The resurgence of COVID in China could not have happened at a worse time for Middle Eastern producers. Saudi Arabia brought back all its 1 mbpd voluntary production cut and already started ramping up production along the lines of the latest OPEC+ deal that would largely see it adding 100kbpd every forthcoming month in 2021. In a similar fashion, the Emirati ADNOC has started to roll back its self-imposed supply cuts from 15% to an eventual zero. Thus, sizeable volumes of incremental supply will be coming back next month, just as peak summer demand season ends in Europe and North America, implying that lukewarm Asian demand does not bode well with short-term market fundamentals. With this being said, below we will take a look at the pricing strategies of Middle Eastern NOCs to get a feeling of what is to be expected further.

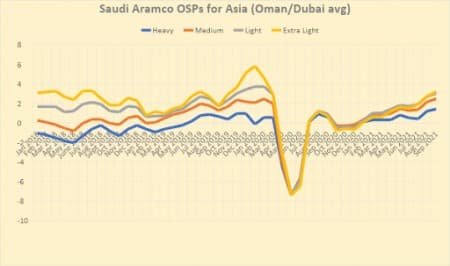

Graph 1. Saudi Aramco OSPs for Asia (FOB Ras Tanura, against Oman/Dubai average).

Source: Saudi Aramco. Saudi Aramco has traditionally set the scene for September formula pricing and the overall anticipation for Asian OSPs was that of a month-on-month increase. Although refining margins saw no big change throughout July, the Dubai M1-M3 backwardation steepened by more than 50 cents per barrel month-on-month, implying that the average changes should be somewhere around that mark. And indeed, they were, yet for Arab Extra Light only, with all other (heavier) grades seeing smaller m-o-m hikes, ranging from 20 cents per barrel for Arab Heavy to 30 cents per barrel for Arab Light. Whilst the likes of Arab Light or Arab Super Light have seen premia as high as they have currently ($3.00 and $3.20 per barrel vs the Oman/Dubai average, respectively) in the pre-pandemic period, too, the current Arab Heavy premium of a $1.40 per barrel premium to the Middle Eastern benchmark duo has no precedent in the pricing history of Saudi Aramco.

Related: China Continues To Tap Crude Reserves Despite Plunge In Refining Activity

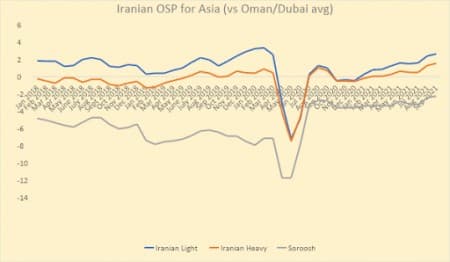

Graph 2. Iranian OSPs for Asia (FOB Kharg Island, against Oman/Dubai average).

Source: NIOC.

With regards to other continents, Saudi Aramco committed to sizeable cuts on the European front, 50-70 cents per barrel for Northwest Europe and 60-80 cents per barrel for the Mediterranean, accounting for a weakening Urals. Traditionally, ASCI-pegged US official formula prices saw the least alterations, though Saudi Aramco did go for another month-on-month hike, rising US-bound cargoes loading in September by 10-20 cents per barrel. Looking forward, unless things change dramatically in the second half of August, October OSPs should put an end to three months of consecutive month-on-month increases in the Asia Pacific region, with backwardation showing signs of easing concurrently with China committing to swift and drastic lockdown measures. Whilst profit maximization remains Saudi Aramco’s key objective for 2021, its Iranian peer NIOC is trying to navigate a challenging external environment.

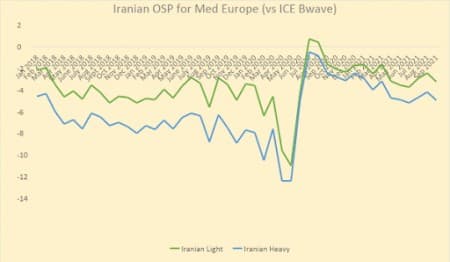

Graph 3. Iranian OSPs for Mediterranean Europe (FOB Kharg Island, against ICE BWave).

Source: NIOC.

NIOC’s pricing for September 2021 follows the trendline set by Saudi Aramco, though the month-on-month increases are lower than the Saudi NOC’s – both Iranian Light and Heavy were hiked by 25 cents per barrel, to premia of $2.65 and $1.55 per barrel against the Oman/Dubai average, respectively. Thus, the IRL-ARL spread, amounting to -$0.35 per barrel, moved to its highest since March 2020, presumably in an attempt to lure potential buyers to purchase even more Iranian barrels. In the meantime, prospects for an Iranian nuclear deal have mostly faded as Ebrahim Raisi took over Iran’s presidency. Even though Raisi named Javad Owji as the new oil minister – a petroleum engineer by training with extensive career experience, including a four-year stint as head of Iran’s gas company NIGC – the overall direction is assumed to be much more hawkish than with the Rouhani Administration.

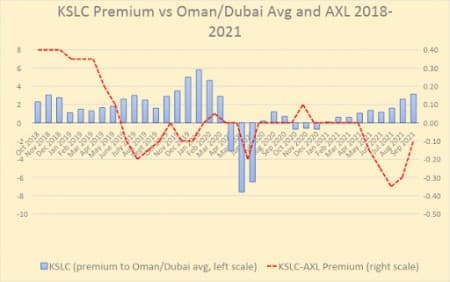

Graph 4. Kuwait Superlight Crude OSPs against Oman/Dubai average and Premia vs Arab Extra Light.

