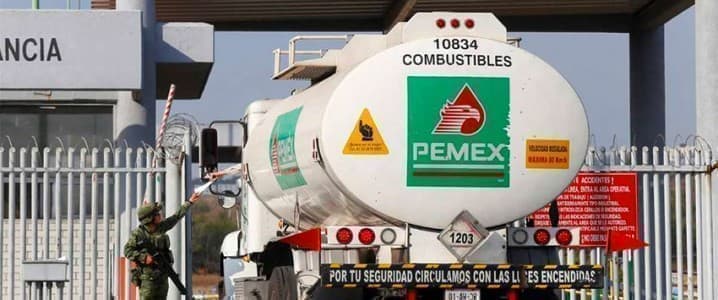

The deadly price war and coronavirus cocktail that threw most of the global industry into a panic seems to have missed one of the large national players: Mexico’s Pemex. While others are already cutting sizeable chunks of their planned spending, idling rigs, and revising drilling plans, Pemex is sticking with its plan to boost production.

The Mexican state oil company has been fighting a consistent decline in oil production for years now and seems bent on turning things around despite the oil price crash. President Andres Manuel Lopez Obrador, after all, promised that Mexico’s oil output would hit 2.5 million bpd by 2024, the end of his term in office. The promise was made long before the surprise industry collapse that no one could anticipate, and it is noteworthy that Pemex has not changed its priorities.

The company plans to double the number of newly drilled wells this year to 423, Bloomberg reported this week, noting that Pemex also planned to speed up the development of 15 new discoveries – a move in stark opposition to what pretty much everyone else in the industry is doing, which is idling rigs and cutting costs.

The Mexican state oil company is on an ambitious mission: it last year said it would aim to discover and develop 20 new oil and gas fields annually. Even though analysts believe this annual rate of discovery would be challenging to maintain, Pemex did, in 2019, identify 20 such projects. Their development, however, is behind schedule, and in January, media reported that only three of these fields would begin production before the end of the current year.

Premium: Oil Market Data Is About To Get Very Ugly

From a certain perspective, this might not be so bad: according to energy consultants from Welligence who spoke to Bloomberg, more than 50 percent of Mexico’s existing oil output is unprofitable at oil prices of $30 per barrel. This means the company will keep losing money if it continues to pursue the last two governments’ production boost plans. And it will pay for it.

Pemex is already the world’s most indebted oil company, dethroning Brazil’s Petrobras. It is in danger of having its credit rating cut to junk status by a second credit ratings agency after S&P cut it last month. This would hurt Mexico’s sovereign debt rating, Bloomberg wrote, and this fact could spur the government into more action to support the company. However, a production plan reversal remains unlikely. Pemex will just redirect some of the oil from export markets to the domestic markets, according to President Andres Manuel Lopez Obrador.

Obrador said in a tweet earlier this week that 400,000 bpd will be redirected to the domestic market and fed into refineries to produce gasoline. Russia’s Sputnik noted this constituted about a third of total exports, which, as of December 2019, averaged 1.2 million bpd. The move makes sense: Mexico imports a lot of gasoline, which is more expensive than the fuel would be if it produces it domestically. With oil prices too low to make exports profitable, raising domestic gasoline production kills two birds with one stone.

But there may well be another reason for the government to continue with its Pemex production growth strategy: the notorious oil hedge.

“Everything” in the Mexican budget that needs to be covered by oil revenues is covered, the country’s Finance Minister, Arturo Herrera, said last month in response to questions about the well-being of Pemex, which has a direct bearing on the well-being of Mexico’s finance. The country hedged its oil exports at $49 per barrel this year, in put options worth $1.4 billion.

“The hedge is usually not cheap, it is expensive, but it is for occasions just like this. The income part is covered, we will not have a direct impact on the budget,” Herrera said.

And there is more: President Lopez Obrador is due to announce an energy industry plan soon, and this plan will include $13.5 billion in public and private investment in the industry, Reuters reported earlier this week. Some of this investment will target an increase in oil production, again despite current circumstances. Mexico is on the path of production growth, and it seems that no oil price collapse can divert it from it. Unless OPEC+, of which the country is part, doesn’t ask it to put its production growth plans on hold.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- What Happens If You Can’t Pay Your Electricity Bill?

- The Only Logical End To The Oil War

- Saudi Arabia Sends Wave Of Supertankers To U.S. Ahead Of Oil Meeting