Starting off the week on February 18 was an unusually comfortable experience for people in the oil industry. Saudi Arabia vowed to cut its crude output beyond OPEC/OPEC+ commitments, which has palpably helped to move prices up, moreover, shutting down its Safaniyah offshore field due to a power outage even brought in an unscheduled upward pressure factor. Even the US-China trade talks have instilled hope in market watchers that a deal might be reached in the upcoming days.

Source: Bloomberg.

The bullish sentiment was somewhat cooled by news of US shale output rising to record highs – the EIA expected shale alone to reach 8.4mbpd next month. As a consequence, Brent dropped from a year-high of $66.83 per barrel on Monday below $66 per barrel on Wednesday afternoon, whilst WTI hovered around $56-56.2 per barrel, having experienced a modest drop from its Monday year-high level of $56.39 per barrel.

1. US Crude Commercial Stocks Still on the Increase

- US commercial crude stocks have increased for the fourth consecutive week during the week ended February 8, up by 3.6 MMbbl to a total of 450.8MMbbl.

- The week ended February 15 is also widely expected to bring about another stock buildup, with a Platts analyst survey hinting at a further 3.5MMbbl inventory accumulation.

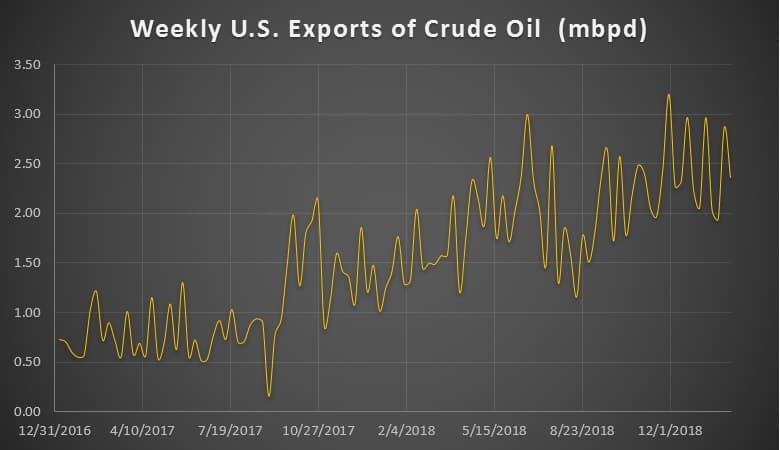

- US crude exports have declined by some 0.5mbpd w-o-w during the week ended February 8, however, they are expected to bounce back a bit from last week’s…

Starting off the week on February 18 was an unusually comfortable experience for people in the oil industry. Saudi Arabia vowed to cut its crude output beyond OPEC/OPEC+ commitments, which has palpably helped to move prices up, moreover, shutting down its Safaniyah offshore field due to a power outage even brought in an unscheduled upward pressure factor. Even the US-China trade talks have instilled hope in market watchers that a deal might be reached in the upcoming days.

Source: Bloomberg.

The bullish sentiment was somewhat cooled by news of US shale output rising to record highs – the EIA expected shale alone to reach 8.4mbpd next month. As a consequence, Brent dropped from a year-high of $66.83 per barrel on Monday below $66 per barrel on Wednesday afternoon, whilst WTI hovered around $56-56.2 per barrel, having experienced a modest drop from its Monday year-high level of $56.39 per barrel.

1. US Crude Commercial Stocks Still on the Increase

- US commercial crude stocks have increased for the fourth consecutive week during the week ended February 8, up by 3.6 MMbbl to a total of 450.8MMbbl.

- The week ended February 15 is also widely expected to bring about another stock buildup, with a Platts analyst survey hinting at a further 3.5MMbbl inventory accumulation.

- US crude exports have declined by some 0.5mbpd w-o-w during the week ended February 8, however, they are expected to bounce back a bit from last week’s 2.4mbpd.

- The week ended February 15 should also bring about a rebound in refinery runs, which have plummeted from the early January level of 17.56mbpd to 15.77mpbd during the week ended February 8.

- Gasoline stocks have been building up for the tenth week in a row, the week ended February 8 witnessing another 0.4MMbbl increase to 258.3MMbbl, almost 10MMbbl above the 5-year average.

2. Another Oil-For-Goods Deal for Iran?

- The Iranian oil minister Bijan Zanganeh travelled to Moscow last week to discuss future energy projects with his Russian counterpart Alexandr Novak.

- Russia and Iran are closing in on a 100kbpd „oil-for-goods” contract, under which Iran would provide the crude in its ports in exchange for Russia paying half of its value in cash and the other half in goods.