Source: KPC.

September prices for Kuwait’s flagship Kuwait Export Blend (KEB) rose in unison with Arab Light, up 30 cents per barrel month-on-month, up to a $2.35 per barrel premium to Oman/Dubai average. Kuwait’s other main crude stream, its Super Light (KSLC) grade, saw its September 2021 OSP increase by 55 cents per barrel, the second-largest month-on-month increase after Arab Super Light. Rumours are circulating that Kuwait and Saudi Arabia would be interested to ramp up production from the jointly managed Khafji neutral zone, which would increase heavy sour supply for the Asian continent (Khafji being 28° API, 2.9% sulphur content). In other news, KPC has received an unexpected boost to its 2021 results as the UN Compensation Commission decided it should receive $600 million as compensation for damages incurred in the 1990-91 Iraqi invasion and the subsequent Operation Desert Storm.

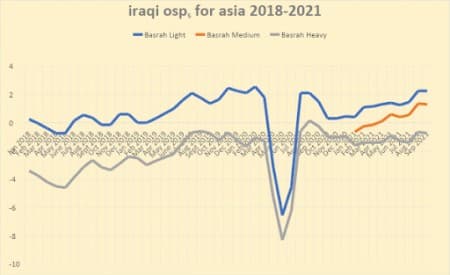

Graph 5. Iraqi OSPs for Asia (FOB Basrah, against Oman/Dubai average).

Source: SOMO.

The Iraqi state oil marketer SOMO has gone against the overall regional trend by dropping two of its three September 2021 OSPs for Asian buyers – Basrah Medium by 5 cents per barrel and Basrah Heavy by 10 cents per barrel – whilst Basrah Light was simply rolled over from August. Whilst July exports from Iraq showed no sign of weakness, in fact reaching a 15-month high at 2.92 mbpd, SOMO might have been alerted to the possibility of weaker-than-anticipated demand after it failed to sell a spot Basrah Medium cargo in early August. Still, considering the evolution of forwards structure from July, which should have presumed some sort of month-on-month increase, the price drop puts Iraqi barrels at a tangible advantage next month – currently, the difference between Arab Medium and Basrah Light (sharing a density of some 31° API as of today, though the former is less sulphurous) stands at -$0.2 per barrel, the lowest since April 2019.

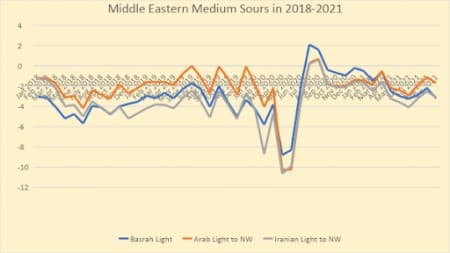

Graph 6. Premium Comparison of Middle Eastern Medium Sours in 2018-2021 (USD per barrel).

Source: SOMO, NIOC, Saudi Aramco.

The ambition of Iraq’s price cutting goes beyond the Asian continent, SOMO’s September prices for the United States and Europe also buck the Saudi-indicated direction. Whilst Saudi Aramco hiked European prices by $0.5-$0.95 per barrel compared to August levels, SOMO went further with $1-$1.35 per barrel cuts (moreover, the Iraqi prices for Europe do not differentiate between European subregions though they are just as curbed by destination restrictions as those of Aramco). Similarly, with US prices, excepting Kirkuk prices (which anyways never sail across the Atlantic), Iraq countered the trend by dropping prices by 5-10 cents per barrel. It remains to be seen whether SOMO’s pivot towards the consumers will be a one-off occurrence or will persist over the autumn months, however September certainly seems to be set for an Iraqi export boost.

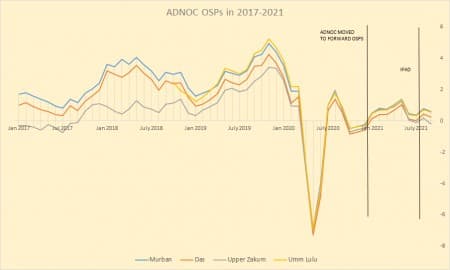

Graph 7. ADNOC OSPs (FOB Jewel Dhanna/Das/ZIrku, against Dubai average).

Source: ADNOC, ICE.

With September 2021 Murban OSPs set on the basis of intra-month trading on the Abu Dhabi exchange, the Emirati grade’s marginal depreciation foreshadowing the normalization of differentials in the forthcoming months. At the same time, the IFAD Murban futures contracts keep on increasing their exposure, as July trading resulted in a total of 11.5 MMbbls delivered, the highest so far. Overall, the IFAD-set official selling prices weakened over July, with the September premium to Dubai dropping to $0.60 per barrel, with Murban’s outright price at $73.50 per barrel. Looking forward, one might expect that the October Murban-Dubai swaps spread will further narrow in October, with the ADNOC grade’s premium already dropped to early June levels by mid-August.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- The Main Reason Oil Prices Won't Go Above $80 Per Barrel

- What Happens If We Stop Pumping Oil Tomorrow?

- Oil Prices Set For Longest Losing Streak Since March