Breaking News:

Texas Is Preparing for Electricity Demand to Surge

Texas is breaking for electricity…

Tesla Partners with Baidu for Full Self-Driving Rollout in China

Tesla's Full Self-Driving system has…

U.S. Crude Oil, Gasoline, Cushing See Inventory Dips

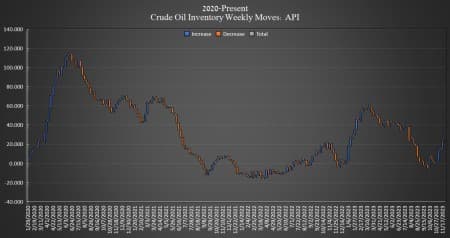

Crude oil inventories in the United States fell this week by 817,000 barrels for week ending November 24, according to The American Petroleum Institute (API), after a 9.05-million-barrel rise in crude inventories in the week prior, API data showed. Analysts had expected a 2 million barrel draw.

API data shows a net build in crude oil inventories in the United States of more than 20 million barrels so far this year.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) broke a seven week streak of status quo, rising by 300,000 barrels. Inventories are still near the 40-year low of 351.3 million barrels, with total purchases for the SPR coming in at about 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading up substantially ahead of API data release despite OPEC+ chatter that dampened the markets hopes that the group would cut production deeper at its next meeting, which is currently scheduled to take place this Thursday. At 3:40 pm ET, Brent crude was trading up 2.13% at $81.68—still $.30 per barrel short of where it was this same time last week. The U.S. benchmark WTI was trading up on the day by 2.06% at that time, at $76.40--$1 per barrel below this time last week.

Gasoline inventories also fell this week, by 898,000 barrels, on top of the 1.79 million barrel decrease in the week prior. As of last week, gasoline inventories were 2% below the five-year average for this time of year.

Distillate inventories saw the only rise this week, with a gain of 2.806 million barrels. Last week, distillates fell by 3.51 million barrels in the week prior. Distillates are roughly 13% below the five-year average.

Cushing inventories fell by 465,000 barrels, after rising by 640,000 barrels in the previous week.

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Traders Cut Bullish Bets on Oil Ahead of OPEC+ Meeting

- Connecticut Plan to Ban Gasoline Cars Faces Opposition

- Alberta Strikes Back at the Federal Government’s Energy Transition Plan

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B