- It remains to be seen who would be the crude receiver on the Russian end, however, the crude would be very well suited for Rosneft to supply it to its Indian Nayara refinery system.

- A potential Rosneft involvement is all the more likely as the Russian oil majors is reportedly interested in taking up 5 oil fields in Yaran, Koupal, Maroun, Bangestan and Azadegan.

- Teheran seems intent on giving Russian companies preferential treatment when it comes to upstream endeavours – the long-mooted updated version of the Iranian Petroleum Contracts will be presented to Russian investors on March 27 in Moscow.

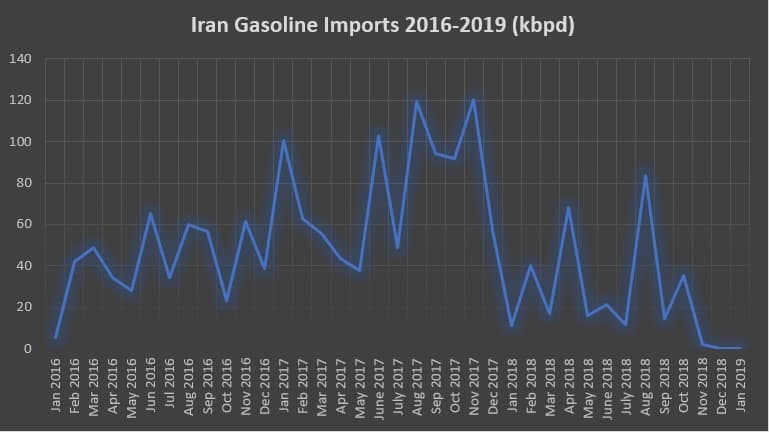

3. Iran Launches Phase 3 of Persian Gulf Star, Ending Gasoline Imports

- Iran has started up Phase 3 (120kbpd) of its 480kbpd Persian Gulf Star (PGS) condensate splitter in Bandar Abbas on the Strait of Hormuz.

- Iranian state refiner NIORDC puts current PGS throughput at 206kbpd, to be increased gradually as third phase production ramps up.

- This would place Iran into net exporter territory, with its refining capacity surpassing the 580kbpd gasoline demand, largely dispelling fears that Teheran might witness a return of fuel shortages it had struggled from during the 2012-2015 period.

- The last gasoline cargo to Iran arrived mid-November 2018 from the Indian port of Pipanav, there has been no maritime gasoline activity thereafter.

- Iran’s commissioning of PGS is quite a significant feat, given that in the summer of 2017 they were buying on average 105-110kbpd of gasoline.

- Iranian oil minister Bijan Zanganeh stated the nation wants first to build up stocks and only then go on with exports, which, amid US sanctions, will inevitably require a tight web of intermediaries and middlemen.

4. Indian IOC Signs First-Ever US Supply Contract

- IndianOil, the state-owned oil and gas company of India, has signed a year-long supply deal starting from April that would allow it to import up to 3 million tons of US crude grades per year.

- The move marks the first time any Indian entity signs a mid-to-long term deal with regard to US crude, which is seen as a partial solution to mend the problem of Iranian volume tightness.

- It is unclear what the US basket would consist of, however, IOC has previously brought in Midland WTI, LLS, Eagle Ford and Bakken.

- IndianOil’s 9mtpa term supply contract with the Iranian NIOC runs out this March, hence the Indian refiner has been looking for viable alternatives – the heavier barrels would most likely be sourced from Iraq, already supplying some 18mtpa of Basrah crudes.

- US crude exports to India increased more than tenfold in the past two years, from around 20kbpd in January 2017 to 220kbpd in January 2019.

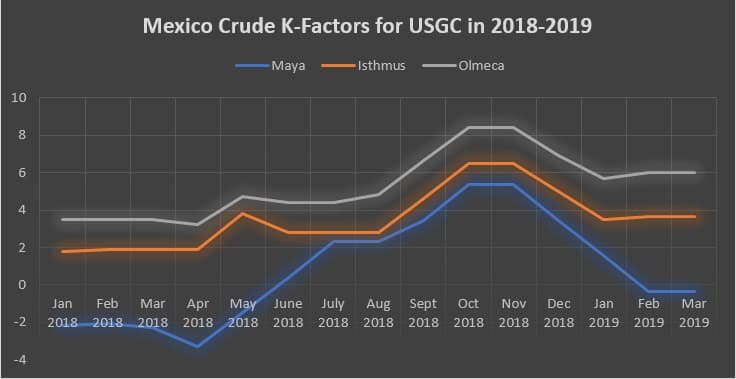

5. Mexico K-factors Up for Everyone Except US Gulf Coast

- PMI, the Mexican state oil marketer, has published K-factors for its March-loading shipments, rolling over all USGC prices while raising K factors for everyone else.

