Incrementum AG sees a 45% probability of the gold price hitting a new all-time high at $2,100 or higher as early as December 2021.

Authored by Ronald Stoeferle and Mark Valek, and now in its 50th iteration, the Liechtenstein-based investment boutique’s annual report entitled ‘In Gold We Trust‘ also argues in its base case future scenario for gold trading at $4,800 per oz. by the end of the decade. Given the wave of ‘monetary climate change’ triggered by the pandemic and the prospect of inflation sticking around for longer brings a gold price hitting $8,900 per oz. “within the realm of possibility” by 2030, the report has found.

At last year’s report launch, Stoeferle and Valek said: “It’s not a question of if, but when we will see a new all-time high.”

“In the months following the stock market collapse in March 2020, we saw a very dynamic rise in the gold price, culminating in new all-time highs in August 2020. This was followed by a consolidation phase, which now seems to be completed,” says Stoeferle, recapping the gold price development of the past 12 months.

“In addition to profit-taking, a firmer US dollar, and opportunity costs in the wake of the Bitcoin bull market, rising bond yields were a key trigger for the emerging headwinds,” adds Valek.

Despite price declines in the second half of the year, the gold price gained 14.3% in euro terms and 24.6% in US dollar terms in 2020. Since the beginning of 2021, price declines of under 1% have been recorded in both currencies.

Monetary climate change

The 2021 edition of the In Gold We Trust report is entitled ‘Monetary climate change’. With this, the two authors draw attention to a multi-layered paradigm shift triggered by the pandemic and the political reactions that followed.

Just as meteorological climate change poses the risk of rising sea levels, “a side effect of monetary climate change is the almost unlimited liquidity that has flooded the markets since the beginning of the covid-19 pandemic and has already caused a noticeable increase in asset price levels and now also consumer price levels”, says Stoeferle.

One of the most dramatic consequences that monetary climate change could bring is a renaissance of consumer price inflation. “In our opinion, we are currently only in the early stages of an inflationary trend”, says Valek.

The enormously inflated money supply and, in particular, a future increase in the velocity of money in circulation point to a higher level of inflation in the future, according to the report. In addition, central banks are increasingly changing their monetary policy strategy.

Although nominal interest rates have risen in recent months, they remain historically low and primarily negative in real terms. According to an analysis by the World Gold Council, real interest rates in the US would have to rise to over 2.5% to have a significant long-term negative impact on the gold price.

Incrementum’a quantitative evaluations also confirm this. In an environment of negative real interest rates, gold’s average annualised performance is 19.3% in nominal terms and 11.4% in real terms. “This is good news for gold,” say the authors, “as we are more convinced than ever that negative real interest rates are the ‘new normal’.”

Silver price spike

The high level of government debt makes significant interest rate increases impossible. The authors argue monetary climate change is turning traditional portfolio allocations on their head, as every change in the inflation regime also changes the dynamics of returns and correlations in the portfolio.

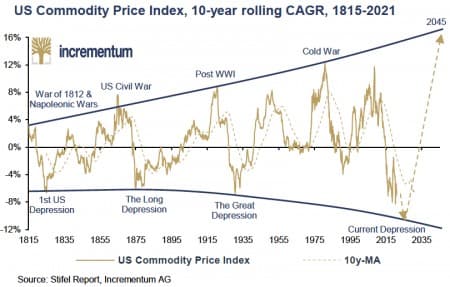

Further, monetary climate change offers considerable risks for investors but also enormous opportunities. “After hibernating for years, commodity prices have now awakened. It is quite possible that the 2010s will turn out to be a repeat of the 1960s and the 2020s of the 1970s. In any case, from our perspective, the signs are clearly mounting that the entire field of inflation-sensitive assets could be at the beginning of a pronounced bull market similar to that of the 1970s,” says Stoeferle.

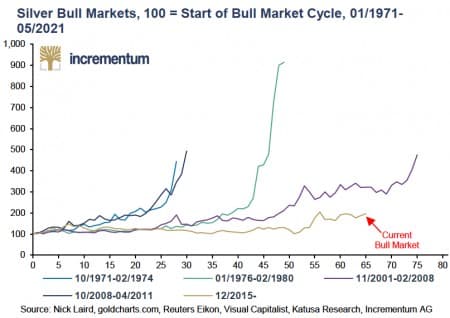

With rising inflation rates, the authors argue that the silver price will also post significant gains.

“In addition to its property as a protection against inflation, its use as an industrial metal also speaks in favour of silver investment. For example, the massively pushed ‘green’ technologies such as photovoltaics cannot be implemented without silver,” Valek says.

A comparison with past silver bull markets shows that typically there was an acceleration at the end of the trend. That phase is likely still to come, according to Stoeferle.

By Mining.com

More Top Reads From Oilprice.com:

- Oil Rises After ‘Cataclysmic’ Boardroom Showdown

- Moody’s: Credit Risk Is Growing For Big Oil

- Activist Investor Wins Exxon Board Seats In Day Of Reckoning For Big Oil