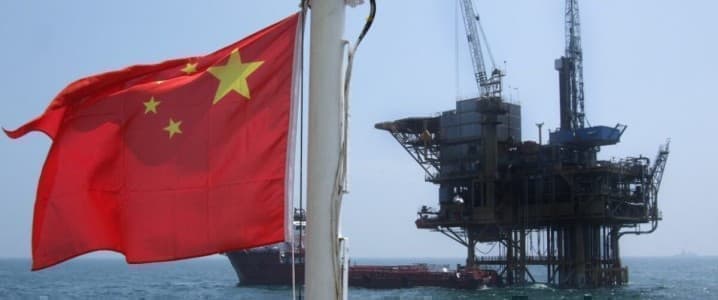

The China National Petroleum Corporation (CNPC), the government-owned parent company of PetroChina, and Cnooc (OTCPK: CEOHF) has kicked off ultra-deepwater exploratory drilling for oil and gas as the country looks to wean itself of foreign oil.

According to Chinese news agency Xinhua Global Service, CNPC will drill a test borehole of up to 11,000 meters (36,089 feet), the country’s deepest ever, which will help it better understand the Earth’s internal structure better, as well as to test underground drilling techniques.

CNPC’s borehole depth is not far from Qatar’s world record of 12,289 meters (40,318 feet) for a petroleum well depth that was drilled in the Al Shaheen Oil Field in 2008 or Russia’s Kola Superdeep well that reached a depth of 12,262 meters (40,230 feet).

In the oil and gas exploration and production (E&P) industry, deepwater is defined as water depth greater than 1,000 feet while ultra-deepwater is defined as depths greater than 5,000 feet.

Deepwater Boom

But China is not the only country willing to drill to ridiculous depths in the pursuit of energy security.

Deepwater oil and gas production is set to increase by 60% by 2030, to contribute 8% of overall upstream production, according to a new report from Wood Mackenzie, as cited by Rig Zone.

Ultra-deepwater production is set to continue growing at breakneck speed to account for half of all deepwater production by 2030.

Deepwater production remains the fastest-growing upstream oil and gas segment with production expected to hit 10.4 million boe/d in 2022 from just 300,000 barrels of oil equivalent per day (boe/d) in 1990. Wood Mackenzie has predicted that by the end of the decade, that figure will pass 17 million boe/d.

Norway's Aker BP (NYSE:BP) (OTCQX:AKRBF) is the latest oil major to make an ultra-deepwater discovery. At a total depth of 8,168 m, Aker BP says the well is the longest exploration well drilled in offshore Norway. The much bigger than expected oil discovery was made in the Yggdrasil area of the North Sea. Related: Kurdistan Has Lost $2 Billion Due To Its Oil Exports Saga

Preliminary estimates indicate a gross recoverable volume of 40 million-90 million barrels of oil equivalent (boe), much higher than the company’s earlier projection of between 18 million and 45 million boe. The discovery will significantly enhance the company’s resource base for the Yggdrasil development, which previously was estimated at 650M gross boe.The oil discovery is located within production licenses 873 and 442: In license 873, with Equinor ASA (NYSE:EQNR) and PGNiG Upstream Norway as partners. The plan for development and operations (PDO) for this project was submitted to Norwegian authorities in December 2022, with production scheduled to start in 2027.

In 2021, U.S. oil and gas major Exxon Mobil (NYSE: XOM) made a big deepwater oil and gas find. Exxon announced that it had made two more discoveries at the Sailfin-1 and Yarrow-1 wells in the Stabroek block offshore Guyana, bringing discoveries on the block to more than 30 since 2015. Exxon revealed that the Sailfin-1 well was drilled in 4,616 feet of water and encountered 312 feet of hydrocarbon-bearing sandstone, while the Yarrow-1 well was drilled in 3,560 feet of water and encountered 75 feet of hydrocarbon-bearing sandstone.

Exxon did not disclose how much crude oil or gas it estimates the new discoveries to contain, but hiked a previous output forecast for the third quarter from older discoveries in the region.

The supermajor has boosted development and production offshore Guyana at a pace that "far exceeds the industry average”. Exxon’s two sanctioned offshore Guyana projects, Liza Phase 1 and Liza Phase 2, are now producing above design capacity and have already achieved an average of nearly 360K bbl/day of oil. The supermajor expects total production from Guyana to cross a million barrels per day by the end of this decade.

Exxon said a third project, Payara, is expected to launch by year-end 2023 while a fourth project, Yellowtail, could kick off operations in 2025.

Exxon is the operator of the Stabroek block where it holds a 45% interest while partners Hess Corp. (NYSE: HES) and Cnooc hold a 30% and 25% interest, respectively. Exxon’s oil and gas production is well below record levels, averaging 3.7M boe/day, nearly 9% below 4.1M boe/day set in 2016.

By Alex KImani for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Moves Lower After EIA Confirms Large Crude Build

- 5 Weird Energy Innovations That May Become Reality

- Polysilicon Price Surge: A Challenge For Emerging Solar Markets