Gold has long been considered a store of value and a hedge against economic uncertainty.

Over the past five decades, its price has been closely intertwined with concerns surrounding the growing U.S. public debt.

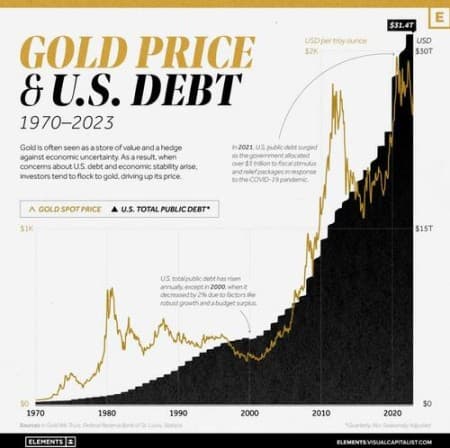

In the graphic below, Visual Capitalist's Bruno Venditti, using data from In Gold We Trust and the Federal Reserve Bank of St. Louis, explores the relationship between gold price and the U.S. national debt.

A $31T Government Debt

The U.S. national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time.

Every fiscal year, if spending exceeds revenue, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS) to cover the deficit.

The American public debt has risen annually since 1970, except in 2000, when it decreased by 2% due to factors like robust growth and a budget surplus.

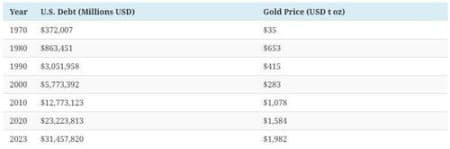

Over the last few decades, the national debt has grown from around $370 million in 1970 to an all-time high of $31.4 trillion in 2023, recently sparking the debate in Congress to increase the debt ceiling to avoid a potential default.

The number is even higher if considering federal unfunded liabilities. Those are future financial obligations that the government has committed to but lacks sufficient funds to fully cover, such as Social Security and Medicare. Taking those into consideration, the current present value of the fiscal imbalance is $244.8 trillion, almost 10 times the current U.S. GDP.

U.S. Debt’s Implication on Gold Prices

A rising US debt often leads to concerns about inflation. When a government accumulates a significant amount of debt, it may resort to measures such as printing more money or increasing government spending, potentially leading to inflationary pressures. In such situations, investors may turn to gold as a hedge against inflation.

In addition, as the federal debt levels rise, investors may become wary of the stability of financial markets and seek safe-haven assets such as gold.

Although the price of gold tends to rise as U.S. debt increases, numerous other factors can also influence the market, including market sentiment, central bank policies, and global economic conditions.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Prices Inch Higher In Cautious Response To Saudi And Russian Cuts

- Brazil’s Petrobras Looks To Buy Oil Assets After A Decade Of Divestments

- New Iran Nuclear Deal May Lead To Quick Increase In Oil Production

The US national debt has grown from around $370 million in 1970 to an all-time high of $31.4 trillion in 2023.

The number is even higher if considering federal unfunded liabilities. Those are future financial obligations that the government has committed to but lacks sufficient funds to fully cover, such as Social Security and Medicare. Taking those into consideration, the current present value of the fiscal imbalance is $244.8 trillion, almost 10 times the current US GDP. In a nutshell, the United States is bankrupt, hence the recent request by the Biden administration to Congress to raise its debt ceiling to avoid default.

That is also why every fiscal year, the federal government is forced to borrow money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, Treasury inflation-protected securities (TIPS) and printing money to cover its fiscal deficit.

As federal debt levels rise, investors may become wary of the stability of financial markets and seek safe-haven assets such as gold.

Then there is the global de-dollarization campaign which has been gaining momentum as countries around the world seek alternatives to the hegemony of the dollar. China, Russia, Brazil, India, ASEAN nations, Kenya, Saudi Arabia, and the UAE are now using local currencies in trade.

Even the Financial Times newspaper has acknowledged that a multipolar currency world is emerging.

There is also the petro-yuan’s challenge to the petrodollar's dominance in the global oil trade.

Sooner or later Saudi-led Gulf Cooperation Council (GCC) countries will adopt the petro-yuan in payment as China is demanding. Once the adoption has become a reality, the petrodollar’s share in global oil trade will decline by 20%. And with China paying for its imports in petro-yuan, Russia selling its crude in rubles, Indian rupees and petro-yuans and India paying rupees and petro-yuans for its imports, the share of the petrodollar in the global oil trade could plummet by 60% leading to a devaluation of the dollar by one third to one half overnight.

China has been vigorously amassing gold partly to augment its foreign reserves and also to support the petro-yuan in the battle with the petrodollar.

The petrodollar is backed by US treasury bills. Contrast this with a petro-yuan convertible to gold. In effect, China is offering customers oil contracts payable either in petro-yuan or gold. In 1970 the price of one ounce of gold was $35. Today it is almost $2,000.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert