There can be a tendency to believe that uranium deposits are scarce from the critical role it plays in generating nuclear energy, along with all the costs and consequences related to the field.

But uranium is actually fairly plentiful: it’s more abundant than gold and silver, for example, and about as present as tin in the Earth’s crust.

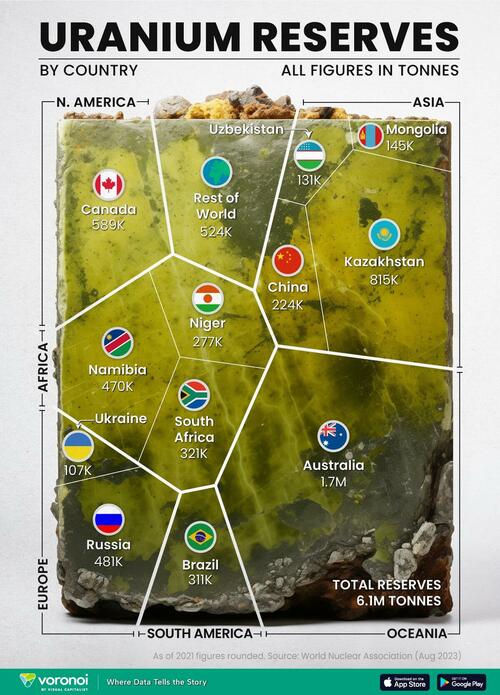

Visual Capitalist's Marcus Lu visualizes the distribution of the world’s uranium resources by country, as of 2021. Figures come from the World Nuclear Association, last updated on August 2023.

Ranked: Uranium Reserves By Country (2021)

Australia, Kazakhstan, and Canada have the largest shares of available uranium resources—accounting for more than 50% of total global reserves.

But within these three, Australia is the clear standout, with more than 1.7 million tonnes of uranium discovered (28% of the world’s reserves) currently. Its Olympic Dam mine, located about 600 kilometers north of Adelaide, is the the largest single deposit of uranium in the world—and also, interestingly, the fourth largest copper deposit.

Despite this, Australia is only the fourth biggest uranium producer currently, and ranks fifth for all-time uranium production.

Figures are rounded.

Outside the top three, Russia and Namibia both have roughly the same amount of uranium reserves: about 8% each, which works out to roughly 470,000 tonnes.

South Africa, Brazil, and Niger all have 5% each of the world’s total deposits as well.

China completes the top 10, with a 3% share of uranium reserves, or about 224,000 tonnes.

A caveat to this is that current data is based on known uranium reserves that are capable of being mined economically. The total amount of the world’s uranium is not known exactly—and new deposits can be found all the time. In fact the world’s known uranium reserves increased by about 25% in the last decade alone, thanks to better technology that improves exploration efforts.

Meanwhile, not all uranium deposits are equal. For example, in the aforementioned Olympic Dam, uranium is recovered as a byproduct of copper mining occurring at the same site. In South Africa, it emerges as a byproduct during treatment of ores in the gold mining process. Orebodies with high concentrations of two substances can increase margins, as costs can be shared for two different products.

By Zerohedge.com

More Top Reads From Oilprice.com:

- U.S. House Passes Reversal Of Biden’s LNG Export Ban

- Electric Vehicle Giant BYD Plans Factory in Mexico

- Starlink Terminals Are Falling Into the Hands of the Russian Military