It is both the best and worst of times for the current Iraqi oil market. Iraqi oil minister Jabbar al-Luaibi said this week that Iraqi oil fields in the south of the country had recorded an 'unprecedented' surge in daily exports from Basrah during the last month. All the while, loadings in Ceyhan, Turkey, of crude from the Kirkuk pipeline in the north of the country continue to remain in check amid regional unrest.

December monthly loadings from Basrah were strong, although not unprecedented, according to our vessel-tracking, vessel lineups and port agent data - reaching their highest monthly level in 2017. While loadings bound for the U.S. hovered around half a million barrels per day for a second month, the most interesting development came from those flows heading east of Suez.

East Asia has traditionally been the largest market for southern Iraqi crude barrels, with China leading the charge (it receives about double the volume that heads to South Korea).

But as Indian crude demand continues to grow, spurred on by both domestic demand and increased refining activity, our ClipperData show the first material increase of barrels loaded for South Asia over East Asia on our records:

(Click to enlarge)

All the while, the U.S. remains the third leading destination for Basrah Light and Basrah Heavy, with deliveries averaging nearly 590,000 bpd in 2017, up over a third versus 2016 arrivals. While the U.S. has certainly felt the brunt of the OPEC production cut deal - and no doubt intentionally so - it hasn't been courtesy of Iraq:

(Click to enlarge)

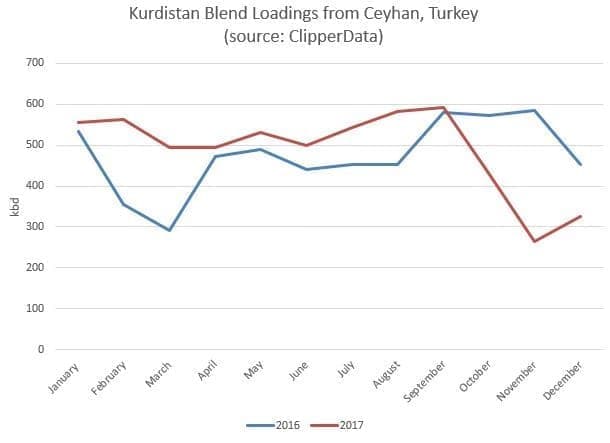

While southern Iraqi loadings remain robust, flows from the north of the country - which are loaded at the Turkish port of Ceyhan after being delivered there by pipeline - have dropped in recent months amid ongoing unrest in the region. Related: Can Norway Survive Without Big Oil?

After exports from Ceyhan averaged 540,000 bpd through the first nine months of the year, loadings dropped considerably in the final quarter. Nonetheless, total exports of crude from the region in 2017 have still finished higher than the prior year, after outpacing year-ago levels through the first three quarters of the year:

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com:

- What Is Keeping Oil From Breaking $70?

- Can Blockchain Bring An End To Corruption?

- Strong Draw In Crude Inventories Lifts Oil Prices