Breaking News:

Oil Prices Fall to 7-Week Low as Market Pressures Mount

Reduced U.S. diesel consumption and…

Anglo American Rejects BHP's $38.8 Billion Takeover Bid

Anglo American rejected BHP's $38.8…

U.S. Crude Oil Inventories Drop, But Gasoline Stocks See Large Build

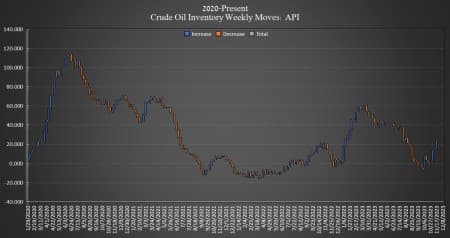

Crude oil inventories in the United States fell this week by 2.349 million barrels for the week ending December 8, according to The American Petroleum Institute (API), after a 594,000-barrel build in crude inventories in the week prior. Analysts had expected inventories to fall by 1.5 million barrels.

API data shows a net build in crude oil inventories in the United States of just over 18 million barrels so far this year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) stayed the same. Inventories are holding at 351.9 million barrels, with total purchases for the SPR coming in just over 5 million barrels since the Biden Administration began its buyback program.

Oil prices were trading down ahead of API data release as the market continues worry about global oil demand, renewed by inflation fears. At 3:40 pm ET, Brent crude was trading down 3.45% at $73.41—more than $4 per barrel short of where it was this same time last week. The U.S. benchmark WTI was trading down on the day by 3.60% at that time, at $68.75 –also just under $4 per barrel below this time last week.

Gasoline inventories rose this week by 5.8 million barrels, on top of the 2.83-million-barrel increase in the week prior. As of last week, gasoline inventories are not just 1% below the five-year average for this time of year.

Distillate inventories also rose this week, with a gain of 300,000 barrels. Last week, distillates rose by 890,000 barrels in the week prior. Distillates are roughly 13% below the five-year average.

Cushing inventories rose by 1.4 million barrels, after rising by 4.28 million barrels in the previous week.

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- China’s EV Sector Will Become Self-Sufficient By 2060

- EU to Allow Members to Ban Russian Pipeline Gas

- Interest Rate Concerns Keep Oil Prices Under Pressure

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B