By Jennifer Kary via AG Metal Miner

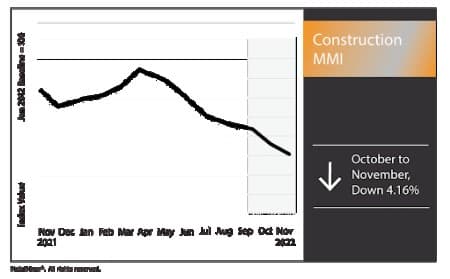

The November Construction MMI (Monthly MetalMiner Index) dropped by 4.16%. The trend over the past 3-4 months reflects a more sideways market than a bullish one. However, October to November proved a particularly volatile month for the construction index. Meanwhile, fluctuating steel prices have put all eyes on China.

The market remains plagued with widespread uncertainty, especially for companies that source construction materials from China and Europe. Chinese President Xi appears reluctant to call off zero-COVID measures after nearly three years. Meanwhile, the strict policy continues to drive down domestic Chinese demand and limit industrial output. This amounts to both fewer materials produced and exported.

For their part, the individual branches of the construction index moved sideways, up, and down all in one month. This drove the index in all different directions. Bar fuel surcharges traded up, for instance. European aluminum also went up, possibly due to the energy crisis and supplies being so pinched. Meanwhile, iron ore traded sideways with no change in price, and h-beam and rebar steel prices dropped.

Hawkish Fed and Labor Shortages

The Fed continues to raise interest rates in light of unrelenting inflation and low unemployment percentages. Meanwhile, steel prices and other construction materials markets continue to feel the impact of high construction costs.

A highlight in MetalMiner’s last weekly newsletter mentioned how Idaho’s Statesman recently reported that CBH Homes had begun to downsize and lay off workers. CBH Homes is Idaho’s largest home-building company, and such layoffs do not bode well for the future of the industry.

But while CBH Homes downsizes, other construction sectors continue to struggle with labor shortages. According to a recent article in McKinsey, construction labor shortages will worsen in the short term and possibly the long term. Currently, the U.S. construction sector has roughly 440,000 job openings. Therefore, getting construction projects completed on time remains increasingly difficult, especially with high-interest rates and fewer workers on the job.

Steel Prices Effect Index and Slight Market Rebound

A significant factor pulling the index down month-over-month was steel prices. Most steel forms within the construction index, including h-beam and rebar, dropped in price. And despite carbon steel holding a more sideways trend over the past few months, this wasn’t enough to drive the construction index up come November.

China is also a large producer and exporter of aluminum supplies to the U.S., and zero-COVID continues to leave that market in a state of uncertainty. And despite the Chinese aluminum bar dropping in price, European 1050 aluminum sheets went up. This likely results from Europe’s ongoing energy crisis and slowing smelter production.

By AgMetalminer

More Top Reads From Oilprice.com:

- Russia’s Oil Output Set To Fall By 1.5 Million Bpd In December

- EU Needs $460 Billion Investment To Maintain Nuclear Power Capacity

- Oil Prices Could Soon Break $100 As Upside Risk Grows