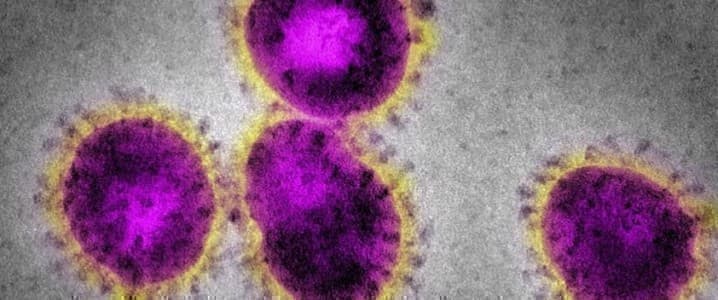

OPEC+ expects the effect of the Omicron variant of the coronavirus on oil prices to be mild and temporary, Reuters reported, citing a technical report by the group.

"The impact of the new Omicron variant is expected to be mild and short-lived, as the world becomes better equipped to manage COVID-19 and its related challenges," the report, by the extended cartel's Joint Technical Committee, said. "This is in addition to a steady economic outlook in both the advanced and emerging economies."

OPEC + is meeting this week to discuss output plans, and the report suggests the group may decide to continue sticking with its original schedule of adding 400,000 bpd to combined output every month until production returns to pre-pandemic levels.

A recent Bloomberg poll also pointed in that direction, even though some members have found it hard to pump as much as their quotas allow them. Russia notably may have failed to take full advantage of its December quota, producing some 10.93 million bpd of crude and condensate, according to Bloomberg, which noted, however, that it was difficult to asset the crude oil component of the total. The agency then assumed a flat condensate output to estimate crude oil output had been 37,000 bpd below the December OPEC+ quota.

White Russia's shortfall may or may not be a fact, West African oil producers are indeed struggling to produce as much as their quotas allow them. According to a recent Argus report, Nigeria was the only West African member of OPEC to increase production in November, but the increase fell short of its target.

Whatever the production challenges of OPEC+, it is important for the cartel to get across the message that it is not bothered by omicron or by planned reserve releases of crude oil from the U.S., Japan, and South Korea.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- How Biden’s Energy Agenda Could Send Oil To $100

- Oil Perks Up With Another Crude Inventory Draw

- Global Oil Demand Could Reach New Heights In 2022

And while the robustness of both the global economy and the global oil demand and also the mild impact of the Omicron variant on the market suggest that OPEC+ will decide in its meeting tomorrow to stick by its decision to increase production by 400,000 barrels a day (b/d), a decision isn’t a fait accompli. OPEC+ always has some surprises up its sleeve.

OPEC+’s 2022 resolution is to ensure a demand-supply balance in the market and a Brent crude price of $80 a barrel or slightly higher which is the price the overwhelming majority of its members with the exception of Russia need to balance their budgets.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London