Via AG Metal Miner

The Raw Steels Monthly Metals Index (MMI) fell by 5.08% from October to November. A number of factors played into steel prices dropping.

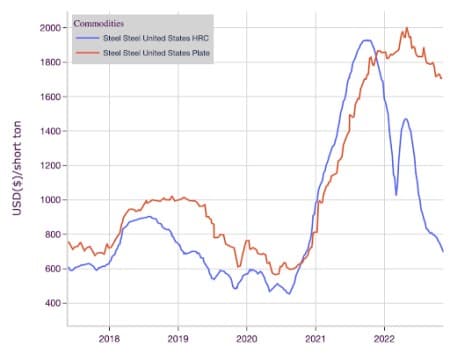

After U.S. steel prices appeared to flatten, the descent for hot rolled coil, cold rolled coil, and hot dipped galvanized prices accelerated throughout October. Hot rolled coil prices now sit at their lowest level since November 2020. Plate prices, however, remain sideways, experiencing only modest declines throughout October.

Nucor Keeps Plate Prices Flat in December

Source: Insights, Chart & Correlation Analysis Tool

American steel giant Nucor announced no change in discrete plate prices for December, meaning they will hold at $1,620/st. This marks the second consecutive month that Nucor kept prices flat after the company lowered them by $120/st in mid-September.

As flat rolled steel prices remain in free fall, plate prices continue to diverge from the larger trend. Since plate prices peaked nearly seven months ago, they have so far declined only 14.76%. For comparison, HRC prices fell a whopping 52.69% during that same period.

For months, buyers have complained about the widening spread between the two commodities. Until HRC prices peaked in October 2021, plate prices averaged around $107/st over HRC. However, that average has since ballooned to almost $600/st, with the current spread sitting at an all-time high of $1,014/st.

New Brandenburg Mill to Test Sideways Plate Trend

The sideways trend will face its next major threat as new capacity comes online. Indeed, operations at Nucor’s Brandenburg, Kentucky plate mill officially began on October 20. At full capacity, the mill can produce up to 1.2 million short tons per year. That said, operations remain in their early stages, and it is still unclear when the mill will reach maximum production.

According to the company, the mill will primarily supply the renewable energy sector, providing plates for solar and wind energy projects. Nonetheless, as the mill begins to add supply to the plate market, the sideways price trend will face increasing downside pressure. Thus far, steel prices have resisted any meaningful decline. However, this new mill could prove the tipping point.

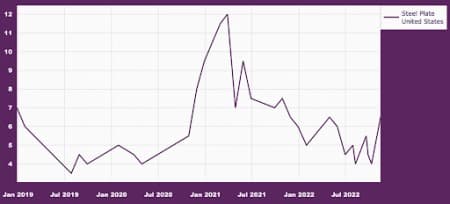

Average Mill Lead Times (weeks)

Still, mill lead times have substantially retraced since last year, ultimately returning to levels well within their historical range. For this reason, the supply/demand equation is unlikely to be the only driver of the current high prices. Overall, plate remains a small market with few major domestic producers. On top of continued demand from infrastructure spending, this has given those producers more control over price relative to other forms of steel.

Strong Plate Prices Offset Narrow Margins for Other Steel Prices

Steel producers remain eager to keep plate prices elevated as much as possible. After all, falling prices continue to eat away at profit margins for other forms of steel. Indeed, high input costs and demand destruction amid a worsening economic outlook put heavy pressure on steel companies’ Q3 earnings. For instance, in its latest earnings report, Nucor noted that the drop in earnings between Q2 and Q3 “was caused primarily by metal margin contraction and reduced shipping volumes.”

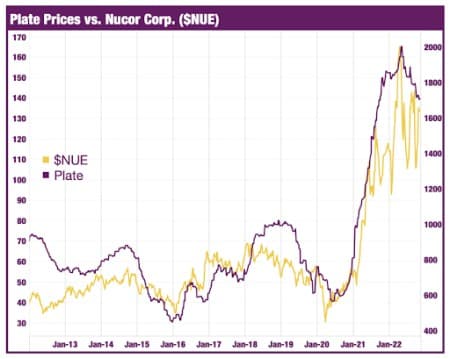

Plate Prices Buoy Nucor Corp.

Nucor Corp. stocks have strongly correlated (92%) with plate prices since 2012. This would suggest that plate prices likely have a substantial impact on company profits. Moreover, they have likely helped offset the impact of declining prices for other forms of steel. Still, the diverging price trends have, in part, led to increased volatility for Nucor Corp. They also remain a significant drag on shares.

In the same report, Nucor warned of another expected decline in earnings between Q3 and Q4. The company noted “increasingly challenging market conditions amid economic uncertainty” on top of declines due to seasonality. This gloomy outlook appears to forecast continued weakness in steel prices, which may begin to extend to plate prices. It could also trigger Nucor and other producers to focus on keeping plate prices flat upon expectations of declines in steel prices elsewhere.

By Nichole Bastin

More Top Reads From Oilprice.com:

- Exxon Mobil Makes First Oil Discovery In Angola In 20 Years

- The Truth About The Energy Crisis That No One Wants To Acknowledge

- Uzbekistan Halts Natural Gas Exports Amid Widespread Power Outages