We've been harping on in recent weeks about how Saudi has been slashing crude flows to North America, but as we can see in our ClipperData below, it has been cutting flows to other key markets too.

The chart below highlights the hangover from Saudi Arabia's late 2016 export ramp-up, which translated into a big year-on-year increase in January deliveries of 730,000 bpd into Saudi's top five suppliers. South Korea was the biggest beneficiary, accounting for nearly a half of this increase.

But as we have moved through 2017, the year-on-year increases have turned into deficits - with the drop in flows to the U.S. particularly pronounced. Japan has seen deliveries hold up best, receiving more crude on a year-over-year basis for the past four consecutive months.

China has received less crude on a relative basis in four of the last five months, while South Korea has seen a deficit in three of the last four. Nonetheless, as we keep harping on...the U.S. is feeling the brunt of lower Saudi exports - something which is set to persist.

(Click to enlarge)

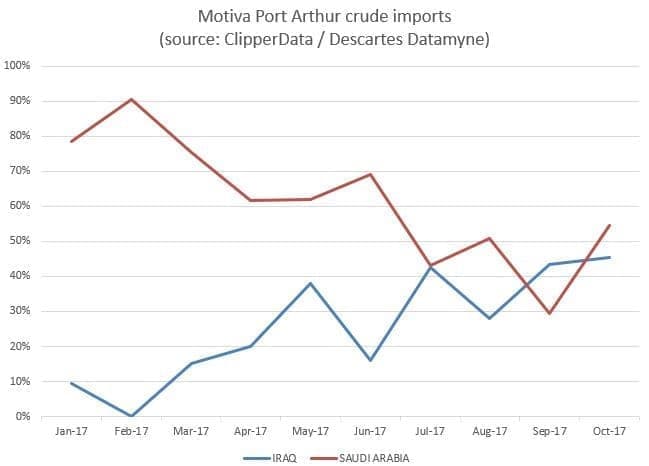

As Saudi dials back on its exports to the U.S., it is cutting flows in particular to its Motiva Port Arthur refinery - the largest in the country.

Total imports to Motiva are currently running at a pace of 270,000 bpd, down about 10 percent from 2016 levels. But after typically accounting for about 65 percent of imports, Saudi flows have dropped to 44 percent in the last four months. On the flip side, deliveries of Iraqi crude have risen to 40 percent of total imports since July, after only accounting for 10 percent of import volumes last year. Related: Putin’s Masterstroke Of Energy Diplomacy

(Click to enlarge)

This theme of buoyant Iraqi deliveries is reflected across the four largest recipients of its grades: India, China, the U.S. and South Korea. While Saudi has dialed back to the U.S., more Iraqi crude has been delivered on a year-over-year basis in nine out of the last ten months.

India has also received higher volumes year-on-year for the last four months. China has been a bit more mixed, receiving lower volumes in recent months - although this may be linked to lower exports to the country in general.

This rise to Iraq's largest markets has not been at the expense of other countries - they have received more crude in every month through the first half of the year than in 2016, although this has fallen to a deficit in three of the last four months. This is because total Iraqi deliveries - although moderating - have been higher on a year-over-year basis in eight of the last ten months.

(Click to enlarge)

By Matt Smith

More Top Reads From Oilprice.com: