from Canada, across Michigan, to a major petrochemical hub in Sarnia, Ontario.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Major Gasoline, Distillate Build Caps Oil Price Gains

- OPEC Oil Exports To The U.S. Fall To Five-Year Low

- Bloodbath In Oil & Gas Stocks Could Continue

That's right: WTI hit an intraday high of $49.22/bbl, almost $7/bbl higher than the recent low of $42.36 or up more than 16%.

Interesting considering this week's EIA report showed huge builds in both gasoline and distillate stocks, with no draw in oil stocks.

"Strong U.S. employment data."

Let's be honest folks: We've seen WTI respond with strong upward gains no matter what the employment data is.

That's because if there is weak employment data, then the U.S. dollar lags and then WTI surges because of that.

Today's excuse was "strong employment data" yet the U.S. dollar was stronger, so shouldn't WTI be cheaper?

"U.S.-China trade talks."

Okay, this has been going on long enough that it is fair enough to say it's far from over yet.

How many times in 2018 did the markets go back-and-forth due to tariffs, then trade talks, then repeat over-and-over.

Did the U.S. get together with China for these talks yet? No. So, was there an agreement? No.

But, as usual, WTI soars on "hopes" which means prices never go lower on "hopes" of lower fuel costs.

"U.S. shale activity slowed in fourth quarter."

So what? The U.S. is still the no. 1 oil producer in the world, so, we're only just shy of record production. Hardly bullish news.

"OPEC production fell in December."

Guess what? Kuwait hasn't sold any oil to the U.S. in months. Has that affected us? No.

Iran's production has slowed due to U.S. sanctions. Did that stop prices from falling? No.

This is not the 1980s...OPEC simply does not have the influence they once had, only jawboning power.

Oh, and 2 years ago there was a glut and OPEC agreed to cut production...after ramping up production to record highs.

How did that work for them? Well, here we are again with yet another glut.

2019 could see a resurgence in oil prices beyond $80 a barrel underpinned by global oil fundamentals that are still virtually as robust as in 2018 with the global economy projected to grow at 3.8% in 2019 compared with 3.9% in 2018, the global oil demand also projected to add 1.4 million barrels a day (mbd) in 2019 over 2018 and with China’s demand for oil accelerating unabated.

Two bullish developments have recently helped push oil prices up. One is the growing feeling in the global economy that the trade war between the US and China could be coming to an end.

The other development is the realization by the global oil market that OPEC+ is determined to ensure that the recent cuts amounting to 1.2 mbd will do the trick and reduce the glut in the market. This has recently been emphasized by Saudi Arabia cutting an estimated 639,000 barrels of oil a day (b/d) from its exports in December 2018 thus signalling to the global oil market its determination and that of OPEC+ to defend the oil prices. Moreover, there is evidence that Saudi Arabia is determined to take an axe to its production to ensure that it gets a price higher than $80 barrel it needs to balance its budget.

And despite bullish tail winds, a bearish element may still be at play in 2019, namely the failure of US sanctions to cost Iran the loss of even one barrel from its oil exports leading the global oil market to realize that there will not be a supply deficit in the market.

Moreover, US sanction waivers which were issued to eight countries in November last year will most probably be renewed in May this year if only to be used by the Trump administration as a fig leaf to mask the fact that their zero oil exports option is out of reach and that the sanctions are deemed to fail.

The disclosure by the Wall Street Journal (WSJ) that US shale companies have over-hyped the production potential from thousands of shale wells comes as no surprise as many authoritative organizations including MIT have been accusing the US Energy Information Administration (EIA) of overstating US oil production. According to the WSJ, two-thirds of projections made between 2014 and 2017 in America’s four hottest drilling regions appear to have been overly optimistic according to the analysis of some 16,000 wells operated by 29 of the biggest producers in oil basins in Texas and North Dakota.

Claims about explosive growth of US shale production are pure hype by the EIA supported by the International Energy Agency (IEA). The EIA’s claim that US oil production reached 11.7 mbd in 2018 is overstated by at least 3 mbd made up of 2 mbd of liquid gases and 1 mbd of ethanol all of which don’t qualify as crude oil. In fact International Exchanges around the world don’t consider them as substitutes for crude oil. And if the International Exchanges don’t accept them as substitutes, then they are not crude. Therefore, US oil production could have been no more than 8.7 mbd in 2018.

Moreover, the US has been manipulating oil prices for quite a while through the EIA’s falsifying claims about rising US oil production and significant build-up in US crude and products inventories and hiking the value of the US dollar opposite other currencies.

To mitigate the adverse impact of such malpractice on oil prices and also on oil export revenues of OPEC members, OPEC is well advised to cut its oil exports to the United States altogether since these exports help augment US crude oil inventories. Moreover, OPEC is also well advised to adopt the petro-yuan in preference to the petrodollar since 80% of their oil exports go to the Asia-Pacific region particularly China.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London