- K-factors are used by PMI as price adjustments, to be modified on a monthly basis, reflecting current trading interest, and included in the price formula.

- The standard Maya formula for USGC, stated below, witnessed no change month-on-month at a -0.35 per barrel discount.

[Price= 0.4*(WTS+FO 6.3%S) + 0.1*(LLS+Brent Dated) + K]

- The 22° API, 3.4 percent Sulphur Maya crude’s K-factor for Europe, India and the Middle East rose a whopping 1.7 USD m-o-m, with Far East hiked by 95 cents per barrel.

European Maya Formula = [0.527*Brent Dated + 0.467*(FO 3.5%S) – 0.25*(FO 1%S – FO 3.5%S) + K]

- The Maya hike reflects a tightening heavy sour market globally following the Iran and Venezuela sanctions, however PEMEX seems to be extra careful not to lose out on the core USGC market.

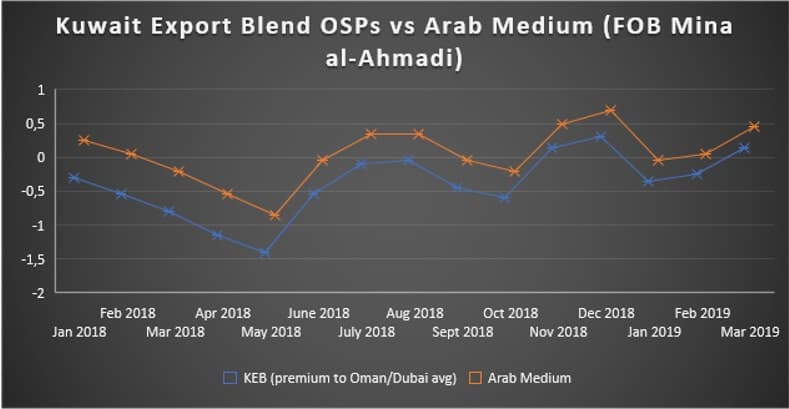

6. Kuwait OSPs in Complete Unison with Saudi

- The Kuwaiti state oil company KPC has raised the March-loading official selling prices of its Kuwait Export Crude blend by 40 US cents per barrel, echoing a similar move by the Saudis.

- The KPC-Arab Medium spread has remained at 30 cents per barrel for the third consecutive month, the narrowest it has been during the past 5 years.

- Two years ago, in February 2017, the spread stood at 55 cents, whilst a year ago, in February 2018 it reached 60 cents per barrel.

- KPC cuts its March-loading OSP for its Kuwait Super Light crude by 20 cents to 1.30 USD per barrel amid weak light distillates’ margins and the arb bringing in loads of trans-Atlantic cargoes.

- The KSLC seems to mirror the pricing developments of Arab Extra Light, remaining at +0.35 USD per barrel for the third month in a row.

- In the meantime, KPC is reported to work on streamlining the company’s operations by merging its eight business units into four – chronic internal disputes have led tot he resignation of Oil Minister Al-Rashidi in December and mergers are seen as a way of shaking off recurring rows.

7. Egypt Exploration Licensing Round

- Egyptian Natual Gas Holding (EGAS) and Egyptian General Petroleum Corporation (EGPC) have announced the results of their 2018 licensing round, allocating 12 of the 27 available blocks.

- Shell was by far the most active international major, having clinched 2 two gas-bearing and three 3 oil-bearing blocks.

- The fly in Shell’s ointment is that all big parts of the three oil blocks it saw allocated were previously assessed, by Amoco or Braspetro in the 1970s or by someone else later on, and relinquished afterwards despite discovering oil-bearing reservoirs.

- The Northeast El Amriya block (Block #3) elicited the most intensive bidding, with a newcomer to Egypt’s offshore, ExxonMobil, clinching the deal for a $10 million signing bonus and $100 million financial commitment.

- A total of 6 international majors bid for Block 3 – Shell and Petronas got instead a joint operatorship over Blocks 4 and 6, whilst the ENI/BP consortium got Block 11 not far away from the LNG terminal of Damietta.

- EGAS wants to start a new licensing round for blocks in Egypt’s Western Mediterranean which is heavily underanalyzed and so far wields only two exploration wells drilled, with the first dating back to almost 45 years ago.