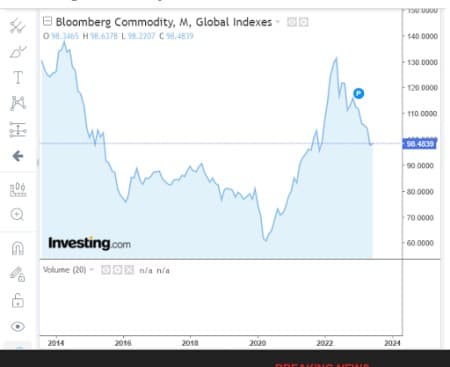

The epic commodity bull run that took off three years ago and saw commodity prices hit multi-decade highs has finally collapsed. From oil, gas and wheat to lithium, copper and iron ore, prices of the world’s leading commodities have pulled back sharply across the board. The Bloomberg Commodities Index (BCOM), the most widely used benchmark for the commodities market tracked by 23 exchange-traded contracts on physical commodities and more than $100 billion in assets, has declined 12% in the year-to-date and shows no signs of reversing course. The index hit a 9-year peak in May 2022 with commodity prices more than doubling in the space of two years. However, BCOM has since then declined nearly 25%, effectively ushering in a commodity bear market.

“The drop in commodity prices seems to reflect the stuttering rebound of China, a looming US recession and supply side destruction in Europe.It’s indeed possible that inflation could turn into temporary disinflation,” Carsten Brzeski, global head of macro at ING, has told Bloomberg.

The Federal Reserve uses the term disinflation to describe a period of slowing inflation. Not to be confused with deflation--a term used to describe a general decline in prices for goods and services, which can harm certain sectors of the economy--disinflation is generally not considered problematic because prices do not actually drop, and does not typically signal the onset of a slowing economy.

Source: Investing.com

The Biggest Winner: Renewable Energy

Obviously, falling fuel and commodity prices are music in the ears of the consumer after suffering under runaway inflation for years now. Although food prices remain stubbornly high, there are growing signs that food inflation could also lose momentum. For instance, wheat futures have more than halved from last year’s record high, with the European Union and Russia, the top two shippers, set for bumper harvests in the current year. Meanwhile, Brazil is recording its best ever corn and soybean crop harvest, tempering feed bills for chicken and hog herds while vegetable oil prices have dropped sharply.

Related: Natural Gas Prices Plunge Further Amid Rise In U.S. Stockpiles

On the other hand, fossil fuel investors are beginning to feel the heat from falling oil and gas prices with the sector’s profits declining from last year’s record highs. But clean energy investors are hardly complaining.

The energy transition is in full swing, with the energy transition driving the next commodity supercycle. This portends immense prospects for metals producers, technology manufacturers, and energy traders and investors.

Indeed, new energy research provider BloombergNEF has provided estimates that the global transition will require ~$173 trillion in energy supply and infrastructure investment over the next three decades, with renewable energy expected to provide 85% of our energy needs by 2050.

For instance, BNEF projects that by 2030, consumption of lithium and nickel by the battery sector will be at least 5x current levels. Meanwhile, demand for cobalt, used in many battery types, will jump by about 70%. Diverse EV and battery commodities such as copper, manganese, iron, phosphorus, and graphite--all of which are needed in clean energy technologies and are required to expand electricity grids--will see sharp spikes in demand.

But rising prices of the commodities needed for renewable energy aka greenflation have been increasing the costs of setting up new green power projects, and threatened to slow down the pace of the transition.

This trend is problematic for one big reason: Falling costs have been a major driving force of the clean energy boom.

Over the past decade, the price of solar electricity dropped 89%, while the price of onshore wind dropped 70%.

Meanwhile, rapidly falling EV battery prices have played a big role in helping electric vehicles become more mainstream. As per Bloomberg, over the past decade, EV battery prices have fallen from almost $1,200 per kilowatt-hour to just $137/kWh in 2020. For an EV with a 50 kWh battery pack, that adds up to savings of more than $43,000 in real terms.

Overall, clean energy has actually reached an economic tipping point: A 2019 report from the nonprofit Rocky Mountain Institute found that it was cheaper to build and use a combination of renewables like wind and solar than to build new natural gas plants. Another 2020 report from Carbon Tracker found that in every single one of the world’s energy markets, it was cheaper to invest in renewables than in coal.

Clean energy technologies require more metals than their fossil fuel-based counterparts. For instance, BNEF estimates that it takes 10,252 tons of aluminum, 3,380 tons of polysilicon and 18.5 tons of silver to manufacture solar panels with 1GW capacity. With global installed solar capacity expected to double by 2025 and quadruple to 3,000 GW by 2030, the solar industry is expected to become a significant consumer of these commodities over the next decade. The new energy research outfit also estimates that it takes 154,352 tons of steel, 2,866 tons of copper, and 387 tons of aluminum to construct wind turbines and infrastructure with the power capacity of a gigawatt. The Global Wind Energy Outlook (GWEO) has forecast installed wind capacity to hit 2,110GW by 2030, representing a 185% growth over the timeframe. Meanwhile, BNEF also estimates that it takes 1,731 tons of copper, 1,202 tons of aluminum, and 729 tons of lithium to manufacture 1GWh Li-ion batteries.

Thankfully, greenflation now appears to be a thing of the past: Copper prices have fallen more than 16% from their $9,435 per tonne January high; Aluminum prices dropped nearly 50% from record highs to hit a 19-month low of $2,076 per tonne; Iron ore prices are projected to decline by nearly 30% by the end of 2023 on the back of a dip in Chinese steel demand and output while lithium hydroxide prices have declined 50% from their November 2022 all-time high.

Not everybody though is convinced we are out of the woods yet, with Goldman Sachs warning that commodity prices could come back roaring back should recession concerns prove to be misplaced. Further, many key commodities remain priced well above pre-war levels. But so far, the commodity price trend has been quite encouraging not only for the consumer but also for clean energy investors.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Jumps As EIA Reports Surprise Crude Build

- Argentina's Vaca Muerta Shale Play Could Produce 1 Million Bpd In 2030

- Singapore Detains Record Number Of Oil Tankers As Shadow Fleet Expands

Driven by what appears to be political bias, the author and many of his colleagues who contribute to the oilprice.com along with Western media are hell-bent on shifting the blame for the slowdown of oil prices over the last two months on China when the real culprit is a shaky US banking system.

How could China the world’s largest economy be blamed when its economy is projected by both the World Bank and the IMF to grow this year by 5.2%-6.5% and when its crude oil imports in April hit almost 13.0 million barrels a day (mbd) in April, the highest in its history?

Moreover, spending an estimated $173 trillion on global energy transition is money wasted on one of the world’s biggest lies since the notion of a global energy transition is an illusion. Furthermore, the claim that renewables are expected to provide 85% of our energy needs by 2050 is another illusion because of their intermittent nature.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert